Question

a. Find a risk-free arbitrage strategy if the shares of Somedebt are sold at $110 per share. So the share price of Somedebt must be

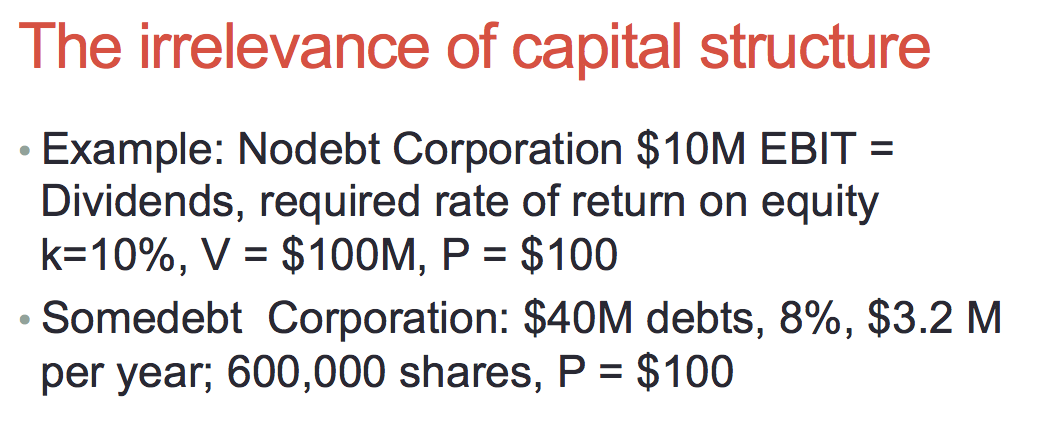

a. Find a risk-free arbitrage strategy if the shares of Somedebt are sold at $110 per share. So the share price of Somedebt must be sold at exactly $100 per share, which is the same as the share price of Nodebt stock. This illustrates the MM theorem on the irrelevance of financial structure.

b. Now, as I mentioned in class, this example is not reasonable, because even if the share price of Somedebt stock is $100, we can still find another risk-free arbitrage strategy, which is to buy either Somedebt shares or Nodebt shares and short bonds. Detail the arbitrage strategy and its cash flow.

c. A more robust example of the MM theorem is to assume that EBIT (Earning before interest and taxes) has equal probabilities of being $15M or $5M per year. Show that the strategy in a) is still a risk-free arbitrage if the share price of Somedebt stock is $110; however, the strategy in b) is no longer a risk-free arbitrage.

d. Calculate the required rate of return on the equity of Somedebt Corporation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started