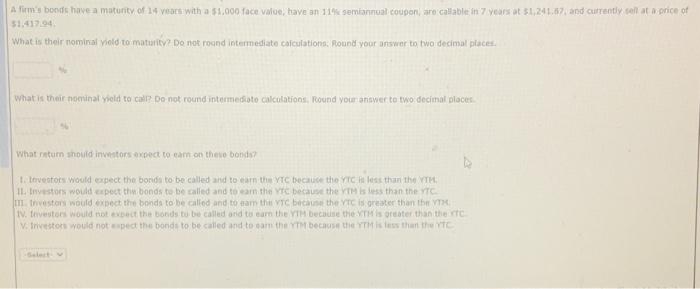

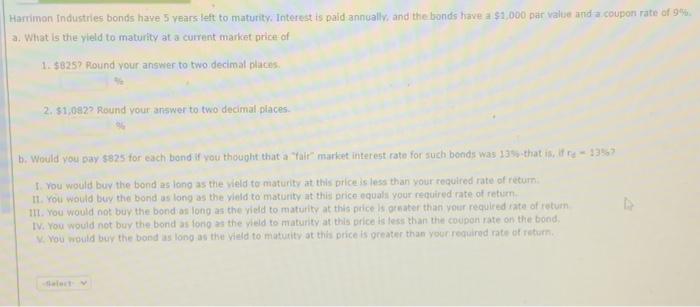

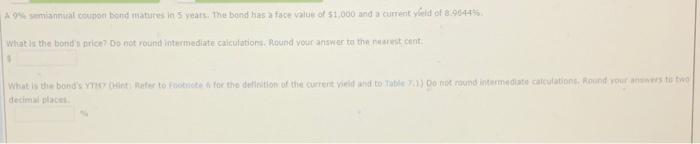

A firms bonds have a maturity of 14 ans with a $1.000 face value, have an 11 semiannual coupon, are calable in 7 years at 51241.67 and currently sell at a price of What is their nominal viold to maturity? Do not roand intermediate calculations, Round your answer to two decimal places What is their nominal yield to Do not round intermediato calculations, Round your answer to two decimal places What turn should investors expect to cam on the bonds tervestors would expect the bonds to be called and to earn the Yic because they less than the In tvestors would expect the bonds to be called and to earn the Ye because they is less than they I Investors would expect the bonds to be called and to mam the VTC because the VTC is greater than the IV. trivestors would not expect the bonds to be called and to earn the YTH because the this greater than the V Investors would not expect the bonds to be called and to car the because they les that the Harriman Industries bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $1.000 par value and a coupon rate of 99 a. What is the yield to maturity at a current market price of 1.58257 Round your answer to two decimal places 2. $1.082 Round your answer to two decimal places b. Would you pay $825 for each bond if you thought that a "fair market interest rate for such bonds was 135 that is re- 3357 You would buy the bond as long as the veldto maturity at this price is less than your required rate of retum 11. You would buy the bond as long as the veld to maturity at this price equals your required rate of retum HIL. You would not buy the bond as long as the yield to maturity at this price is greater than your required rate of return IV. You would not buy the bond as long as the yield to maturity at this price is less than the coupon rate on the bond, You would buy the bond as long as the Vield to maturity at this price is greater than your required rate of return A9manual con bond matures in 5 years. The band has a tace value of $1,000 and a current yeld of 8.96445 What is the bonds price? Do not found intermediate calculation Round your answer to the cont What is the band's en Water to Foot for the definition or the current vild widto Tablea), Doron intermediate calculation Round warmest decimet