Question

You are interviewed by an investment bank for a job position on its commodities desk. You are given the following exercise. The storage cost for

You are interviewed by an investment bank for a job position on its commodities desk. You are given the following exercise. The storage cost for a commodity is 1% of the spot price per year and interest rate is 2%. The current time is April, 1 month prior to the May settlement date. The spot price is 1.96.

What is the fair value of the May futures contract (with storage cost)?

Assume now that the fair value formula is given by

F0(0) = S(0).e(r−κ)T

Where κ is the so-called convenience yield.

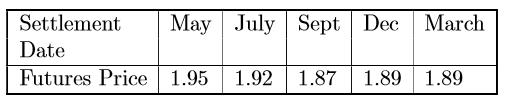

The futures prices of this storable commodity are shown below:

1) Compute the annualized convenience yield κ for all contracts?

2) Explain the notion of "convenience yield" and its link with the benefits of holding some inventories of the underlying commodity?

May July Sept Dec March Settlement Date Futures Price 1.95 1.92 1.87 1.89 1.89

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here is my response to the exercise 1 The fair value of the May futures contract with 1 annual st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started