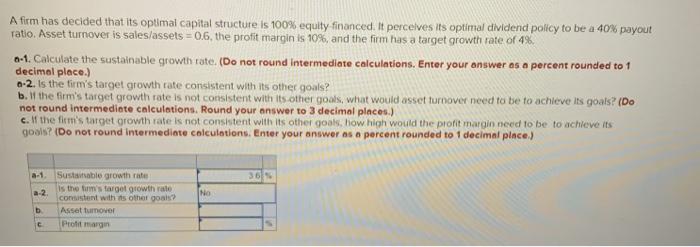

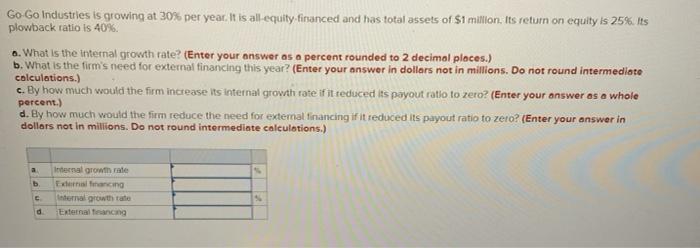

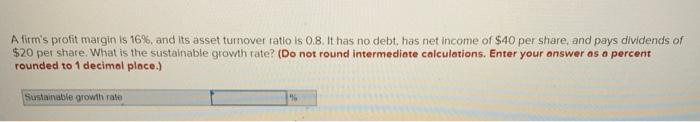

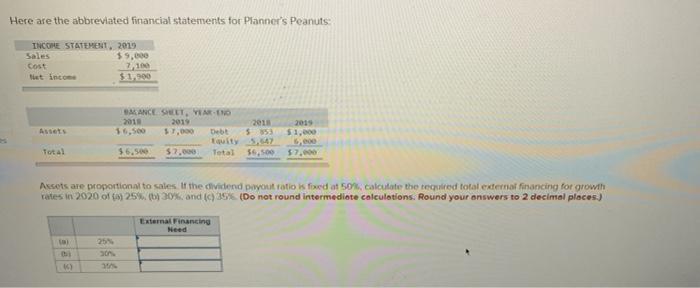

A firm has decided that its optimal capital structure is 100% equity financed. It perceives its optimal dividend policy to be a 40% payout ratio. Asset turnover is sales/assets = 0.6, the profit margin is 10%, and the firm has a target growth rate of 4% 6-1. Calculate the sustainable growth rate. (Do not round Intermediate calculations. Enter your answer as a percent rounded to 1 6-2. is the firm's target growth rate consistent with its other goals? b. the firm's target growth rate is not consistent with its other goals, what would asset turnover need to be to achieve its goals? (Do not round Intermediate calculations. Round your answer to 3 decimal places.) c. If the firm's target growth rate is not consistent with its other goals. how high would the profit margin need to be to achieve its goals? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place) 36 No a-1. Sustainable growth rate is the turm's target growth rate a-2 consistent with other goals? b Asset turnover C Profit margin Go Go Industries is growing at 30% per year. It is all-equity firsanced and has total assets of $1 millon. Its return on equity is 25%. Its plowback ratio is 40% a. What is the internal growth rate? (Enter your answer as a percent rounded to 2 decimal places.) b. What is the firm's need for external financing this year? (Enter your answer in dollars not in millions. Do not round intermediate calculations.) c. By how much would the firm increase its internal growth rate if it reduced its payout ratio to zero? (Enter your answer as a whole percent.) d. By how much would the firm reduce the need for external financing if it reduced its payout ratio to zero? (Enter your answer in dollars not in millions. Do not round intermediate calculations.) a b Internal growth rate External facing Internal growth rate External ancang E d Afirm's profit margin is 16%, and its asset turnover ratio is 0.8. It has no debt, has net income of $40 per share, and pays dividends of $20 per share. What is the sustainable growth rate? (Do not round intermediate calculations. Enter your answer os o percent rounded to 1 decimal place.) Sustainable growth rate Here are the abbreviated financial statements for Planner's Peanuts INCORE STATEMENT 2019 Sales $9.000 Cost 2.100 tist income $1.200 2015 Aute MEANCE SHEET, VARNO 2018 2019 2018 57.000 5353 quity 5.547 $7.000 56,500 Total $7.000 Assets are proportional to sales of the dividend payout ratio is foed at 50%, calculate the required total external financing for growth rates in 2020 of 25%(6) 30% and 35% (Do not round intermediate calculations. Round your answers to 2 decimal places.) External Financing Need 28