Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is 100% equity financed and has 10 million shares. Its current share price is $50. To reduce its corporate tax, it decided

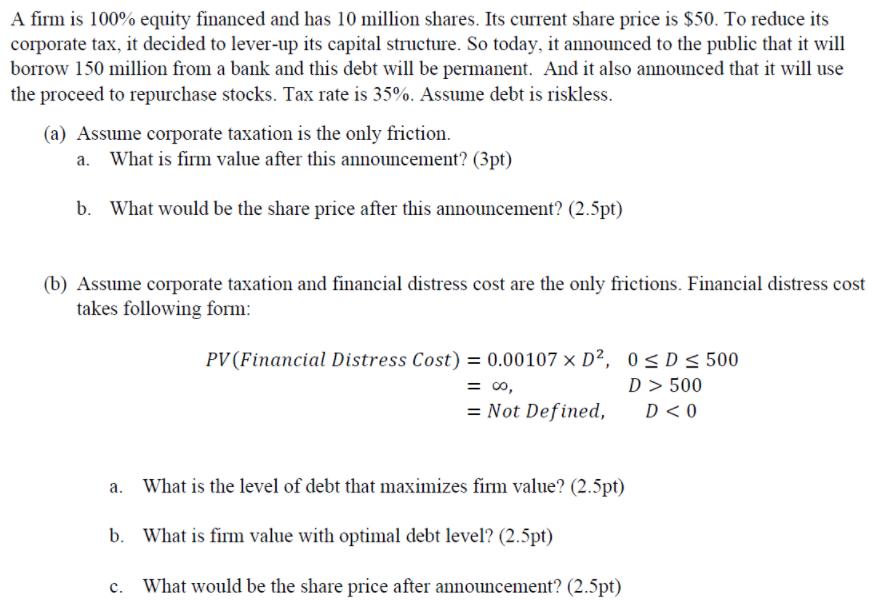

A firm is 100% equity financed and has 10 million shares. Its current share price is $50. To reduce its corporate tax, it decided to lever-up its capital structure. So today, it announced to the public that it will borrow 150 million from a bank and this debt will be permanent. And it also announced that it will use the proceed to repurchase stocks. Tax rate is 35%. Assume debt is riskless. (a) Assume corporate taxation is the only friction. a. What is firm value after this announcement? (3pt) b. What would be the share price after this announcement? (2.5pt) (b) Assume corporate taxation and financial distress cost are the only frictions. Financial distress cost takes following form: PV (Financial Distress Cost) = 0.00107 x D, 0D 500 D> 500 D

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The firms value after the announcement is Value of firm Equity value Debt value Equity value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started