Answered step by step

Verified Expert Solution

Question

1 Approved Answer

) A firm with a low Z-score has high A) insolvency risk. B) interest rate risk. C) liquidity risk. D) international risk. E) None of

) A firm with a low Z-score has high

A) insolvency risk.

B) interest rate risk.

C) liquidity risk.

D) international risk.

E) None of these options are correct.

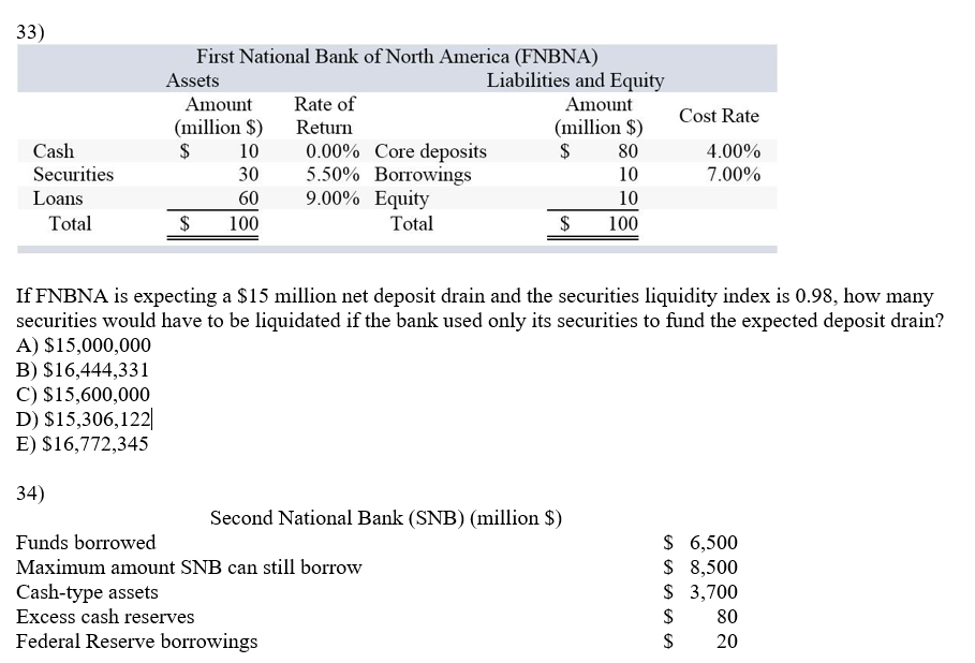

33) Cost Rate First National Bank of North America (FNBNA) Assets Liabilities and Equity Amount Rate of Amount (million $) Return (million $) $ 10 0.00% Core deposits $ 80 5.50% Borrowings 10 9.00% Equity 10 $ 100 Total $ 100 4.00% 7.00% 30 Cash Securities Loans Total If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98, how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain? A) $15,000,000 B) $16,444,331 C) $15,600,000 D) $15,306,122 E) $16,772,345 34) Second National Bank (SNB) (million $) Funds borrowed Maximum amount SNB can still borrow Cash-type assets Excess cash reserves Federal Reserve borrowings $ 6,500 $ 8,500 $ 3,700 80 $ 20 33) Cost Rate First National Bank of North America (FNBNA) Assets Liabilities and Equity Amount Rate of Amount (million $) Return (million $) $ 10 0.00% Core deposits $ 80 5.50% Borrowings 10 9.00% Equity 10 $ 100 Total $ 100 4.00% 7.00% 30 Cash Securities Loans Total If FNBNA is expecting a $15 million net deposit drain and the securities liquidity index is 0.98, how many securities would have to be liquidated if the bank used only its securities to fund the expected deposit drain? A) $15,000,000 B) $16,444,331 C) $15,600,000 D) $15,306,122 E) $16,772,345 34) Second National Bank (SNB) (million $) Funds borrowed Maximum amount SNB can still borrow Cash-type assets Excess cash reserves Federal Reserve borrowings $ 6,500 $ 8,500 $ 3,700 80 $ 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started