Question

A firm has completed its projected cash budget for the next fiscal year. There is currently an upward sloping yield curve which implies that longer

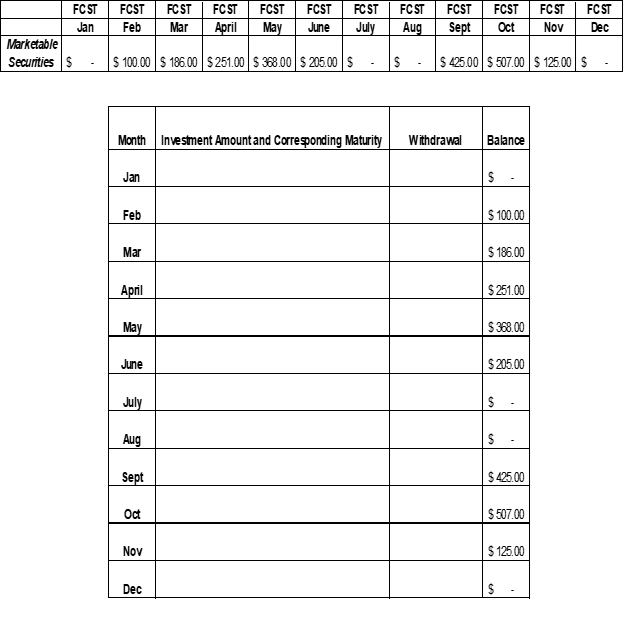

A firm has completed its projected cash budget for the next fiscal year. There is currently an upward sloping yield curve which implies that longer maturity investments yield a higher interest rate. Layout a plan to invest the marketable securities forecasted for the next year into treasury bills such that you are optimizing the potential interest earned over the planning horizon. Assume that all cash collections are received at the beginning of the month and all expenses are paid at the end of the month so that the full balance can be invested over the month in which it occurs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started