Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm is currently partially financed with zero-coupon debt that promises to repay bondholders $200 at maturity. These bonds mature one year from today

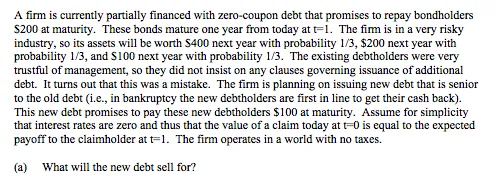

A firm is currently partially financed with zero-coupon debt that promises to repay bondholders $200 at maturity. These bonds mature one year from today at t-1. The firm is in a very risky industry, so its assets will be worth $400 next year with probability 1/3, $200 next year with probability 1/3, and $100 next year with probability 1/3. The existing debtholders were very trustful of management, so they did not insist on any clauses governing issuance of additional debt. It turns out that this was a mistake. The firm is planning on issuing new debt that is senior to the old debt (i.e., in bankruptcy the new debtholders are first in line to get their cash back). This new debt promises to pay these new debtholders $100 at maturity. Assume for simplicity that interest rates are zero and thus that the value of a claim today at t=0 is equal to the expected payoff to the claimholder at t=1. The firm operates in a world with no taxes. (a) What will the new debt sell for?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the price at which the new debt will sell we need to calculate its expected pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started