Question

A firm currently sells its product with a 2% discount to customers who pay by cash or credit card when they purchase one of the

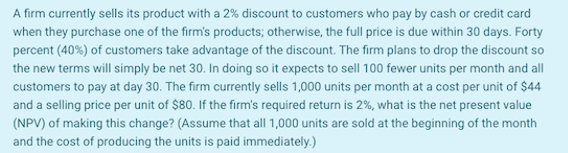

A firm currently sells its product with a 2% discount to customers who pay by cash or credit card when they purchase one of the firm's products; otherwise, the full price is due within 30 days. Forty percent (40%) of customers take advantage of the discount. The firm plans to drop the discount so the new terms will simply be net 30. In doing so it expects to sell 100 fewer units per month and all customers to pay at day 30. The firm currently sells 1,000 units per month at a cost per unit of $44 and a selling price per unit of $80. If the firm's required return is 2%, what is the net present value (NPV) of making this change? (Assume that all 1,000 units are sold at the beginning of the month and the cost of producing the units is paid immediately.) Please show full workings.

Select one:

a. $3335760

b. $-174960

c. $-29862

d. $-394960

A firm currently sells its product with a 2% discount to customers who pay by cash or credit card when they purchase one of the firm's products; otherwise, the full price is due within 30 days. Forty percent (40%) of customers take advantage of the discount. The firm plans to drop the discount so the new terms will simply be net 30. In doing so it expects to sell 100 fewer units per month and all customers to pay at day 30. The firm currently sells 1,000 units per month at a cost per unit of $44 and a selling price per unit of $80. If the firm's required return is 2%, what is the net present value (NPV) of making this change? (Assume that all 1,000 units are sold at the beginning of the month and the cost of producing the units is paid immediately.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started