Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm has decided to acquire a new machine to produce a profitable new product. The machine would cost $12.8m and would have economic

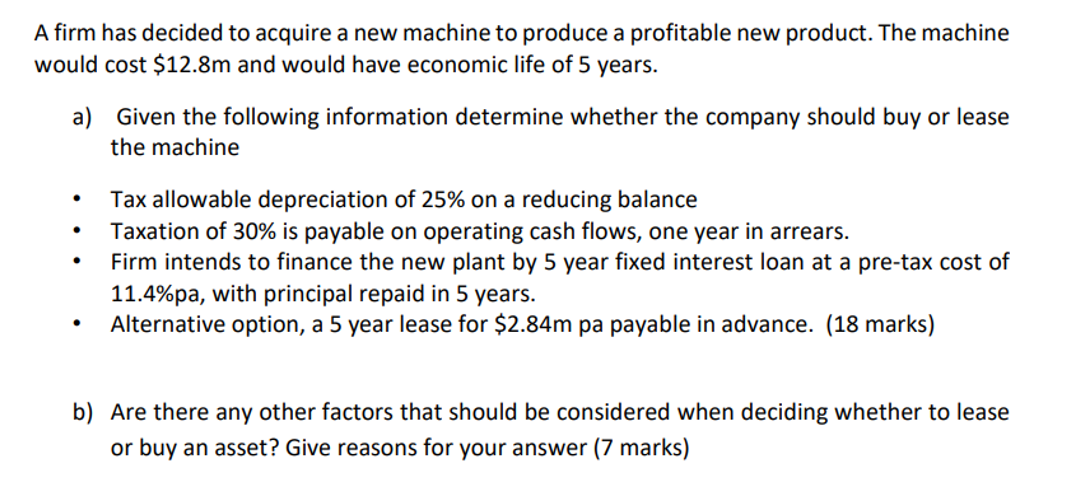

A firm has decided to acquire a new machine to produce a profitable new product. The machine would cost $12.8m and would have economic life of 5 years. a) Given the following information determine whether the company should buy or lease the machine Tax allowable depreciation of 25% on a reducing balance Taxation of 30% is payable on operating cash flows, one year in arrears. Firm intends to finance the new plant by 5 year fixed interest loan at a pre-tax cost of 11.4%pa, with principal repaid in 5 years. Alternative option, a 5 year lease for $2.84m pa payable in advance. (18 marks) b) Are there any other factors that should be considered when deciding whether to lease or buy an asset? Give reasons for your answer (7 marks)

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether the company should buy or lease the machine we need to calculate the aftertax cost of both options Option 1 Buying the machine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started