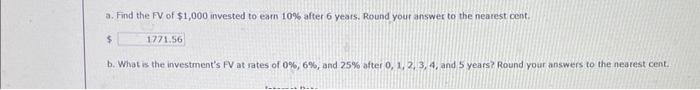

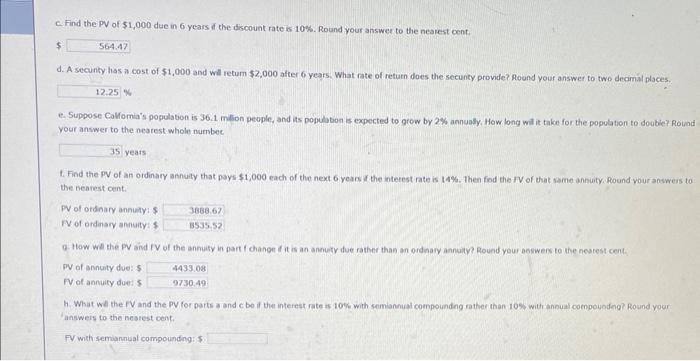

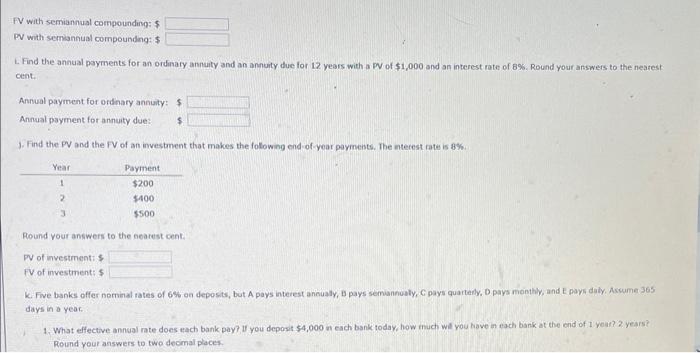

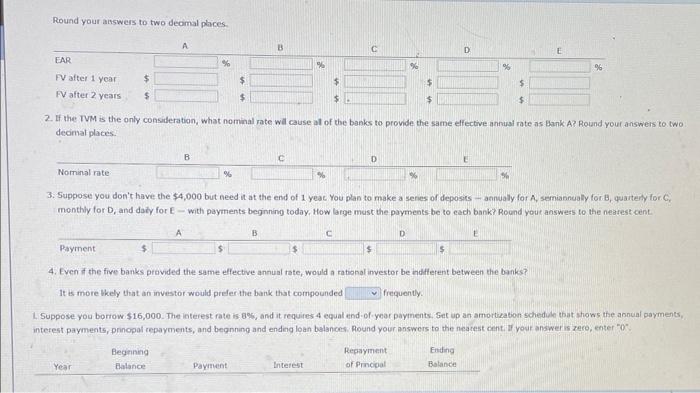

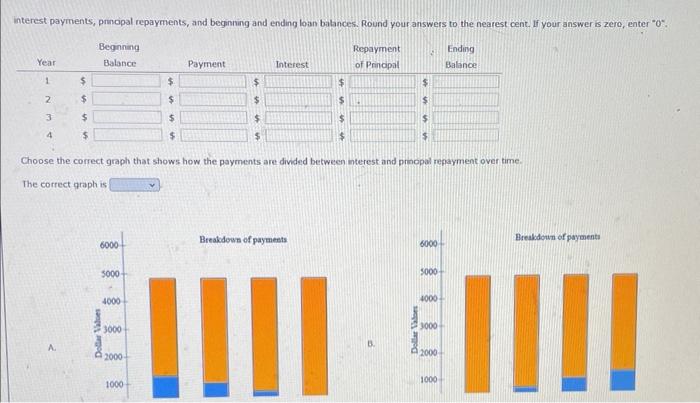

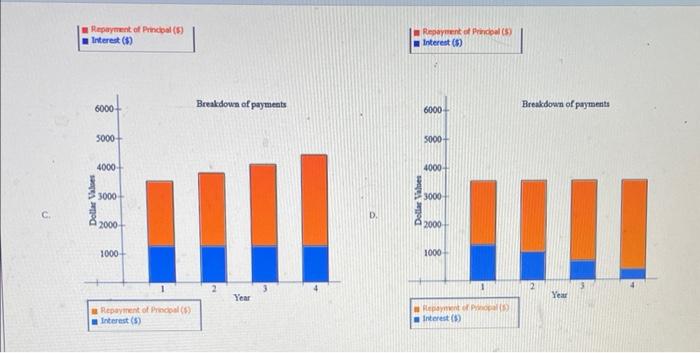

a. Find the FV of $1,000 invested to eam 10% after 6 years. Round your answer to the nearest cent. 5 b. What is the investment's FV at sates of 0%,6%, and 25% after 0,1,2,3,4, and 5 years? Round your answers to the neatest cent. c. Find the PV of $1,000 due in 6 years if the discount rate is 10%. Round your answer to the nearest cent. 5 d. A secunty has a cost of $1,000 and wil retum $2,000 alter 6 years. What rate of return does the secunty provide? Roond your answer to two decamal places. a. e. Suppose CaMomia's population is 36.1 mition people, and its population is expected to grow by 2% annualy. How long wil it take for the population to doutief Rotion your answer to the nearest whole numbec years 1. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years f the interest rate is 14%. Then find the rV of that rame annuity. Poond your answers to the nearest cent. PV of ordinary annuityis PV of ordinary annuity: 4 How. We the PV aind fV of the anhuity in part f change if it is an anewety due rather than an ordinary annuity? Round your onewers to the nearest cent: PPV of arinuty due: 5 FV of annuity due: 5 14. What we the fV and the PV for parts a and c be if the interest rate is 10% with semiannusi compoundeg rather than 105 with annual coenpoundeq? Round your Hanswers to the nestest cent. FV with semiannual compounding: $ FV with semianinual compoundirg: $ PN with semiannual compounding: $ L. