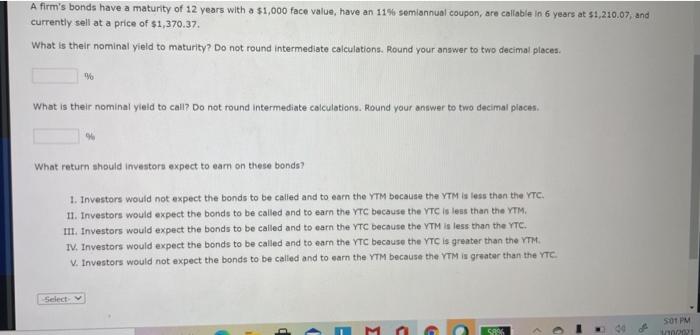

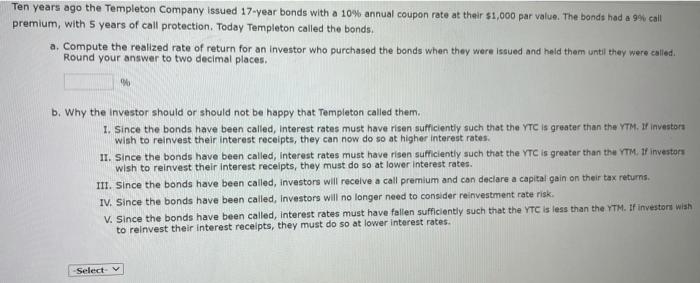

A firm's bonds have a maturity of 12 years with a $1,000 face value, have an 11% semiannual coupon, are callable in 6 years at $1,210.07, and currently sell at a price of $1,370.37. What is their nominal yield to maturity? Do not round intermediate calculations, Round your answer to two decimal places What is their nominal yield to call? Do not found intermediate calculations. Round your answer to two decimal places. What return should investors expect to eam on these bonds? 1. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. 11. Investors would expect the bonds to be called and to earn the VTC because the VTC is less than the YTM m. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. IV. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM V. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Select 501 PM V100 SAS Ten years ago the Templeton Company issued 17-year bonds with a 10% annual coupon rate at their $1,000 par value. The bands had a 9% call premium, with 5 years of call protection. Today Templeton called the bonds. a. Compute the realized rate of return for an investor who purchased the bonds when they were issued and hold them until they were called Round your answer to two decimal places. 9% b. Why the investor should or should not be happy that Templeton called them. 1. Since the bonds have been called, Interest rates must have risen sufficiently such that the YTC is greater than the YTM. I investors wish to reinvest their interest receipts, they can now do so at higher interest rates 11. Since the bonds have been called, Interest rates must have risen sufficiently such that the VTC is greater than the YTM. 1 investors wish to reinvest their interest receipts, they must do so at lower interest rates. III. Since the bonds have been called, investors will receive a call premium and can declare a capital gain on their tax returns. IV. Since the bonds have been called, Investors will no longer need to consider reinvestment rate risk V. Since the bonds have been called, interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interest receipts, they must do so at lower interest rates Select