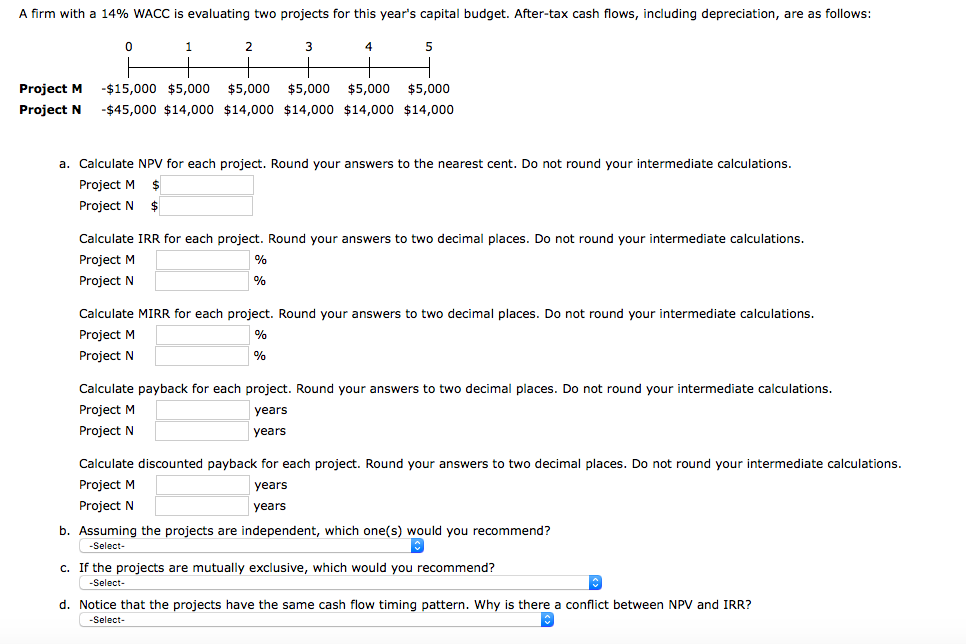

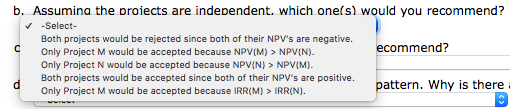

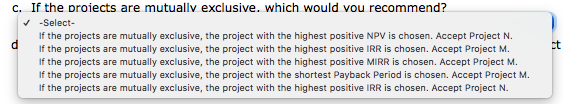

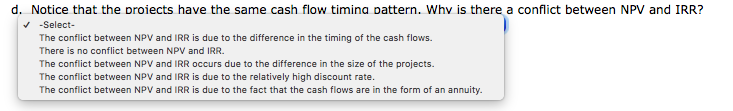

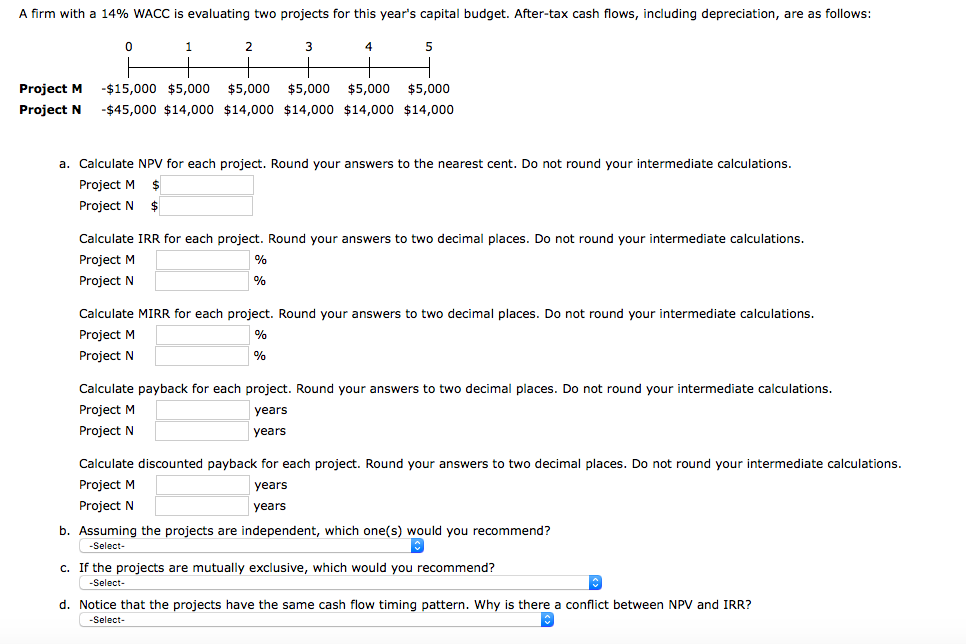

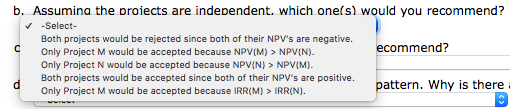

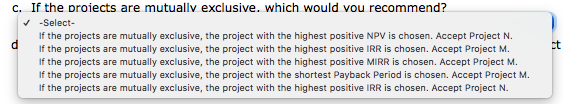

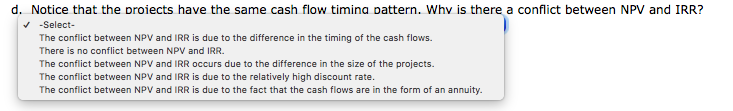

A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0 1 2 3 4 5 Project M -$15,000 $5,000 $5,000 $5,000 $5,000 $5,000 Project N -$45,000 $14,000 $14,000 $14,000 $14,000 $14,000 a. Calculate NPV for each project. Round your answers to the nearest cent. Do not round your intermediate calculations. Project M $ Project N Calculate IRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M Project N Calculate MIRR for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M % Project N % Calculate payback for each project. Round your answers to two decimal places. Do not round your intermediate calculations Project M years Project N years Calculate discounted payback for each project. Round your answers to two decimal places. Do not round your intermediate calculations. Project M years Project N years b. Assuming the projects are independent, which one(s) would you recommend? -Select c. If the projects are mutually exclusive, which would you recommend? -Select d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR? -Select- b. Assumina the proiects are independent. which onefs) would you recommend? Select- Both projects would be rejected since both of their NPV's are negative. ecommend? C Only Project M would be accepted because NPV(M)> NPV(N) Only Project N would be accepted because NPV(N)> NPV(M) Both projects would be accepted since both of their NPV's are positive Only Project M would be accepted because IRR(M)> IRR(N) pattern. Why is there c. If the proiects are mutuallv exclusive. which would vou recommend? Select If the projects are mutually exclusive, the project with the highest positive NPV is chosen. Accept Project N If the projects are mutually exclusive, the project with the highest positive IRR is chosen. Accept Project M If the projects are mutually exclusive, the project with the highest positive MIRR is chosen. Accept Project M If the projects are mutually exclusive, the project with the shortest Payback Period is chosen. Accept Project M If the projects are mutually exclusive, the project with the highest positive IRR is chosen. Accept Project N t d. Notice that the proiects have the same cash flow timina pattern. Whv is there a conflict between NPV and IRR? Select The conflict between NPV and IRR is due to the difference in the timing of the cash flows. There is no conflict between NPV and IRR. The conflict between NPV and IRR occurs due to the difference in the size of the projects The conflict between NPV and IRR is due to the relatively high discount rate. The conflict between NPV and IRR is due to the fact that the cash flows are in the form of an annuity