Question

A firm in mine industry generates risky cash flows with an expected value of $ 750, 000 per year (perpetuity). Using direct tracking method of

A firm in mine industry generates risky cash flows with an expected value of $ 750, 000 per year (perpetuity). Using direct tracking method of valuation, the CFO of the firm has found that in order to replicate the cash flows, the amount of money invested in the market portfolio (i.e., the term b) needs to be equal to the amount of money invested in risk-free asset (i.e., the term a). The financial market is mean-variance efficient, the safe rate of interest is 5 percent, and the market expected return is 10 percent. The firm has outstanding debt with a market value of $ 1 million. The debt is risk-free. The number of outstanding shares is 1 million. The corporate tax rate is 30%.

i) What is the firm value?

ii) What is the share price?

Suppose that this mine firm plans to borrow an additional $100,000 on a permanent basis through a leveraged recapitalization in which it would use the borrowed funds to repurchase outstanding shares. After the new borrowing, the debt is still risk-free.

iii) What is the share price after the capital structure change is completed?

iv) How many shares are repurchased?

direct tracking method-

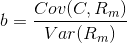

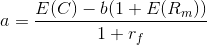

money invested in market portfolio

money invested in risk free asset

PV

PV = a+b

Beta = b/PV = b/a+b

C = cashflow

b= Cou(C, Rm) Var(Rm) 1 a = E(C) 6(1 + E(Rm)) 1+rf b= Cou(C, Rm) Var(Rm) 1 a = E(C) 6(1 + E(Rm)) 1+rfStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started