Answered step by step

Verified Expert Solution

Question

1 Approved Answer

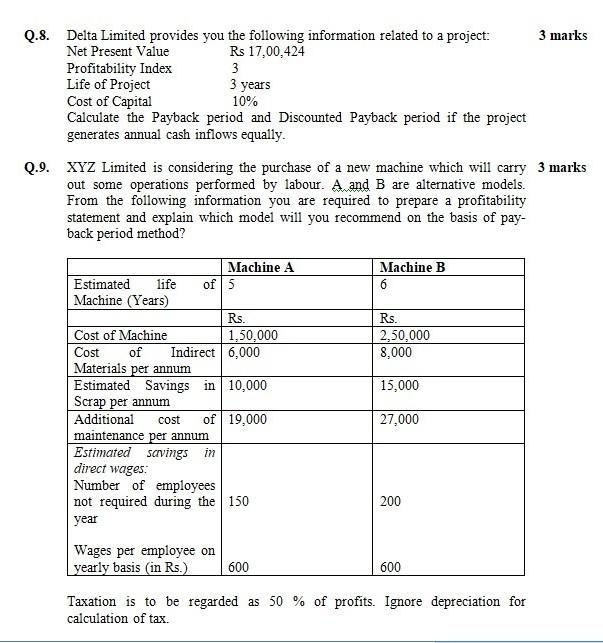

Q.8. Delta Limited provides you the following information related to a project: 3 marks Net Present Value Rs 17,00,424 Profitability Index 3 Life of Project

Q.8. Delta Limited provides you the following information related to a project: 3 marks Net Present Value Rs 17,00,424 Profitability Index 3 Life of Project 3 years Cost of Capital 10% Calculate the Payback period and Discounted Payback period if the project generates annual cash inflows equally. Q.9. XYZ Limited is considering the purchase of a new machine which will carry 3 marks out some operations performed by labour. A and B are alternative models. From the following information you are required to prepare a profitability statement and explain which model will you recommend on the basis of pay- back period method? Machine B 6 Rs. 2,50,000 8,000 Machine A Estimated life of 5 Machine (Years) Rs. Cost of Machine 1,50.000 Cost of Indirect 6,000 Materials per annum Estimated Savings in 10,000 Scrap per annum Additional cost of 19,000 maintenance per annum Estimated savings in direct wages: Number of employees not required during the 150 year 15,000 27,000 200 Wages per employee on yearly basis (in Rs.) 600 600 Taxation is to be regarded as 50 % of profits. Ignore depreciation for calculation of tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started