Question

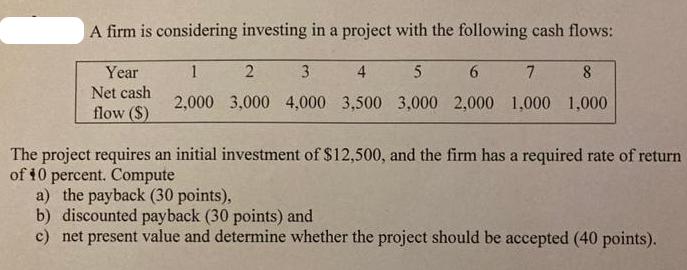

A firm is considering investing in a project with the following cash flows: Year Net cash 1 2 3 4 5 6 7 8

A firm is considering investing in a project with the following cash flows: Year Net cash 1 2 3 4 5 6 7 8 2,000 3,000 4,000 3,500 3,000 2,000 1,000 1,000 flow ($) The project requires an initial investment of $12,500, and the firm has a required rate of return of 40 percent. Compute a) the payback (30 points), b) discounted payback (30 points) and c) net present value and determine whether the project should be accepted (40 points).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Project Investment Analysis a Payback Period The payback period is the number of years it takes for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management Sustainability And Supply Chain Management

Authors: Jay Heizer, Barry Render, Chuck Munson

14th Edition

0137476442, 978-0137476442

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App