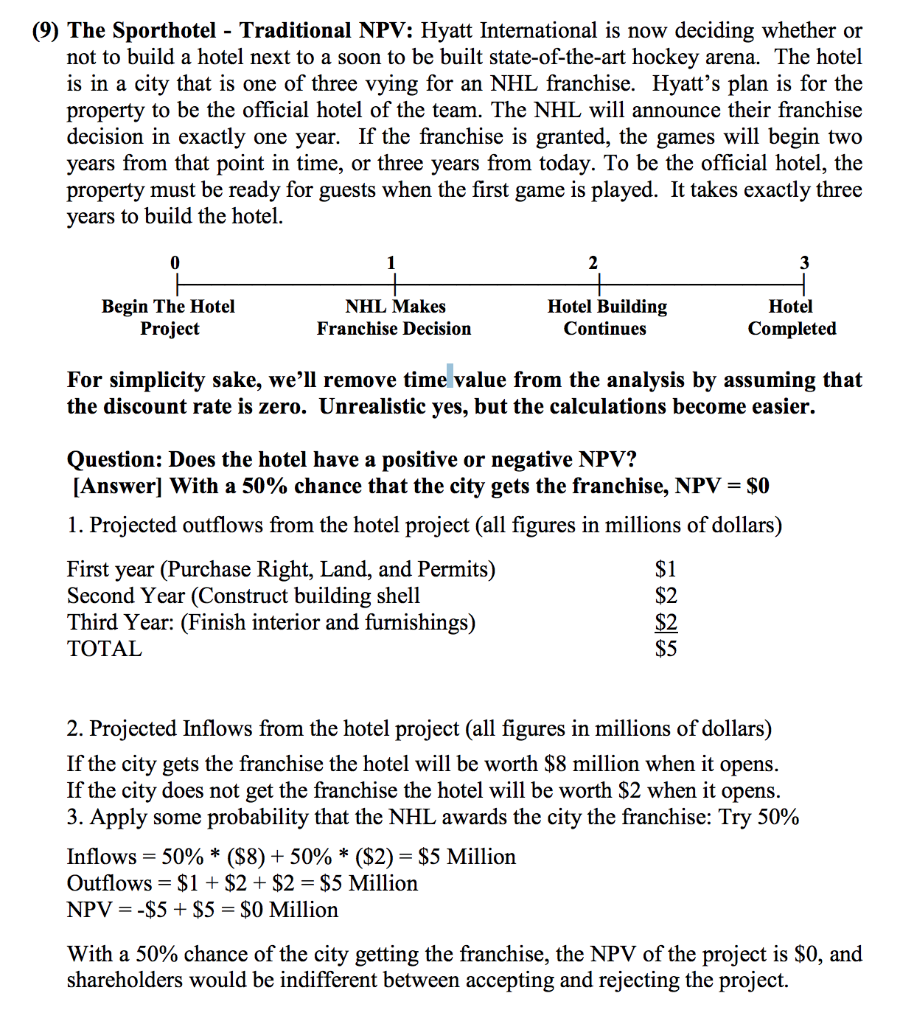

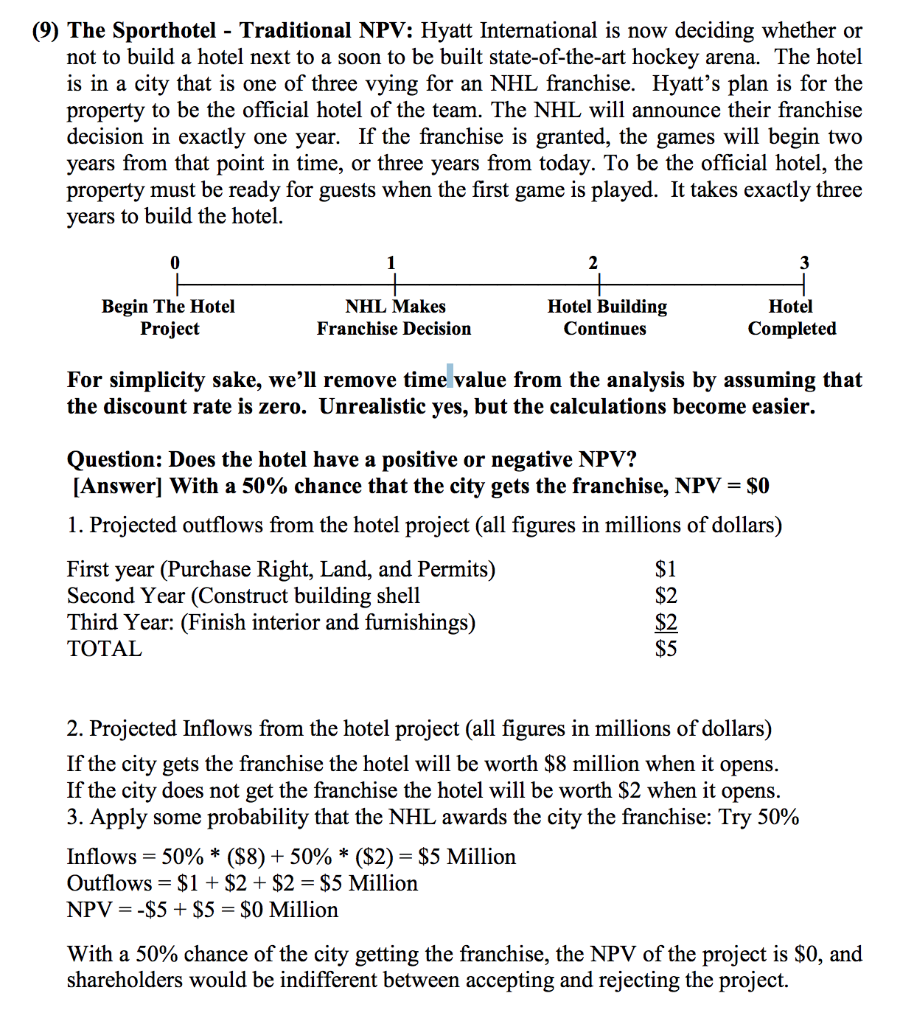

A firm has invested S600 in a new machine that is expected to generate cash flows over the next 8 years. The machine will be depreciated on a straight line basis down to zero by the end of its life. The firm projects their annual cash inflows at S650 per year and annual cash outflows at 300 per year. Assuming the tax rate of 38%, determine the firm's cash flow next year. Place your answer to dollars and cents. Do not include a dollar sign or a comma in your answer. (9) The Sporthotel - Traditional NPV: Hyatt International is now deciding whether or not to build a hotel next to a soon to be built state-of-the-art hockey arena. The hotel is in a city that is one of three vying for an NHL franchise. Hyatt's plan is for the property to be the official hotel of the team. The NHL will announce their franchise decision in exactly one year. If the franchise is granted, the games will begin two years from that point in time, or three years from today. To be the official hotel, the property must be ready for guests when the first game is played. It takes exactly three years to build the hotel. Begin The Hotel Project NHL Makes Franchise Decision Hotel Building Continues Hotel Completed For simplicity sake, we'll remove time value from the analysis by assuming that the discount rate is zero. Unrealistic yes, but the calculations become easier. Question: Does the hotel have a positive or negative NPV? Answer! with a 50% chance that the city gets the franchise, NPV 1. Projected outflows from the hotel project (all figures in millions of dollars) First year (Purchase Right, Land, and Permits) Second Year (Construct building shell Third Year: (Finish interior and furnishings) TOTAL $1 $2 $2 S5 2. Projected Inflows from the hotel project (all figures in millions of dollars) If the city gets the franchise the hotel will be worth $8 million when it opens If the city does not get the franchise the hotel will be worth $2 when it opens. 3. Apply some probability that the NHL awards the city the franchise: Try 50% Inflows-50% * ($8) + 50% * ($2)-$5 Million Outflows $1 +$2$2 $5 Million NPV--S5$5- $0 Million With a 50% chance of the city getting the franchise, the NPV of the project is so, and shareholders would be indifferent between accepting and rejecting the project