Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm has the following capital structure: 1. Bonds with market value of $6000,000 2. Preferred Stock with a market value of $1,000,000 3.

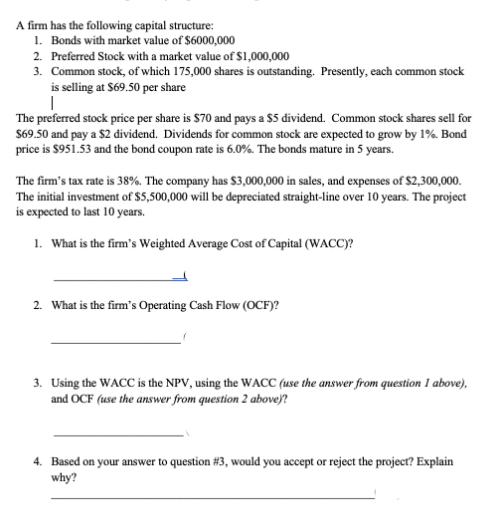

A firm has the following capital structure: 1. Bonds with market value of $6000,000 2. Preferred Stock with a market value of $1,000,000 3. Common stock, of which 175,000 shares is outstanding. Presently, each common stock is selling at $69.50 per share T The preferred stock price per share is $70 and pays a $5 dividend. Common stock shares sell for $69.50 and pay a $2 dividend. Dividends for common stock are expected to grow by 1%. Bond price is $951.53 and the bond coupon rate is 6.0%. The bonds mature in 5 years. The firm's tax rate is 38%. The company has $3,000,000 in sales, and expenses of $2,300,000. The initial investment of $5,500,000 will be depreciated straight-line over 10 years. The project is expected to last 10 years. 1. What is the firm's Weighted Average Cost of Capital (WACC)? 2. What is the firm's Operating Cash Flow (OCF)? 3. Using the WACC is the NPV, using the WACC (use the answer from question I above), and OCF (use the answer from question 2 above)? 4. Based on your answer to question #3, would you accept or reject the project? Explain why?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the firms Weighted Average Cost of Capital WACC we need to determine the weight of each component in the capital structure and the cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started