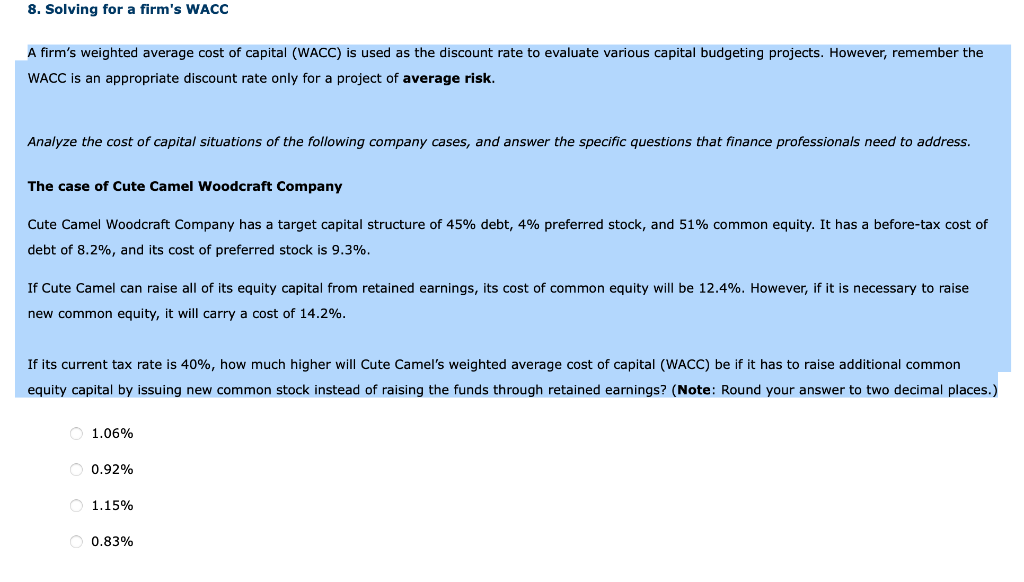

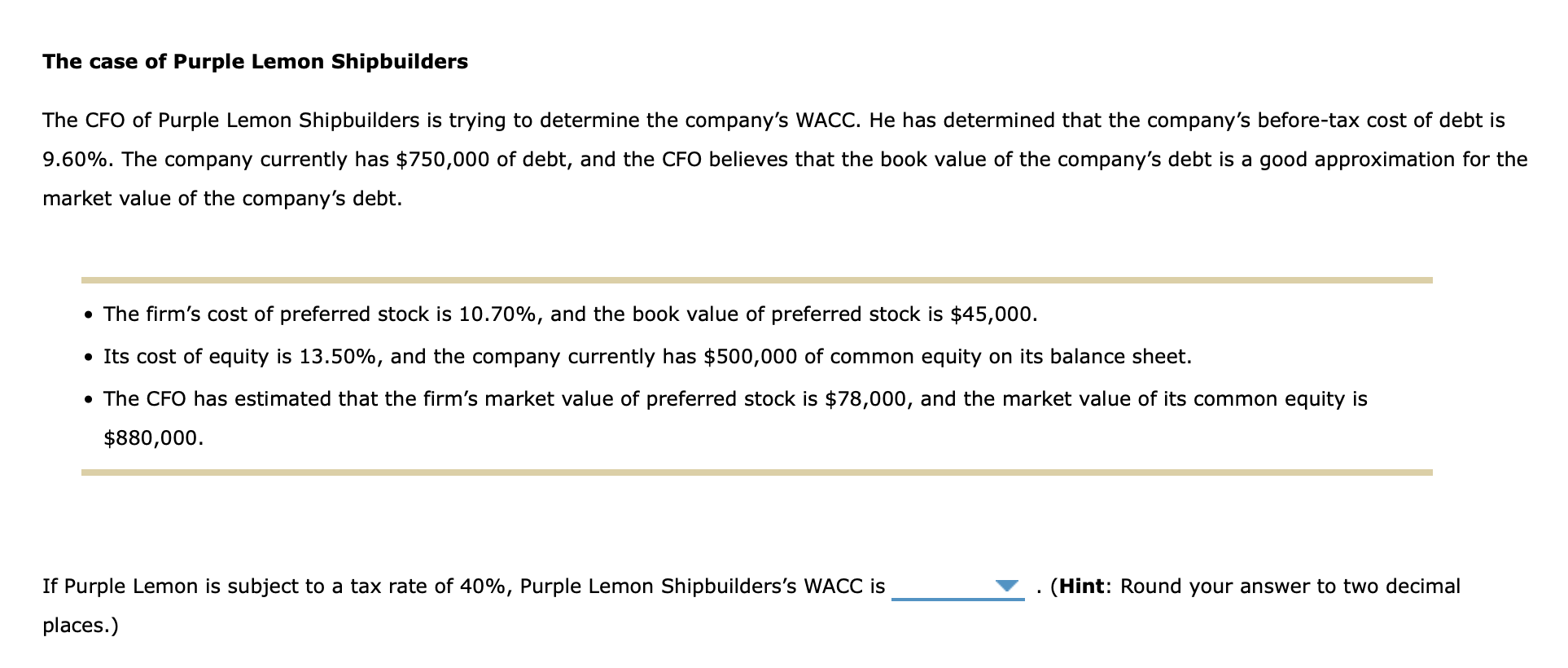

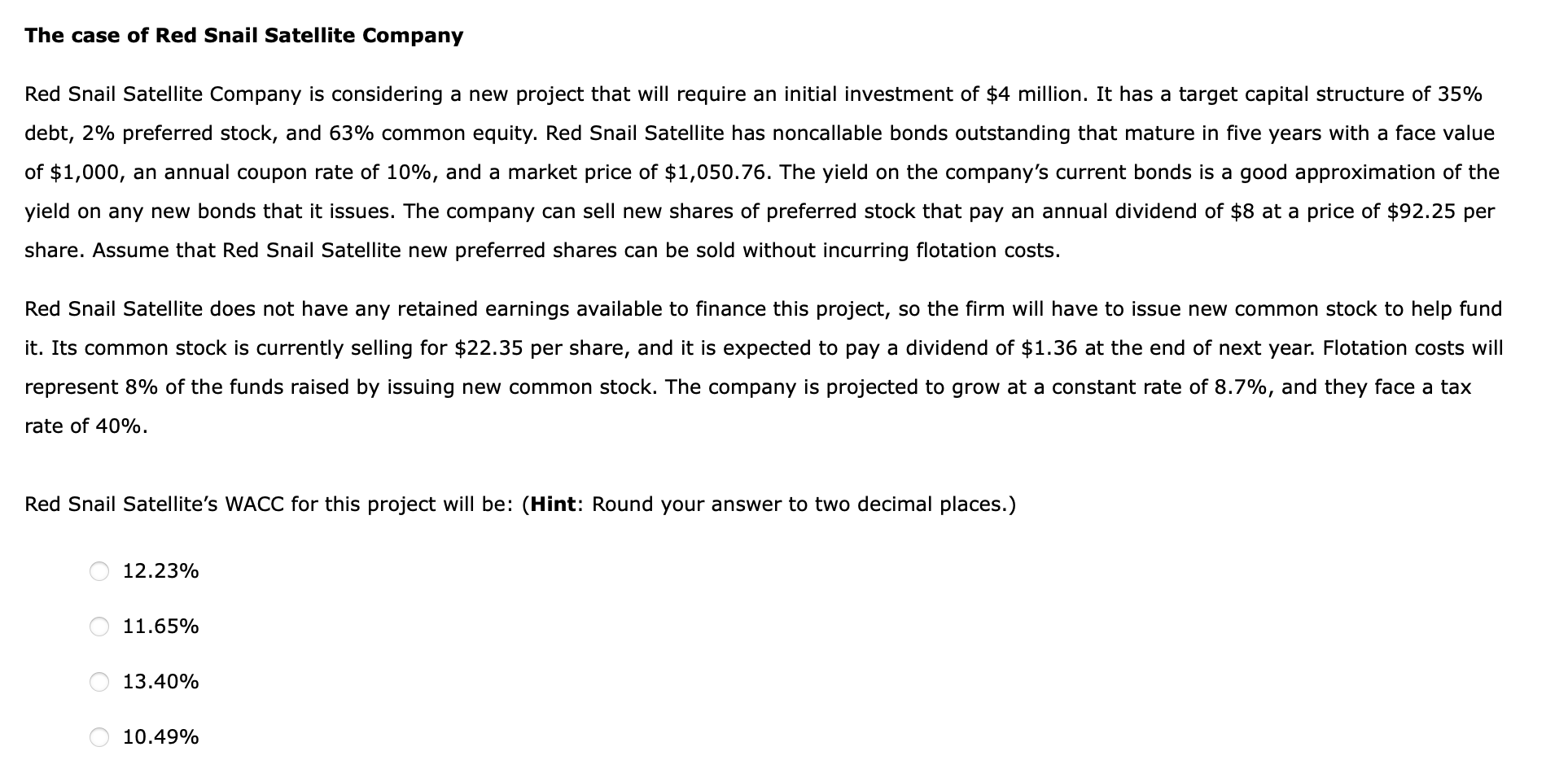

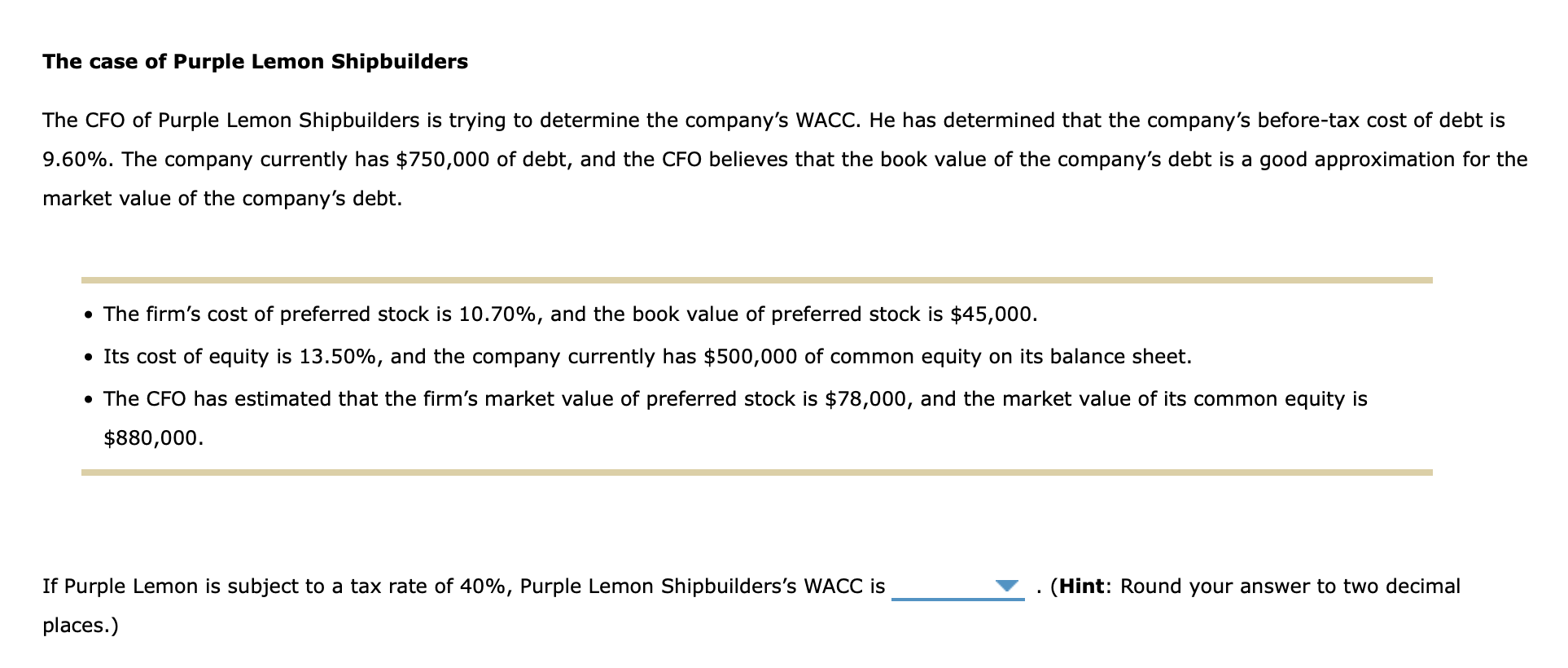

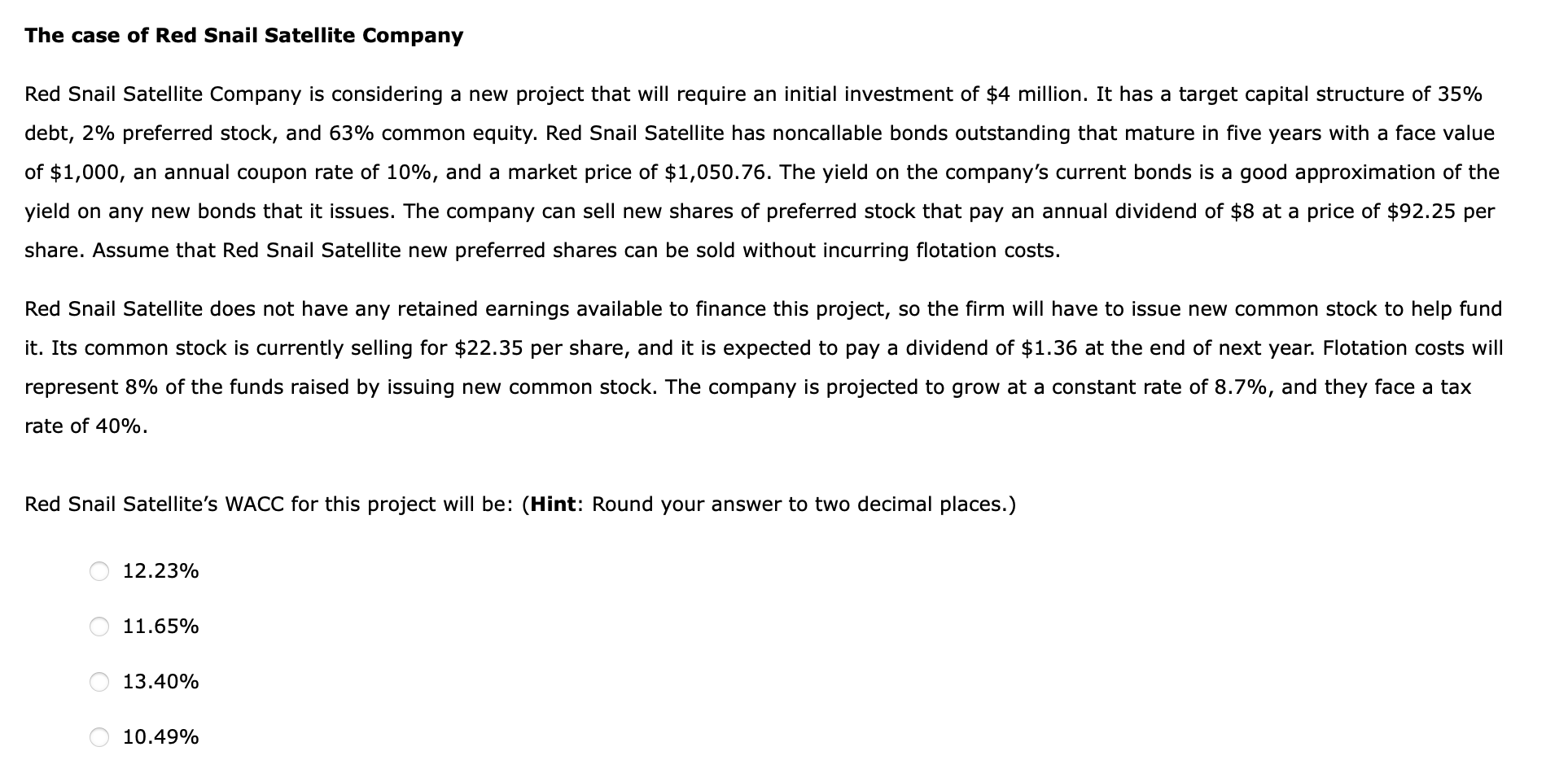

A firm's weighted average cost of capital (WACC) is used as the discount rate to evaluate various capital budgeting projects. However, remember the WACC is an appropriate discount rate only for a project of average risk. The case of Cute Camel Woodcraft Company Cute Camel Woodcraft Company has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity. It has a before-tax cost