Answered step by step

Verified Expert Solution

Question

1 Approved Answer

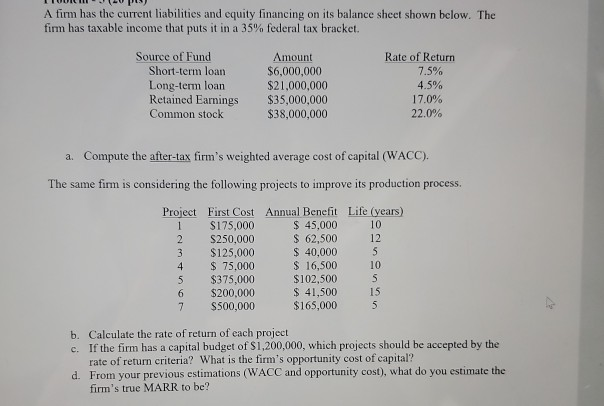

A firm has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that puts it in a

A firm has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that puts it in a 35% federal tax bracket. Source of Fund Rate of Return Amount $6,000,000 $21,000,000 $35,000,000 $38,000,000 Short-term loan 7.5% Long-term loan Retained Earnings 4.5% 17.0% 22.0% Common stock a. Compute the after-tax firm's weighted average cost of capital (WACC). The same firm is considering the following projects to improve its production process. Project First Cost Annual Benefit Life (years) 10 $ 45,000 $ 62,500 $ 40,000 $ 16,500 $102,500 $ 41,500 $165,000 S175,000 $250,000 12 $125,000 $ 75,000 $375,000 10 4 15 $200,000 $500,000 b. Calculate the rate of return of each project c. If the firm has a capital budget of $1,200,000, which projects should be accepted by the rate of return criteria? What is the firm's opportunity cost of capital? d. From your previous estimations (WACC and opportunity cost), what do you estimate the firm's true MARR to be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started