Question

A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is $ 1.82 million plus $

A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is

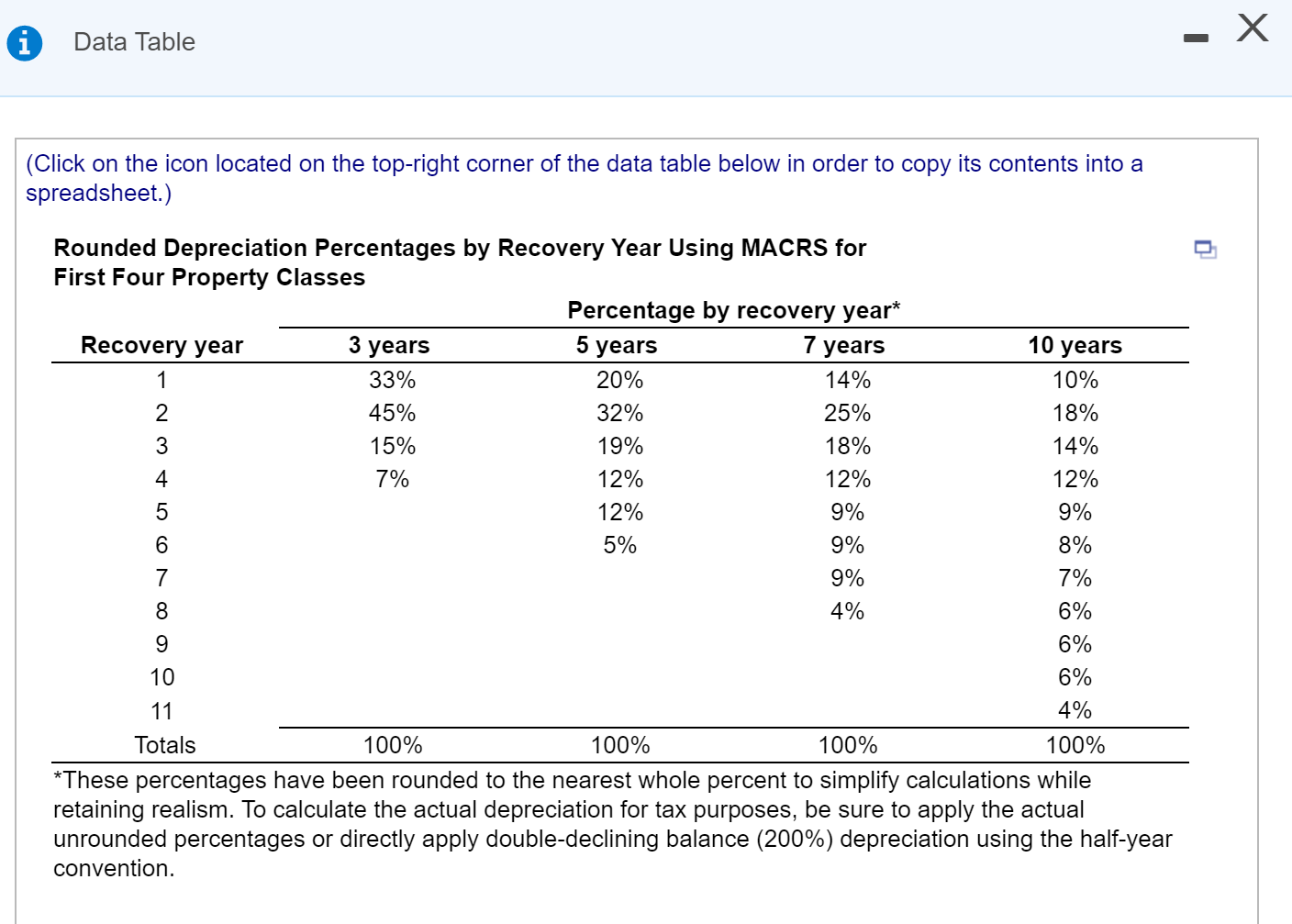

$ 1.82 million plus $ 104,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery period (see table attached in photo). Additional sales revenue from the renewal should amount to $ 1.22million per year, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 35 % of the additional sales. The firm is subject to a tax rate of 40 %

(Note:

Answer the following questions for each of the next 6 years.) I MUST ANSWER SEVERAL ANSWERS TO UNDERSTAND THIS. I HAVE BEEN STUCK FOR DAY'S. I POSTED MY LAST EXAMPLE WHICH WAS WRONG WITH THE CORRECT ANSWERS (below question c. and above the table) to use as a guide BUT THEY GAVE ME A NEW PROBLEM WHICH IS POSTED ABOVE which I need help with and to answer with all the examples for the new problem> HELP!

a. What incremental earnings before depreciation, interest, and taxes will result from the renewal?

b. What incremental net operating profits after taxes will result from the renewal?

c. What incremental operating cash inflows will result from the renewal?

===========================================================================================

(My problem I got wrong with the right answers is posted below)

181.million plus 115000 (5 year recovery)

1.13 million per year, 39% of additional costs, 40% tax rate (6 years)

A) 689300

B)

YEAR 1

Profit Before Depreciation and Taxes ) 689300

Depreciation) 385000

Net Profit Before Taxes) 304300

Taxes) 121720

Net Profit After Taxes) 182580

YEAR 2

Profit Before Depreciation and Taxes ) 689300

Depreciation) 616000

Net Profit Before Taxes) 73300

Taxes) 29320

Net Profit After Taxes) 43980

YEAR 3

Profit Before Depreciation and Taxes ) 689300

Depreciation) 365750

Net Profit Before Taxes) 323550

Taxes) 129420

Net Profit After Taxes) 194130

YEAR 4

Profit Before Depreciation and Taxes ) 689300

Depreciation) 231000

Net Profit Before Taxes) 458300

Taxes) 183320

Net Profit After Taxes) 274980

YEAR 5

Profit Before Depreciation and Taxes ) 689300

Depreciation) 231000

Net Profit Before Taxes) 458300

Taxes) 183320

Net Profit After Taxes) 274980

YEAR 6

Profit Before Depreciation and Taxes ) 689300

Depreciation) 96250

Net Profit Before Taxes) 593050

Taxes) 237220

Net Profit After Taxes) 335830

C)

year 1= 567580

year 2= 659980

year 3= 559880

year 4= 505980

year 5= 505980

year 6= 452080

(Same table for both problems)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started