Answered step by step

Verified Expert Solution

Question

1 Approved Answer

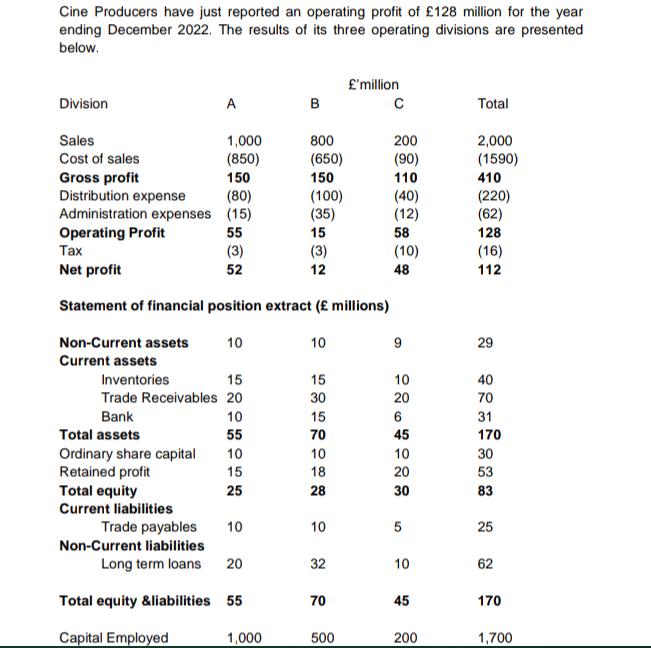

Cine Producers have just reported an operating profit of 128 million for the year ending December 2022. The results of its three operating divisions

Cine Producers have just reported an operating profit of 128 million for the year ending December 2022. The results of its three operating divisions are presented below. Division Sales Cost of sales Gross profit Distribution expense (80) Administration expenses (15) Operating Profit 55 (3) Inventories A 1,000 (850) 150 15 Trade Receivables 20 Bank 10 Total assets 55 Ordinary share capital Retained profit Total equity Current liabilities Tax Net profit 52 Statement of financial position extract ( millions) Non-Current assets 10 Current assets 10 15 25 Trade payables Non-Current liabilities Long term loans Total equity &liabilities 55 Capital Employed 1,000 10 B 20 800 (650) 150 (100) (35) 15 (3) 12 10 15 30 15 70 10 18 28 10 32 70 'million 500 C 200 (90) 110 (40) (12) 58 (10) 48 9 10 20 6 45 10 20 30 5 10 45 200 Total 2,000 (1590) 410 (220) (62) 128 (16) 112 29 40 70 31 170 30 53 83 25 62 170 1,700 The company currently uses Return on Capital Employed (ROCE) as its single measure to assess and compare the financial performance of the divisions. However, the company has now decided: To set a target return on capital employed (ROCE) for each division and to pay a bonus to the Divisional Manager if the target is met. To use appropriate non-financial performance measures. You may assume that the company does not pay corporation tax. Required: a) b) c) To also use Residual Income (RI) as a divisional performance measure. The company has calculated its cost of capital at 3%. d) Determine the ROCE for the company and each of its three divisions and give your opinion as to whether the company is making a satisfactory return. Using the company's cost of capital of 3% determine and comment on the Residual Income for each division. For the company (not divisions), calculate the following ratios (i) Gross profit margin (ii) Operating profit margin (iii) Net profit margin (iv) Trade receivable days (v) Trade payable days (vi) Asset Turnover (vii) Gearing Evaluate ROCE as a performance measure. What do you consider to be its strengths and weaknesses?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started