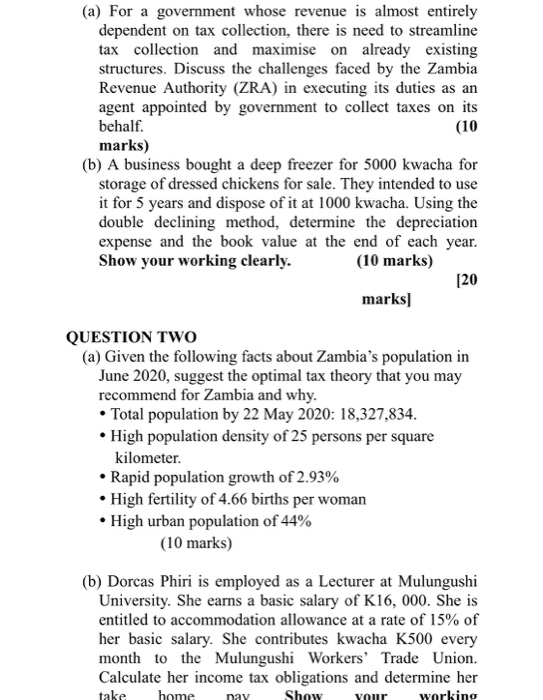

(a) For a government whose revenue is almost entirely dependent on tax collection, there is need to streamline tax collection and maximise on already existing structures. Discuss the challenges faced by the Zambia Revenue Authority (ZRA) in executing its duties as an agent appointed by government to collect taxes on its behalf. (10 marks) (b) A business bought a deep freezer for 5000 kwacha for storage of dressed chickens for sale. They intended to use it for 5 years and dispose of it at 1000 kwacha. Using the double declining method, determine the depreciation expense and the book value at the end of each year. Show your working clearly. (10 marks) [20 marks) QUESTION TWO (a) Given the following facts about Zambia's population in June 2020, suggest the optimal tax theory that you may recommend for Zambia and why. Total population by 22 May 2020: 18,327,834. High population density of 25 persons per square kilometer. Rapid population growth of 2.93% High fertility of 4.66 births per woman High urban population of 44% (10 marks) (b) Dorcas Phiri is employed as a Lecturer at Mulungushi University. She earns a basic salary of K16, 000. She is entitled to accommodation allowance at a rate of 15% of her basic salary. She contributes kwacha K500 every month to the Mulungushi Workers' Trade Union. Calculate her income tax obligations and determine her home Show Working take nav vour (a) For a government whose revenue is almost entirely dependent on tax collection, there is need to streamline tax collection and maximise on already existing structures. Discuss the challenges faced by the Zambia Revenue Authority (ZRA) in executing its duties as an agent appointed by government to collect taxes on its behalf. (10 marks) (b) A business bought a deep freezer for 5000 kwacha for storage of dressed chickens for sale. They intended to use it for 5 years and dispose of it at 1000 kwacha. Using the double declining method, determine the depreciation expense and the book value at the end of each year. Show your working clearly. (10 marks) [20 marks) QUESTION TWO (a) Given the following facts about Zambia's population in June 2020, suggest the optimal tax theory that you may recommend for Zambia and why. Total population by 22 May 2020: 18,327,834. High population density of 25 persons per square kilometer. Rapid population growth of 2.93% High fertility of 4.66 births per woman High urban population of 44% (10 marks) (b) Dorcas Phiri is employed as a Lecturer at Mulungushi University. She earns a basic salary of K16, 000. She is entitled to accommodation allowance at a rate of 15% of her basic salary. She contributes kwacha K500 every month to the Mulungushi Workers' Trade Union. Calculate her income tax obligations and determine her home Show Working take nav vour