Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year

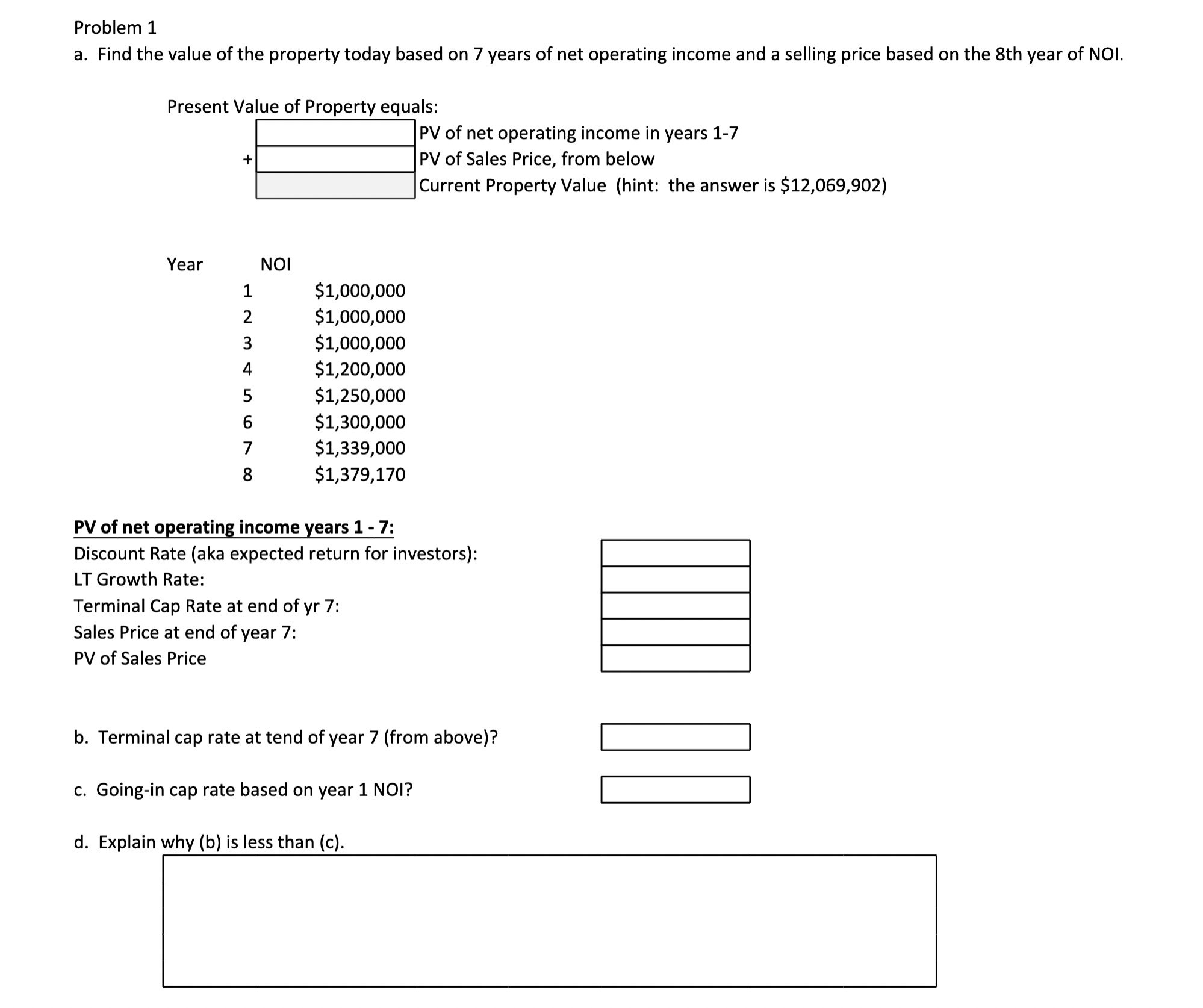

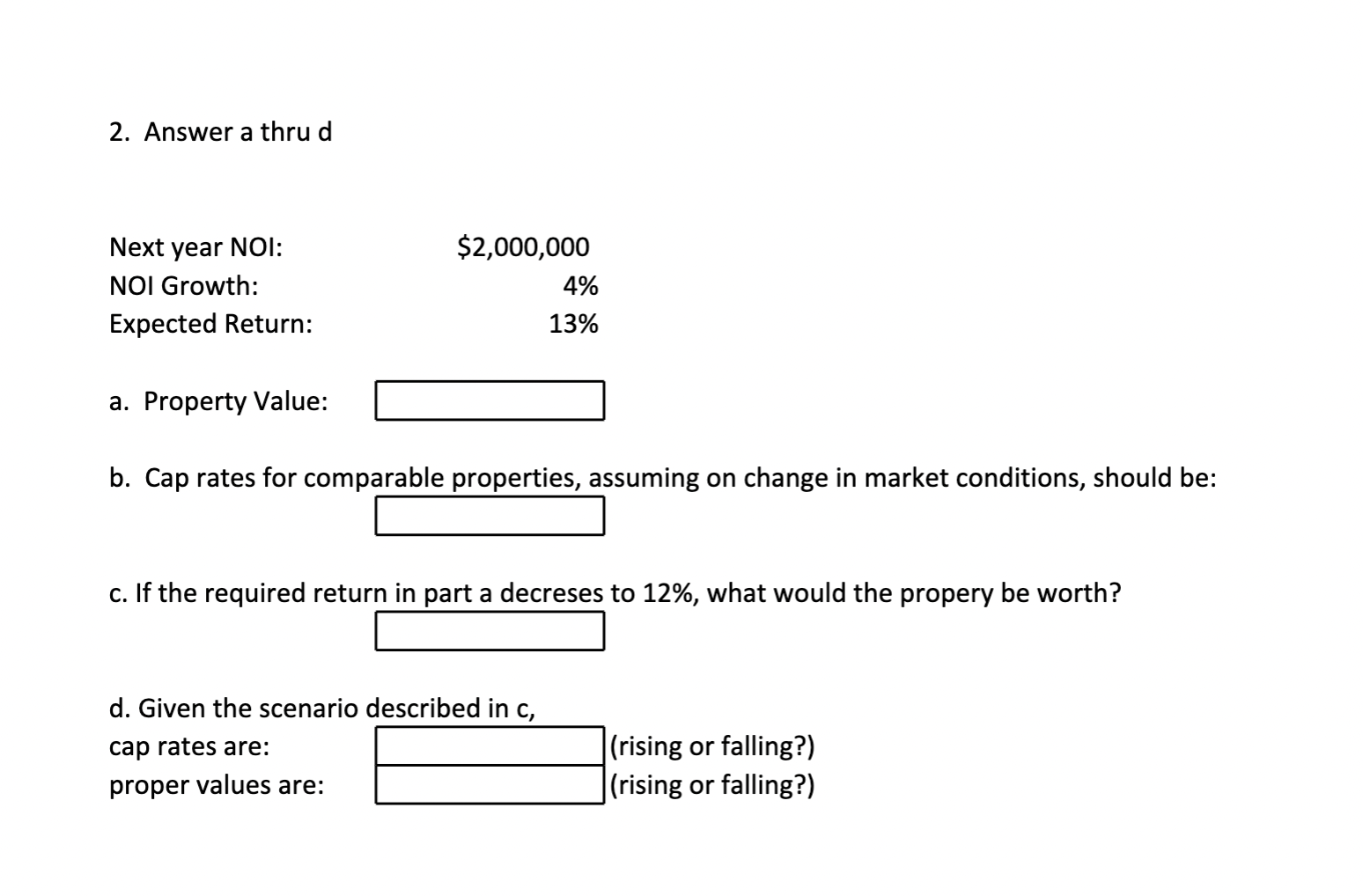

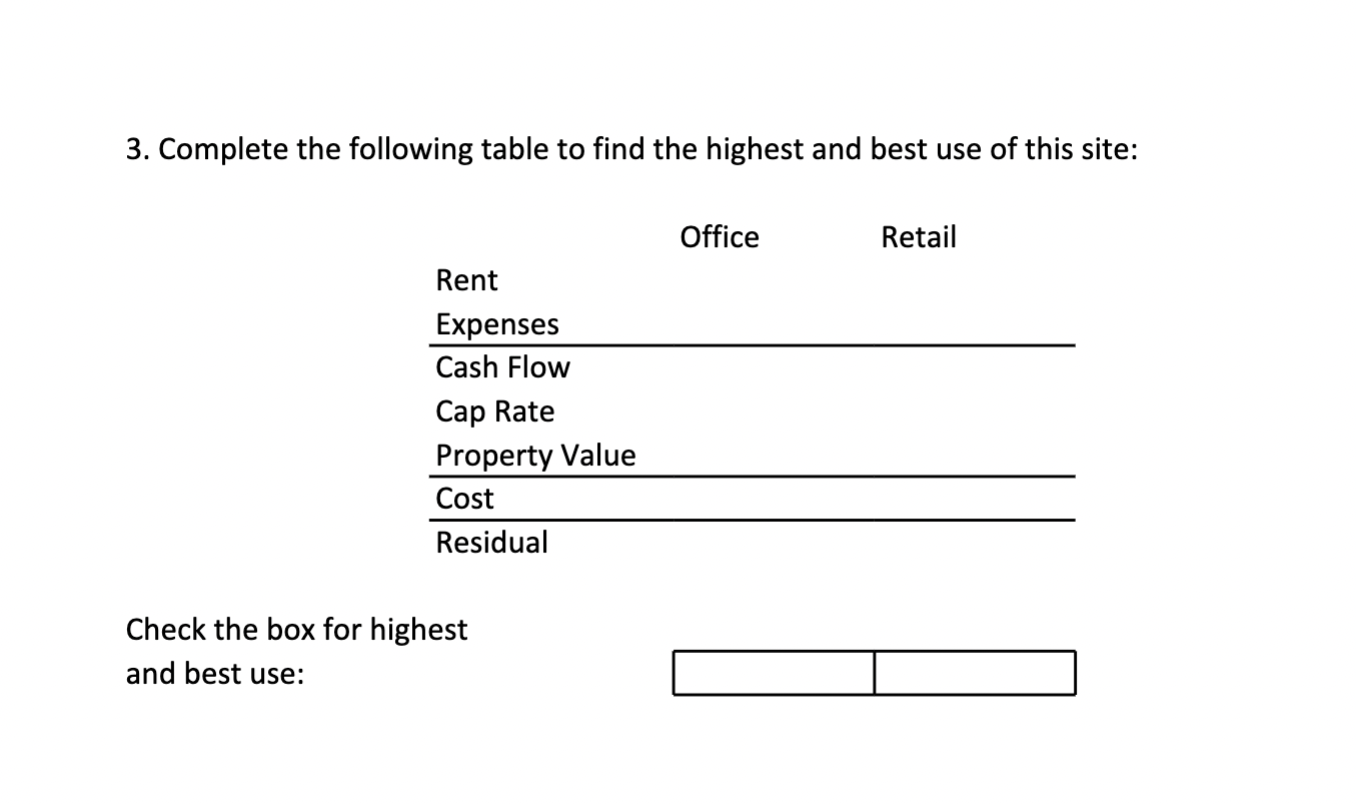

a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of NOI. Present Value of Property equals: PV of net operating income in years 1-7 PV of Sales Price, from below Current Property Value (hint: the answer is $12,069,902 ) PV of net operating income years 1 - 7: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7: Sales Price at end of year 7 : PV of Sales Price \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 2. Answer a thru d a. Property Value: b. Cap rates for comparable properties, assuming on change in market conditions, should be: c. If the required return in part a decreses to 12%, what would the propery be worth? d. Given the scenario described in c, cap rates are: (rising or falling?) proper values are: (rising or falling?) 3. Complete the following table to find the highest and best use of this site: Check the box for highest and best use: a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of NOI. Present Value of Property equals: PV of net operating income in years 1-7 PV of Sales Price, from below Current Property Value (hint: the answer is $12,069,902 ) PV