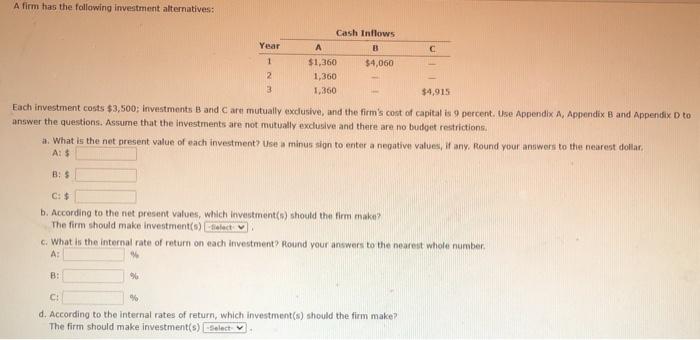

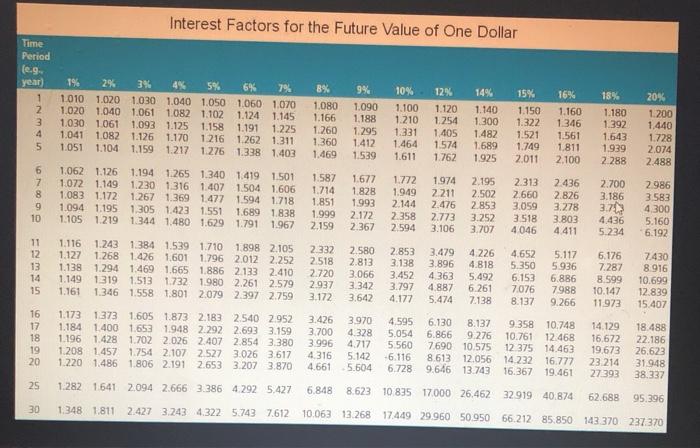

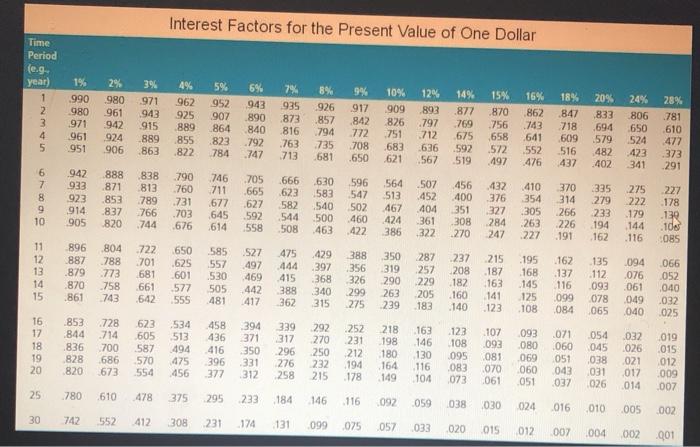

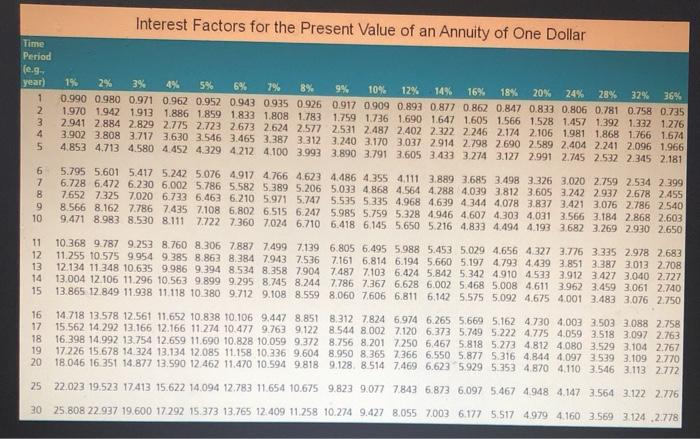

A firm has the following Investment alternatives: Cash Intlows Year A 1 $1,360 $4,060 2 1,360 3 1,360 $4,915 Each investment costs $3,500; Investments B and Care mutually exclusive, and the firm's cost of capital is 9 percent. Use Appendix A, Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions a. What is the net present value of each investment? Use a minussion to enter a negative values, if any, Round your answers to the nearest dollar A: B: $ C: $ b. According to the net present values, which investment() should the firm make The firm should make Investment(s) c. What is the internal rate of return on each Investment Round your answers to the nearest whole number A: B: % C: % d. According to the internal rates of return, which investment(s) should the firm make? The firm should make investment(s) Select Interest Factors for the Future Value of One Dollar Time Period (e.g. year) 19 2% 3% 4% 5% 6% 7% B% 9% 10% 12% 14% 15% 1 1010 1.020 1.030 1.040 1050 1060 1070 1.080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.082 1.102 1.124 1.145 1.166 1.188 1.210 1.254 1.300 1.322 1.030 1061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.521 4 1.041 1.082 1.126 1.170 1216 1.262 1.311 1.360 1.412 1.464 1574 1.689 1.749 5 1.051 1.104 1.159 1.217 1.276 1.338 1403 1.469 1539 1.611 1.762 1.925 2011 6 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.974 2.195 2.313 7 1.072 1.149 1.230 1316 1.407 1.504 1606 1.714 1.828 1.949 2211 2.502 2.660 8 1.083 1.172 1.267 1.369 1477 1.594 1718 1.851 1993 2.144 2.476 2.853 3.059 9 1.094 1.195 1.305 1.423 1551 1.689 1.838 1.999 2.172 2.358 2.773 3.252 3518 10 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2594 3.106 3.707 4046 NM 16% 1.160 1346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2.074 2.488 2.436 2.826 3.278 3.803 4.411 2.700 3.186 3.7 4,436 5.234 2986 3.583 4.300 5.160 6.192 11 12 13 14 15 1.116 1.243 1384 1.539 1.710 1.898 2.105 1.127 1.268 1.426 1.601 1.796 2012 2.252 1.138 1.294 1.469 1.665 1.886 2133 2.410 1.149 1319 1.513 1732 1980 2.261 2.579 1.161 1.346 1.558 1.801 2.079 2.397 2.759 2332 2518 2.720 2.937 3.172 2.580 2.813 3.066 3.342 3.642 2.853 3.138 3.452 3.797 4.177 3.479 3.896 4363 4.887 5.474 4.226 4.818 5.492 6.261 7.138 4.652 5.350 6.153 7.076 8.137 5.117 5.936 6.886 7988 9.266 6.176 7.287 8.599 10.147 11973 7430 8.916 10.699 12.839 15.407 16 17 18 19 20 1.173 1373 1.605 1.873 2.183 2540 2952 1.184 1.400 1.653 1948 2.292 2.693 3.159 1.196 1.428 1.702 2.026 2.407 2.854 3.380 1.208 1.457 1754 2.107 2.527 3.026 3.617 1.220 1.486 1.806 2.191 2.653 3.207 3.870 3.426 3970 3.700 4.328 3.996 4.717 4316 5.142 4.661 5.604 4.595 5.054 5.560 -6.116 6.728 6.130 8.137 6.866 9.276 7.690 10.575 8.613 12.056 9.646 13.743 9.358 10.761 12 375 14.232 16.367 10.748 12.468 14.463 16.777 19.461 14.129 16.672 19.673 23. 