Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm currently has 900,000 shares of common stock outstanding. If the firm does not raise any new funds, the true value of each

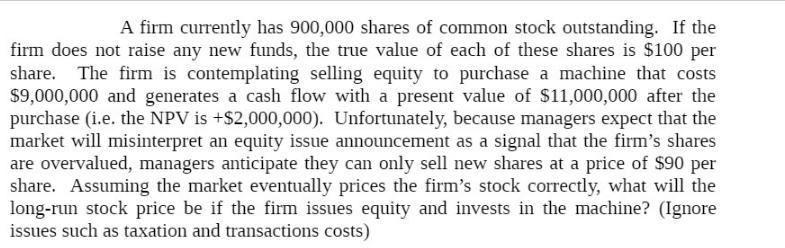

A firm currently has 900,000 shares of common stock outstanding. If the firm does not raise any new funds, the true value of each of these shares is $100 per share. The firm is contemplating selling equity to purchase a machine that costs $9,000,000 and generates a cash flow with a present value of $11,000,000 after the purchase (i.e. the NPV is +$2,000,000). Unfortunately, because managers expect that the market will misinterpret an equity issue announcement as a signal that the firm's shares are overvalued, managers anticipate they can only sell new shares at a price of $90 per share. Assuming the market eventually prices the firm's stock correctly, what will the long-run stock price be if the firm issues equity and invests in the machine? (Ignore issues such as taxation and transactions costs)

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sure lets work through this question step by step To solve for the longrun stock price if the firm i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started