Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is considering a new project that will require an initial investment of $10 million. The project is expected to generate cash flows

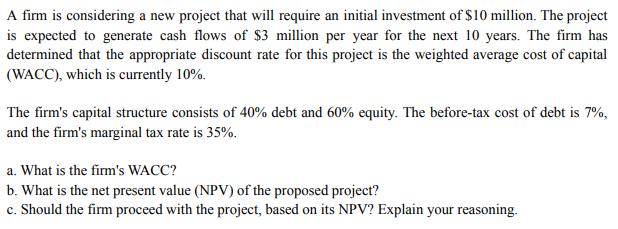

A firm is considering a new project that will require an initial investment of $10 million. The project is expected to generate cash flows of $3 million per year for the next 10 years. The firm has determined that the appropriate discount rate for this project is the weighted average cost of capital (WACC), which is currently 10%. The firm's capital structure consists of 40% debt and 60% equity. The before-tax cost of debt is 7%, and the firm's marginal tax rate is 35%. a. What is the firm's WACC? b. What is the net present value (NPV) of the proposed project? c. Should the firm proceed with the project, based on its NPV? Explain your reasoning.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started