Answered step by step

Verified Expert Solution

Question

1 Approved Answer

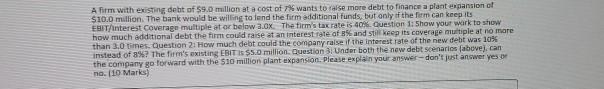

A firm with existing debt of 59.0 million at a cost of 7% wants to raise more debt to finance a plant expansion of $10.0

A firm with existing debt of 59.0 million at a cost of 7% wants to raise more debt to finance a plant expansion of $10.0 million. The bank would be willing to lend the firm additional funds, but only of the firm can keep its EBIT/Interest Coverage multiple at or below a.ox. The firm's tax rate is 40%. Question 1: Show your wark to show how much additional debt the firm could raise at an interest rate of 85 and still keep its coverage multiple at no mare than 3.0 mes Question 2. How much debt could the company raise if the interest rate of the new debt was 1056 instead of 8%? The firm's existing EBITIS $5.0 million Question 3 Under both the new debt scenarios fabovej. can the company go forward with the $10 million plant expansion. Pleast explain your answer-don't just answer yeso no. 10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started