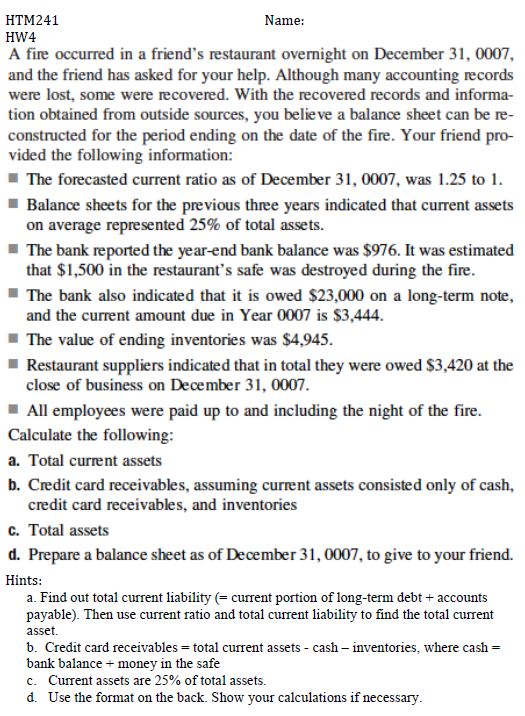

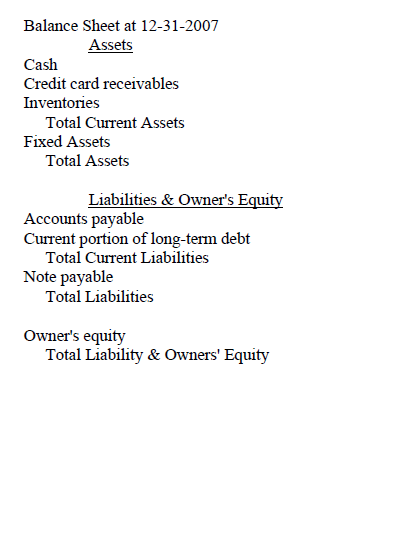

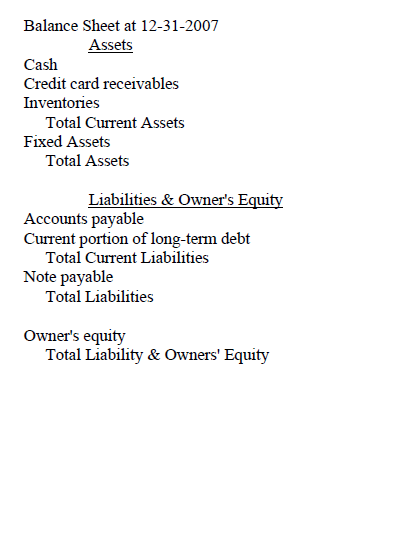

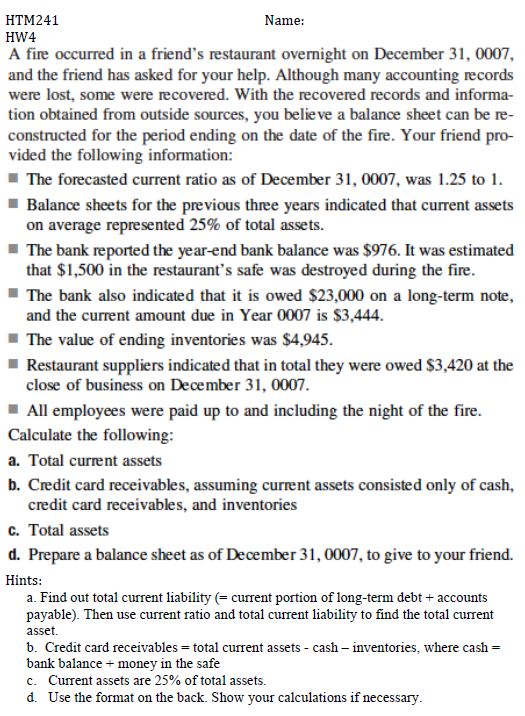

A fine occurred in a friend's restaurant overnight on December 31, 0007, and the friend has asked for your help. Although many accounting records were lost, some were recovered. With the recovered and information obtained from outside sources, you believe a balance sheet can be reconstructed for the period ending on the date of the fire. Your friend provided the following information: The forecasted current ratio as of December 31, 0007, was 1.25 to 1. Balance sheets for the previous three years indicated that current assets on average represented 25% of total assets. The bank reported the year-end bank balance was $976. It was estimated that $1,500 in the restaurant's safe was destroyed during the fire. The bank also indicated that it is owned $23,000 on a long-term note, and the current amount due is Year 0007 is $3,444. The value of ending inventories was $4,945. Restaurant suppliers indicated that in total they were $3,420 at the close of business on December 31, 0007. All employees were paid up to and including the night of the fire. Calculate the following: Total current assets Credit card receivables and inventories Total assets Prepare a balance sheet as of December 31, 0007, to give to your friend. Hints: Find out total current liability (= current portion of long-term debt + accounts payable). Then use current ratio and total current liability to find the total current asset. Credit card receivables = total current assets - cash - inventories, where cash = bank balance + money in the safe Current assets are 25% of total assets. Use the format on the back. Show your calculations if necessary. Balance Sheet at 12-31-2007 Assets Cash Credit card receivables Inventories Total Current Assets Fixed Assets Total Assets Liabilities & Owner's Equity Accounts payable Current portion of long-term debt Total Current Liabilities Note payable Total Liabilities Owner's equity A fine occurred in a friend's restaurant overnight on December 31, 0007, and the friend has asked for your help. Although many accounting records were lost, some were recovered. With the recovered and information obtained from outside sources, you believe a balance sheet can be reconstructed for the period ending on the date of the fire. Your friend provided the following information: The forecasted current ratio as of December 31, 0007, was 1.25 to 1. Balance sheets for the previous three years indicated that current assets on average represented 25% of total assets. The bank reported the year-end bank balance was $976. It was estimated that $1,500 in the restaurant's safe was destroyed during the fire. The bank also indicated that it is owned $23,000 on a long-term note, and the current amount due is Year 0007 is $3,444. The value of ending inventories was $4,945. Restaurant suppliers indicated that in total they were $3,420 at the close of business on December 31, 0007. All employees were paid up to and including the night of the fire. Calculate the following: Total current assets Credit card receivables and inventories Total assets Prepare a balance sheet as of December 31, 0007, to give to your friend. Hints: Find out total current liability (= current portion of long-term debt + accounts payable). Then use current ratio and total current liability to find the total current asset. Credit card receivables = total current assets - cash - inventories, where cash = bank balance + money in the safe Current assets are 25% of total assets. Use the format on the back. Show your calculations if necessary. Balance Sheet at 12-31-2007 Assets Cash Credit card receivables Inventories Total Current Assets Fixed Assets Total Assets Liabilities & Owner's Equity Accounts payable Current portion of long-term debt Total Current Liabilities Note payable Total Liabilities Owner's equity