Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The

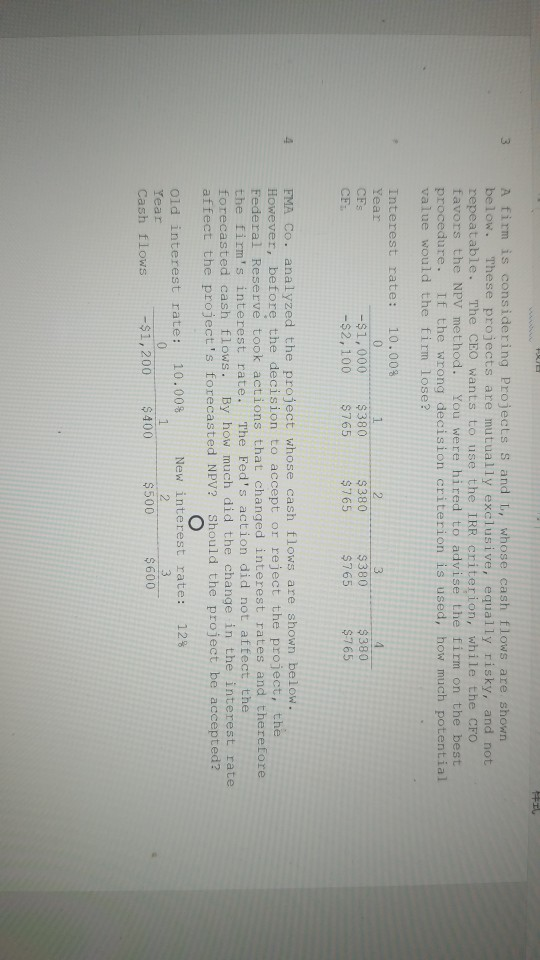

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose? 3 Interest rate: 10.00% Year CFs 0 -$1,000 $380 -$2,100 $765 $765 $765 $765 $380 $380 $380 4 FMA Co. analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's interest rate. The Fed's action did not affect the forecasted cash flows. By how much did the change in the interest rate affect the project's forecasted NPV? Should the project be accepted? Old interest rate: 10.00% Year Cash flows New interest rate: 12% 2 $500 0 $600 -$1,200 $400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started