Answered step by step

Verified Expert Solution

Question

1 Approved Answer

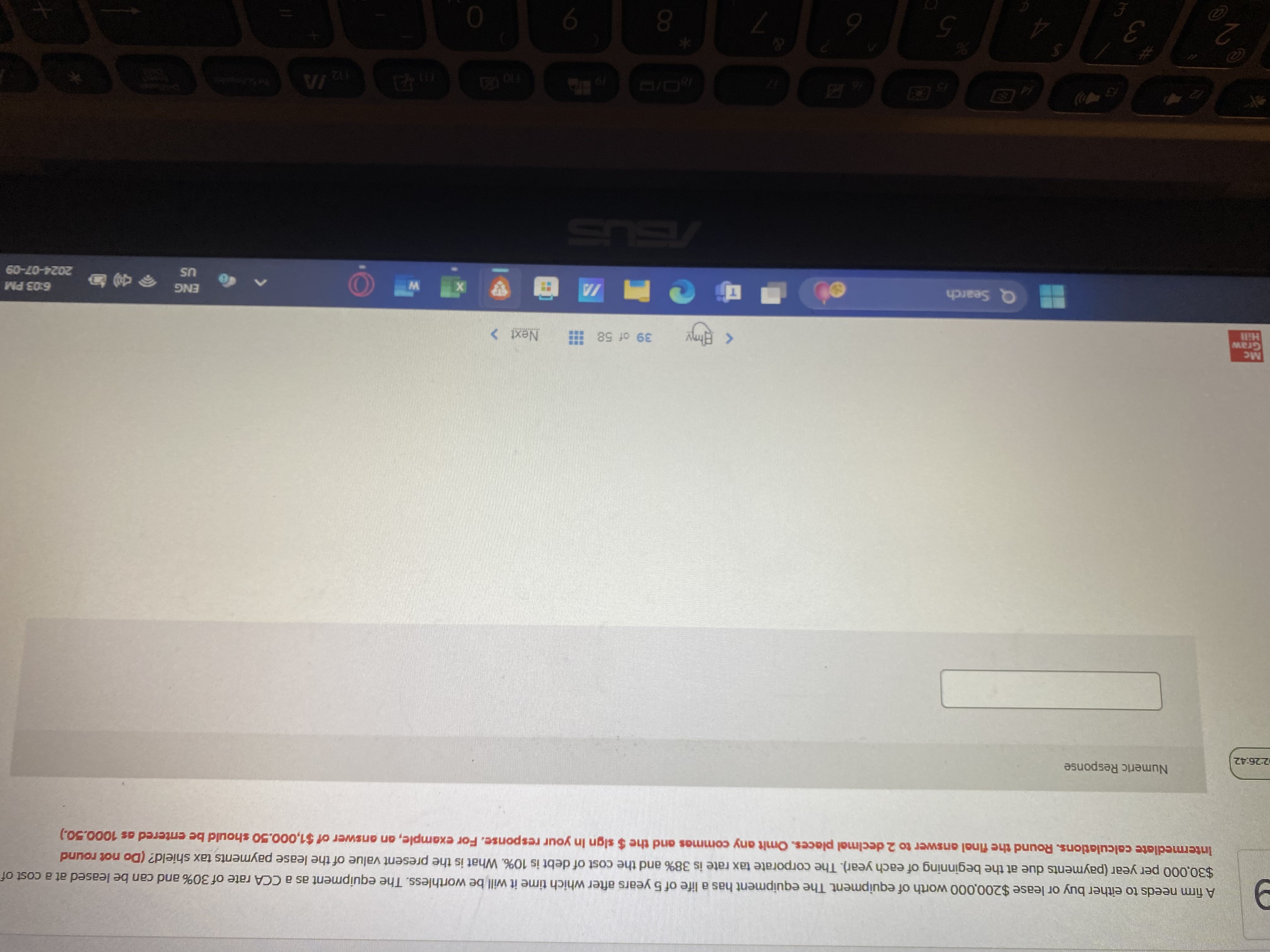

A firm needs to either buy or lease $ 2 0 0 , 0 0 0 worth of equipment. The equipment has a life of

A firm needs to either buy or lease $ worth of equipment. The equipment has a life of years after which time it will be worthless. The equipment as a CCA rate of and can be leased at a cost of $ per year payments due at the beginning of each year The corporate tax rate is and the cost of debt is What is the present value of the lease payments tax shield?A firm needs to either buy or lease $ worth of equipment. The equipment has a life of years after which time it will be worthless. The equipment as a CCA rate of and can be leased at a cost of $ per year payments due at the beginning of each year The corporate tax rate is and the cost of debt is What is the present value of the lease payments tax shield? Do not round Intermedlate calculations. Round the finol answer to declmal places. Omlt any commas and the $ sign In your response. For example, an answer of $ should be entered as

Numerlc Response

Mc

Biny

of

Next

Searc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started