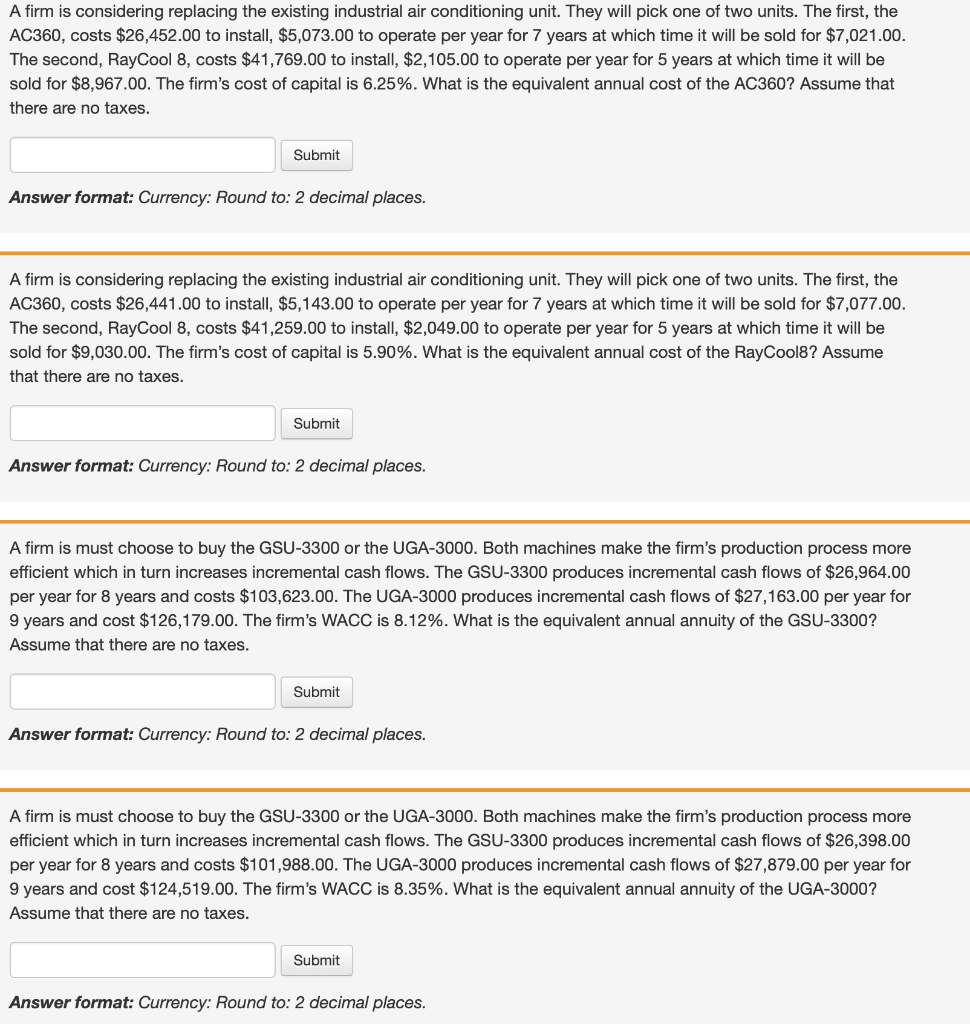

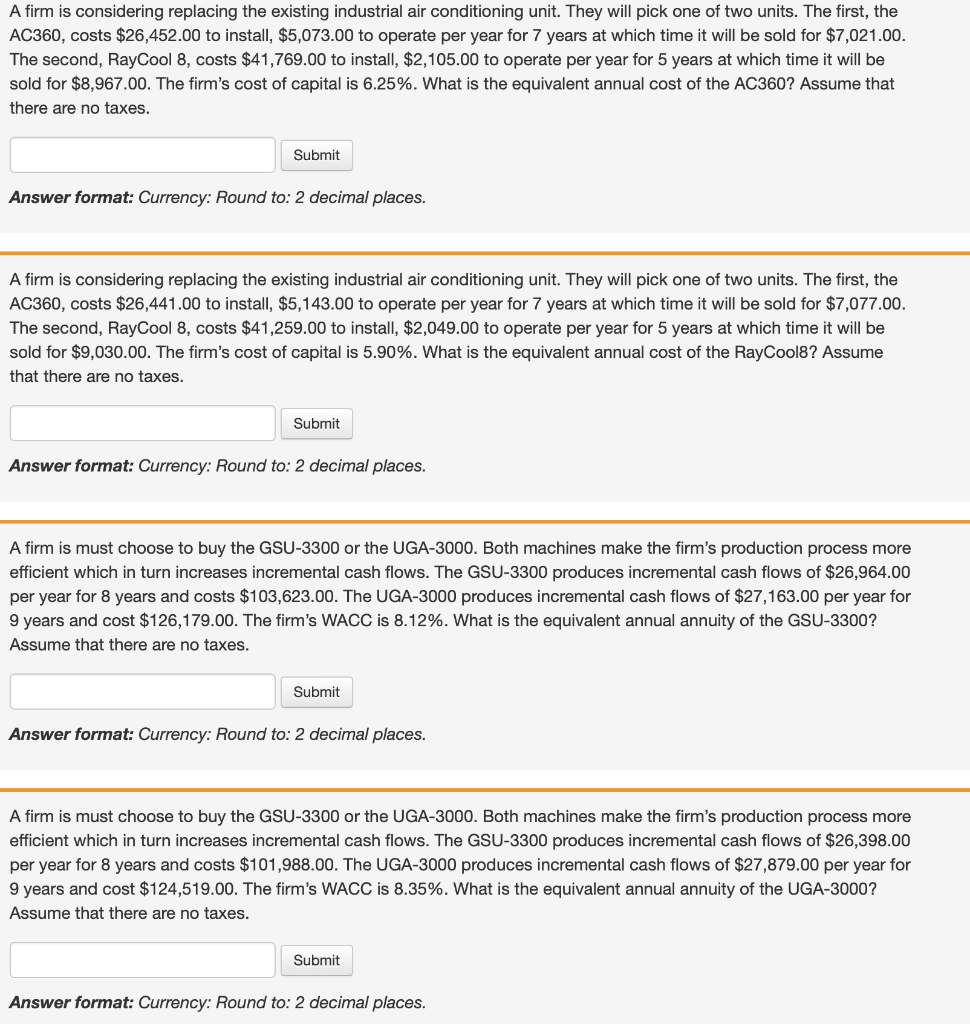

A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,452.00 to install, $5,073.00 to operate per year for 7 years at which time it will be sold for $7,021.00. The second, RayCool 8, costs $41,769.00 to install, $2,105.00 to operate per year for 5 years at which time it will be sold for $8,967.00. The firm's cost of capital is 6.25%. What is the equivalent annual cost of the AC360? Assume that there are no taxes. Submit Answer format: Currency: Round to: 2 decimal places. A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,441.00 to install, $5,143.00 to operate per year for 7 years at which time it will be sold for $7,077.00. The second, RayCool 8, costs $41,259.00 to install, $2,049.00 to operate per year for 5 years at which time it will be sold for $9,030.00. The firm's cost of capital is 5.90%. What is the equivalent annual cost of the RayCool8? Assume that there are no taxes. Submit Answer format: Currency: Round to: 2 decimal places. A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $26,964.00 per year for 8 years and costs $103,623.00. The UGA-3000 produces incremental cash flows of $27,163.00 per year for 9 years and cost $126,179.00. The firm's WACC is 8.12%. What is the equivalent annual annuity of the GSU-3300? Assume that there are no taxes. Submit Answer format: Currency: Round to: 2 decimal places. A firm is must choose to buy the GSU-3300 or the UGA-3000. Both machines make the firm's production process more efficient which in turn increases incremental cash flows. The GSU-3300 produces incremental cash flows of $26,398.00 per year for 8 years and costs $101,988.00. The UGA-3000 produces incremental cash flows of $27,879.00 per year for 9 years and cost $124,519.00. The firm's WACC is 8.35%. What is the equivalent annual annuity of the UGA-3000? Assume that there are no taxes. Submit Answer format: Currency: Round to: 2 decimal places