Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is considering an investment project that requires an initial outlay of RM10,000,000. The project is expected to provide net cash flows of

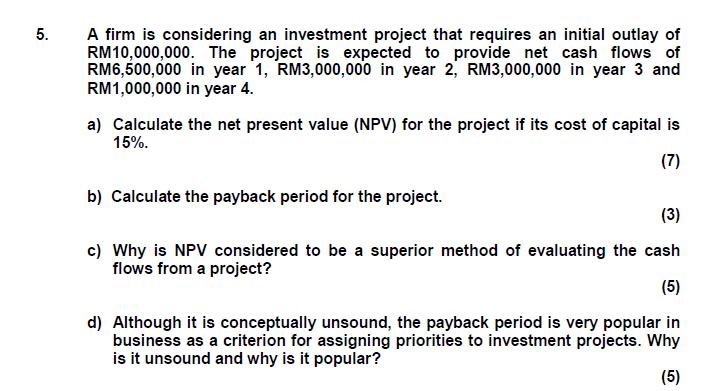

A firm is considering an investment project that requires an initial outlay of RM10,000,000. The project is expected to provide net cash flows of RM6,500,000 in year 1, RM3,000,000 in year 2, RM3,000,000 in year 3 and RM1,000,000 in year 4. 5. a) Calculate the net present value (NPV) for the project if its cost of capital is 15%. (7) b) Calculate the payback period for the project. (3) c) Why is NPV considered to be a superior method of evaluating the cash flows from a project? (5) d) Although it is conceptually unsound, the payback period is very popular in business as a criterion for assigning priorities to investment projects. Why is it unsound and why is it popular? (5)

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a cost of capital 15 Present value of cash flow 6500000115300000011523000000115310000001154104649068...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started