of debt of 8.2%, and its cost of preferred stock is 9.3%. If Cute Camel can raise all of its equity capital from retained earnings, its cost of common equity will be 12.4%. However, if is necessary to raise new common equity, it will carry a cost of 14.2%. equity capital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your answer to two decimal places.) 1.06% 0.92% 1.15% 0.83% The case of Purple Lemon Shipbuilders The CFO of Purple Lemon Shipbuilders is trying to determine the company's WACC. He has determined that the company's before-tax cost of debt is 9.60%. The company currently has $750,000 of debt, and the CFO believes that the book value of the company's debt is a good approximation for the market value of the company's debt. - The firm's cost of preferred stock is 10.70%, and the book value of preferred stock is $45,000. - Its cost of equity is 13.50%, and the company currently has $500,000 of common equity on its balance sheet. - The CFO has estimated that the firm's market value of preferred stock is $78,000, and the market value of its common equity is $880,000. If Purple Lemon is subject to a tax rate of 40%, Purple Lemon Shipbuilders's WACC is (Hint: Round your answer to two decimal places.) The case of Red Snail Satellite Company Red Snail Satellite Company is considering a new project that will require an in in 35% yield on any new bonds that it is is share. Assume that Red Snail Satellite new preferred shares can be sold without incuring flotation costs. represent 8% of the funds raised by issuing new common stock. The company is projected to grow at at a constant rate rate of 40% Red Snail Satellite's WACC for this project will be: (Hint: Round your answer to two decimal places.) 12.23% 11.65%13.40% 10.49%