214 27393 18.488 22.186 26.623 31.948 38.337 25 1.282 1.641 2.094 2.666 3.386 4.292 5.427 6.848 8.623 10 835 17.000 26.462 3291940.874 62.688 95.396 30 1.348 1.811 2.427 3.243 4.3225.743 7.612 10.063 13.268 17449 29.960 50.950 66.212 85.850 143370 237.370 Interest Factors for the Present Value of One Dollar Time Period (e.g year) 1 3% 1% 990 6% 943 8% 926 971 943 915 .889 863 4% 962 925 889 855 822 15% 870 .756 780 478 375 233 030 742 412 308 174 015 1% Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g year) 19 2% 3% 5% 6% 7% B% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 1 0.990 0.980 0.971 0.962 0.952 0943 0.935 0.926 0.917 0909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 2 1.970 1942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1736 1690 1647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1674 4 3.902 3.808 3.717 3630 3.546 3.465 3.387 3312 3.240 3.170 3.037 2914 2.798 2690 2589 2.404 2.241 2.096 1.966 5 4.853 4.713 4.580 4.452 4.329 4212 4.100 3.9933.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2937 2678 2.455 8 7.652 7.325 7,020 6.733 6.463 6.210 5.971 5.747 5535 5.335 4.968 4,639 4 344 4.078 3.837 3.421 3.076 2.786 2.540 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 49464.607 4.303 4.031 3.566 3.184 2.868 2.603 10 9.471 8.983 8.530 8.111 7722 7.360 7024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9.385 8.863 8,384 7943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 13 12.134 11.348 10.635 9986 9.394 8.534 8.358 7904 7.487 7.103 6.424 5.842 5.342 4910 4533 3.912 3427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 15 13.865 12.849 11.938 11.118 10 380 9.712 9.108 8.559 8,060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6974 6.265 5.669 5.162 4.730 4,003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11 274 10.477 9763 9.122 8.544 8002 7.120 6.373 5.749 5:222 4.775 4,059 3.518 3.097 2.763 16,398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8201 7.250 6.467 5.818 5.273 4.812 4.000 3.529 3.104 2.767 17.226 15.678 14 324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7366 6.550 5.877 5.316 4.844 4.097 3539 3.109 2770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5353 4.870 4.110 3.546 3.113 2772 22.023 19.523 17413 15.622 14.094 12,783 11.654 10.675 9.823 9.077 7843 6.873 6.097 5.467 4948 4.147 3.564 3.122 2.776 25 30 25,808 22 937 19.600 17.292 15.373 13.765 12.409.11.258 10.274 9.427 8.055 7.003 6.177 5.517 4979 4.160 3.569 3.124.2.778