Answered step by step

Verified Expert Solution

Question

1 Approved Answer

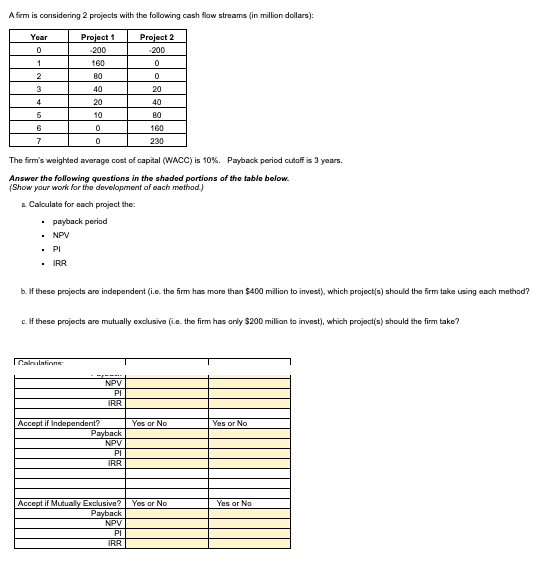

A firm is considering 2 projects with the following cash flow streams ( in million dollars ) : The firm's weighted awerage cost of capital

A firm is considering projects with the following cash flow streams in million dollars:

The firm's weighted awerage cost of capital WACC is Payback period culaff is years.

Answer the following questions in the shaded portions of the table below.

Show your work for the devolopment of each mothod.

a Caloulate for each project the:

payback period

NPV

IRR

b If these projects are independent ie the firm has more than $ milion to invest which prajects should the firm take using each method?

c If these projects are mutually exclusive ie the firm has arly $ milfion to imvest which projects should the firm take?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started