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a DN of $1,000 and an interest rate of B\%. Round your answers to the neatest cent. 1. Find the PV and the FV of an investment that makes the folowing end of yoar payments. The nterest rate is 8% : Round your answers to the nearest cent. PV of nvestmenti $ FV of investment: 5 K. Five banks offer nemial tates of 6% on deposts, but A pays interest annualy, D pays semiannualy, C pays quartefly, D pays monthy, and E pays daly. Acrume 365 days in a year. 1. What effective annual rate does each bank pay? If you deposit $4,000 i each bank today, how inuch wil you have in each bank at the end of 1 yoar? 2 years? Round your answers to two decmal places. Round your answers to two deomal phices. 2. If the TVM is the only consitheration, what nominal mate wal cause al of the banks to provide the same effective annual rate as thank A? Round yout answers to two decinal places. 3. Suppose you don't have the $4,000 but need it at the end of 1 yeac You plan to make a senies of deposies - annualy for A, semianneally for B, quarteny for C,y. monthly for D, and daty for E - with payments beginning today. How large must the payments be to cach banki Round yout answeas to the neazest cent 4. Even if the five banks previded the same effective annual rate, would a rational investor be endferent between the banks? It is more Mkely that an investor would prefer the bank that compounded frequently. L. Suppose you borrow $16,000. The interest rate is 8\%5, and it requires 4 equal end-of-year payments. Get up an amortization schedule that ahows the annual payments, interest payments, prinopol repayments, and begnning and endeng loan balances. Round your answers to the nearest centi zy your answer is zeco, enter "o". interest payments, pmopal repayments, and beginning and ending loan batances. Round your answers to the nearest cent. If your answer is zero, enter "0: Choose the correct graph that shows how the payments are divided between nterest and pricopal repayment over time. The correct qraph is