of net operating income years 1 - 7: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7: Sales Price at end of year 7 : PV of Sales Price \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 2. Answer a thru d a. Property Value: b. Cap rates for comparable properties, assuming on change in market conditions, should be: c. If the required return in part a decreses to 12%, what would the propery be worth? d. Given the scenario described in c, cap rates are: (rising or falling?) proper values are: (rising or falling?) 3. Complete the following table to find the highest and best use of this site: Check the box for highest and best use

a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of NOI. Present Value of Property equals: PV of net operating income in years 1-7 PV of Sales Price, from below Current Property Value (hint: the answer is $12,069,902 ) PV of net operating income years 1 - 7: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7: Sales Price at end of year 7 : PV of Sales Price \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 2. Answer a thru d a. Property Value: b. Cap rates for comparable properties, assuming on change in market conditions, should be: c. If the required return in part a decreses to 12%, what would the propery be worth? d. Given the scenario described in c, cap rates are: (rising or falling?) proper values are: (rising or falling?) 3. Complete the following table to find the highest and best use of this site: Check the box for highest and best use: a. Find the value of the property today based on 7 years of net operating income and a selling price based on the 8th year of NOI. Present Value of Property equals: PV of net operating income in years 1-7 PV of Sales Price, from below Current Property Value (hint: the answer is $12,069,902 ) PV of net operating income years 1 - 7: Discount Rate (aka expected return for investors): LT Growth Rate: Terminal Cap Rate at end of yr 7: Sales Price at end of year 7 : PV of Sales Price \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 2. Answer a thru d a. Property Value: b. Cap rates for comparable properties, assuming on change in market conditions, should be: c. If the required return in part a decreses to 12%, what would the propery be worth? d. Given the scenario described in c, cap rates are: (rising or falling?) proper values are: (rising or falling?) 3. Complete the following table to find the highest and best use of this site: Check the box for highest and best use Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started