Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm whose home currency is the Mexican Peso (MXN) is considering an investment in the United States. The investment is expected to produce after-tax

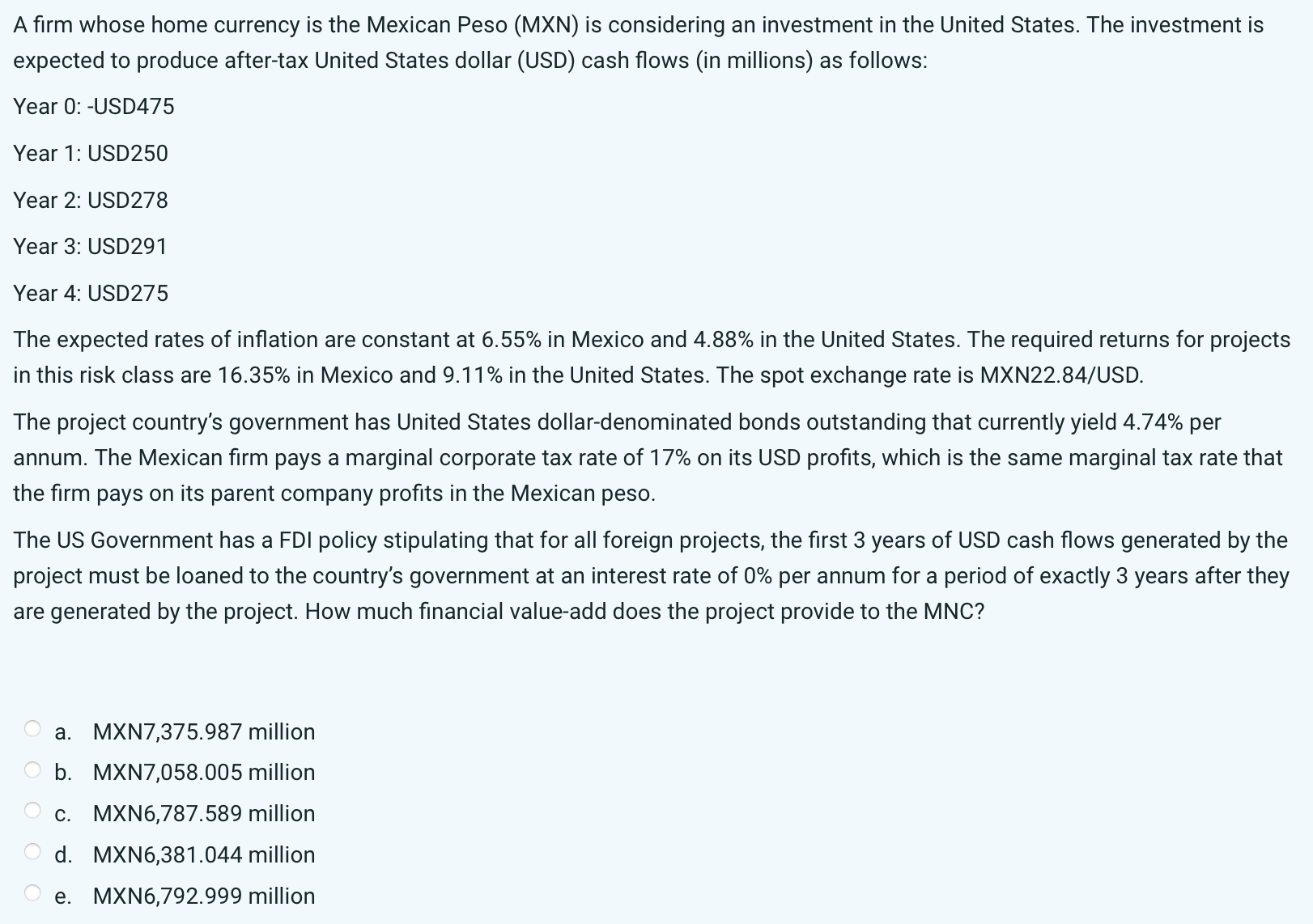

A firm whose home currency is the Mexican Peso (MXN) is considering an investment in the United States. The investment is expected to produce after-tax United States dollar (USD) cash flows (in millions) as follows: Year 0: -USD475 Year 1: USD250 Year 2: USD278 Year 3: USD291 Year 4: USD275 The expected rates of inflation are constant at \6.55 in Mexico and \4.88 in the United States. The required returns for projects in this risk class are \16.35 in Mexico and \9.11 in the United States. The spot exchange rate is MXN22.84/USD. The project country's government has United States dollar-denominated bonds outstanding that currently yield \4.74 per annum. The Mexican firm pays a marginal corporate tax rate of \17 on its USD profits, which is the same marginal tax rate that the firm pays on its parent company profits in the Mexican peso. The US Government has a FDI policy stipulating that for all foreign projects, the first 3 years of USD cash flows generated by the project must be loaned to the country's government at an interest rate of \0 per annum for a period of exactly 3 years after they are generated by the project. How much financial value-add does the project provide to the MNC? a. MXN7,375.987 million b. MXN7,058.005 million c. MXN6,787.589 million d. MXN6,381.044 million e. MXN6,792.999 million

A firm whose home currency is the Mexican Peso (MXN) is considering an investment in the United States. The investment is expected to produce after-tax United States dollar (USD) cash flows (in millions) as follows: Year 0: -USD475 Year 1: USD250 Year 2: USD278 Year 3: USD291 Year 4: USD275 The expected rates of inflation are constant at \6.55 in Mexico and \4.88 in the United States. The required returns for projects in this risk class are \16.35 in Mexico and \9.11 in the United States. The spot exchange rate is MXN22.84/USD. The project country's government has United States dollar-denominated bonds outstanding that currently yield \4.74 per annum. The Mexican firm pays a marginal corporate tax rate of \17 on its USD profits, which is the same marginal tax rate that the firm pays on its parent company profits in the Mexican peso. The US Government has a FDI policy stipulating that for all foreign projects, the first 3 years of USD cash flows generated by the project must be loaned to the country's government at an interest rate of \0 per annum for a period of exactly 3 years after they are generated by the project. How much financial value-add does the project provide to the MNC? a. MXN7,375.987 million b. MXN7,058.005 million c. MXN6,787.589 million d. MXN6,381.044 million e. MXN6,792.999 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started