Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm owns an asset B and it wants to hedge against changes in the value of B by making an offsetting sale of

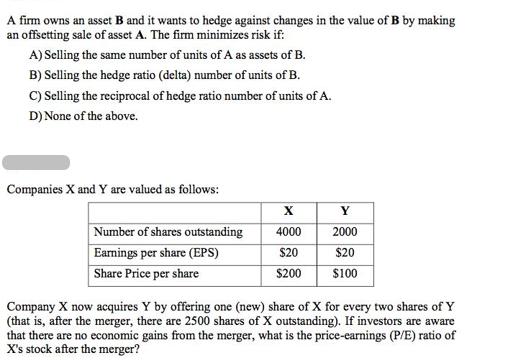

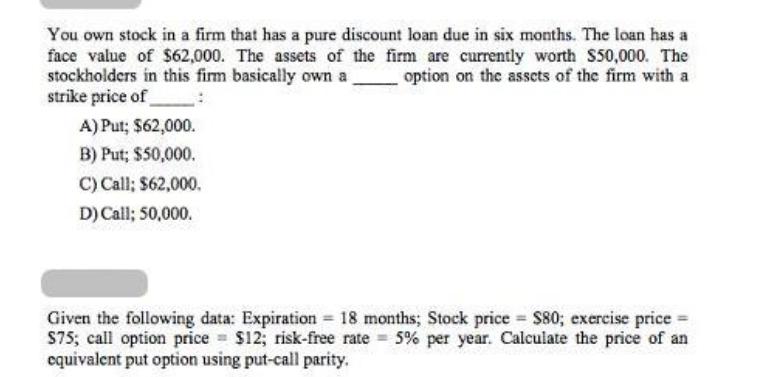

A firm owns an asset B and it wants to hedge against changes in the value of B by making an offsetting sale of asset A. The firm minimizes risk if: A) Selling the same number of units of A as assets of B. B) Selling the hedge ratio (delta) number of units of B. C) Selling the reciprocal of hedge ratio number of units of A. D) None of the above. Companies X and Y are valued as follows: Number of shares outstanding Earnings per share (EPS) Share Price per share X 4000 $20 $200 Y 2000 $20 $100 Company X now acquires Y by offering one (new) share of X for every two shares of Y (that is, after the merger, there are 2500 shares of X outstanding). If investors are aware that there are no economic gains from the merger, what is the price-earnings (P/E) ratio of X's stock after the merger? You own stock in a firm that has a pure discount loan due in six months. The loan has a face value of $62,000. The assets of the firm are currently worth $50,000. The stockholders in this firm basically own a option on the assets of the firm with a strike price of A) Put; $62,000. B) Put; $50,000. C) Call; $62,000. D) Call; 50,000. Given the following data: Expiration = 18 months; Stock price = $80; exercise price = $75; call option price = $12; risk-free rate= 5% per year. Calculate the price of an equivalent put option using put-call parity.

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A The firm minimizes risk if it hedges ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started