Question

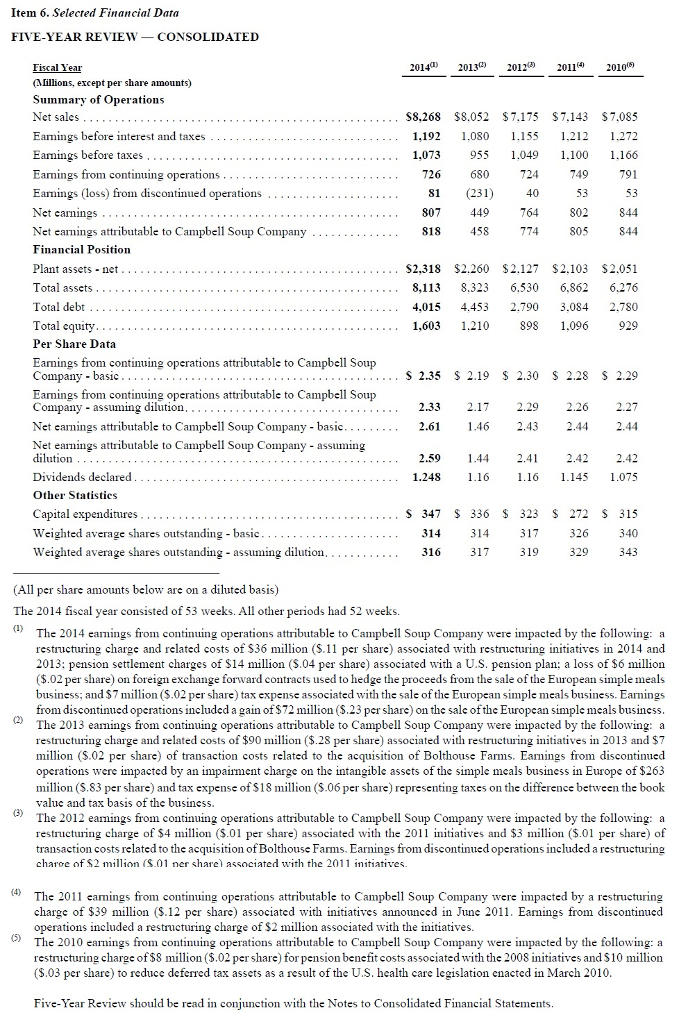

a. Find the net sales in 2011. (Enter your answer in millions.) b. Calculate the operating income in 2010. (Enter your answer in millions.) c.

a. Find the net sales in 2011. (Enter your answer in millions.)

b. Calculate the operating income in 2010. (Enter your answer in millions.)

c. Calculate the difference between operating income and net income in 2012. (Enter your answer in millions.)

d. Find the year(s) in which net income decreased compared to the previous year.

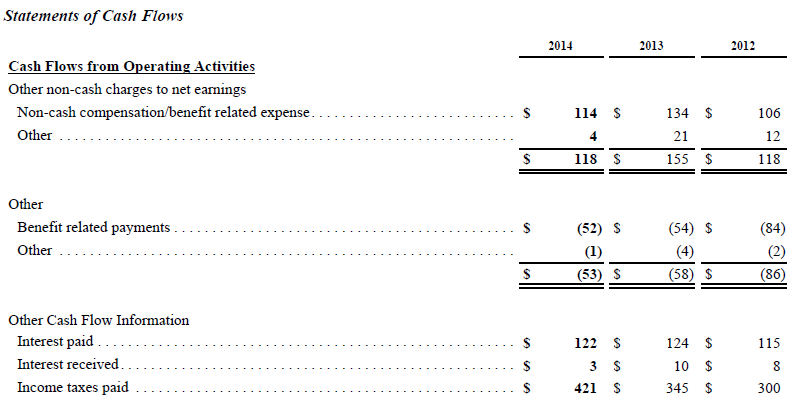

e. Find the amount of interest paid for 2014 in the Notes to the Consolidated Financial Statements

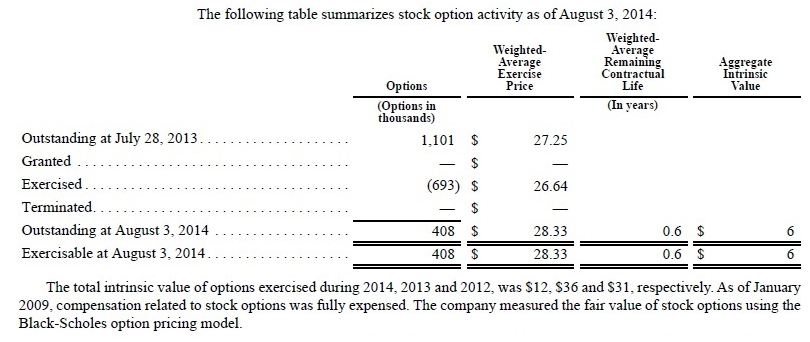

f. Find the number of stock options exercisable at August 3, 2014 in the Notes to the Consolidated Financial Statements.

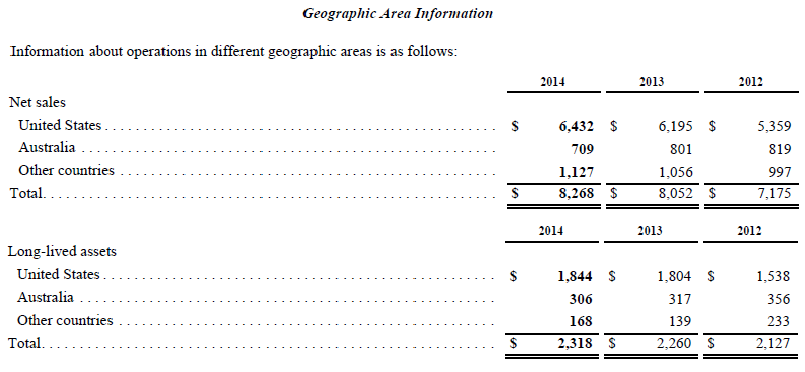

g. Find the net sales to customers outside the United States for 2014 in the Notes to the Consolidated Financial Statements. (Enter your answer in millions.)

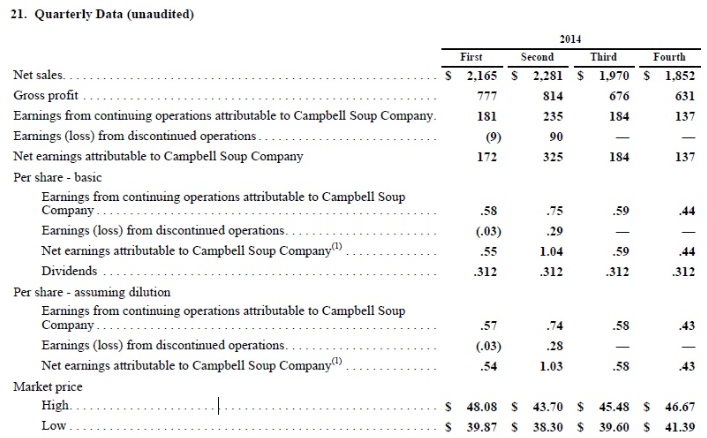

h. Find the cost of products sold for the third quarter of 2014 in the Notes to the Consolidated Financial Statements. (Enter your answer in millions)

Item 6. Selected Financial Data FIVE-YEAR REVIEW CONSOLIDATED 2013C) 2012G) Fiscal Year 014 2011 2010 (Millions, except per share amounts) Summary of Operations Net sales S8.268 $8.052 $7.175 $7.143 $7.085 Eamings before interest and taxe 1.192 1.080 155 1,212 1.272 Earnings before taxes 1.073 955 049 1.100 1.166 Earnings from continuing operations 726 680 724 749 791 Eamings (loss) from discontinued operations (231) 81 40 53 53 Net earnings 807 449 764 802 844 Net earnings attributable to Campbell Soup Company S18 458 774 805 844 Financial Position Plant assets ne $2,318 $2.260 $2.127 $2.103 $2.051 Total assets 8,113 8.323 6.530 6.862 6.276 Total debt 4.015 4.453 2.790 3.08 2.780 Total equity 1.603 1.210 898 1.096 929 Per Share Data Earnings from continuing operations attributable to Campbell Soup Company basic 2,35 2.19 2.30 2.28 2.29 Earnings from continuing operations attributable to Campbell Soup Company assuming dilution 2.33 2.17 et earnings attributable to Campbell Soup Company basic Net earnings attributable to Campbell Soup Company assuming On Dividends declared Other Statistics Capital expenditures S 34 7 336 323 272 315 Weighted average shares outstanding basic 314 314 317 326 340 Weighted average shares outstanding ass ming dilution. 329 316 317 319 343 All per share amounts below are on a diluted ba The 2014 fiscal year consisted of 53 weeks. All other periods had 52 weeks The 2014 team gs fro ons attributa ble to Camp bell Soup Company were impact ed by the fol COI nuing opera owing restructuring charge and relatcd costs of $36 million ($.11 per share associated with restructuring in atives in 2014 and 2013: pension settlement charges of si4 million (s.04 per share) associated with a U.S. pension plan: a loss of $6 million ($.02 per share) on foreign exchange forward co acts used to hedge the proceeds from the sale of the European simple meals business; and $7 mi on ($.02 per share) ed with the sa e of the European simple meals business. Earnings ax cxpensc associa from discontinued operations included a gain of$72million ($.23per share)on the sale ofthe European simple mcals business. The 2013 eamings from continuing operations attributable to Campbell Soup Company were impacted by the following: a restructuring charge and related costs of $90 million ($.28 per share) associated with restructuring init atives in 2013 and $7 on ($.02 per share) of transaction costs related to the acquisi on of Bolthouse Farms. Earnings from discontinued operations were impacted by an impairment charge on the intangible asscts of the simple moals business in Europc of $263 on ($.83 per share) and tax expense of S18 m on ($.06 per share) representing taxes on the difference between the book value and tax basis of the business The 2012 eamings from continuing operations attributable to Campbell Soup Company were impacted by the following: a of $4 m ($.01 per share d with atives and $3 ($.0 per share) of 20 restructuring c associa arge transaction costs related to the acquisition ofBo ouse Farms. Earnings from discontinued operations included a restructurin charoe of $2 m on (S.01 ner share) associated with the 20 tiatives The 2011 eamings from contin g operations attributable to Campbell Soup Company were impacted by a restructuring charge of $39 million ($.12 per share) associated with initiatives announced in June 2011. Eamings from discontinued operations included a restructuring charge of S2 million associated wi h the initiatives The 2010 earnings from continuing operati ons attributable to Campbell Soup Company w d by the fol owing a ere impacte restructuring charge of $8 million ($.02 per share) for pension benefit costs asso ciated with the 2008 in atives and$10 mi on ($.03 per share o reduce deferred tax assets as a result of the U.S. health care legislation enacted in March 2010 Five-Year Review should be read in conjunction with the Notes to Consolidated Financial Stat nts. meStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started