Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. For each manager, calculate (1) the average annual return, (2) the standard deviation of returns, and (3) the semi-deviation of returns. Do not round

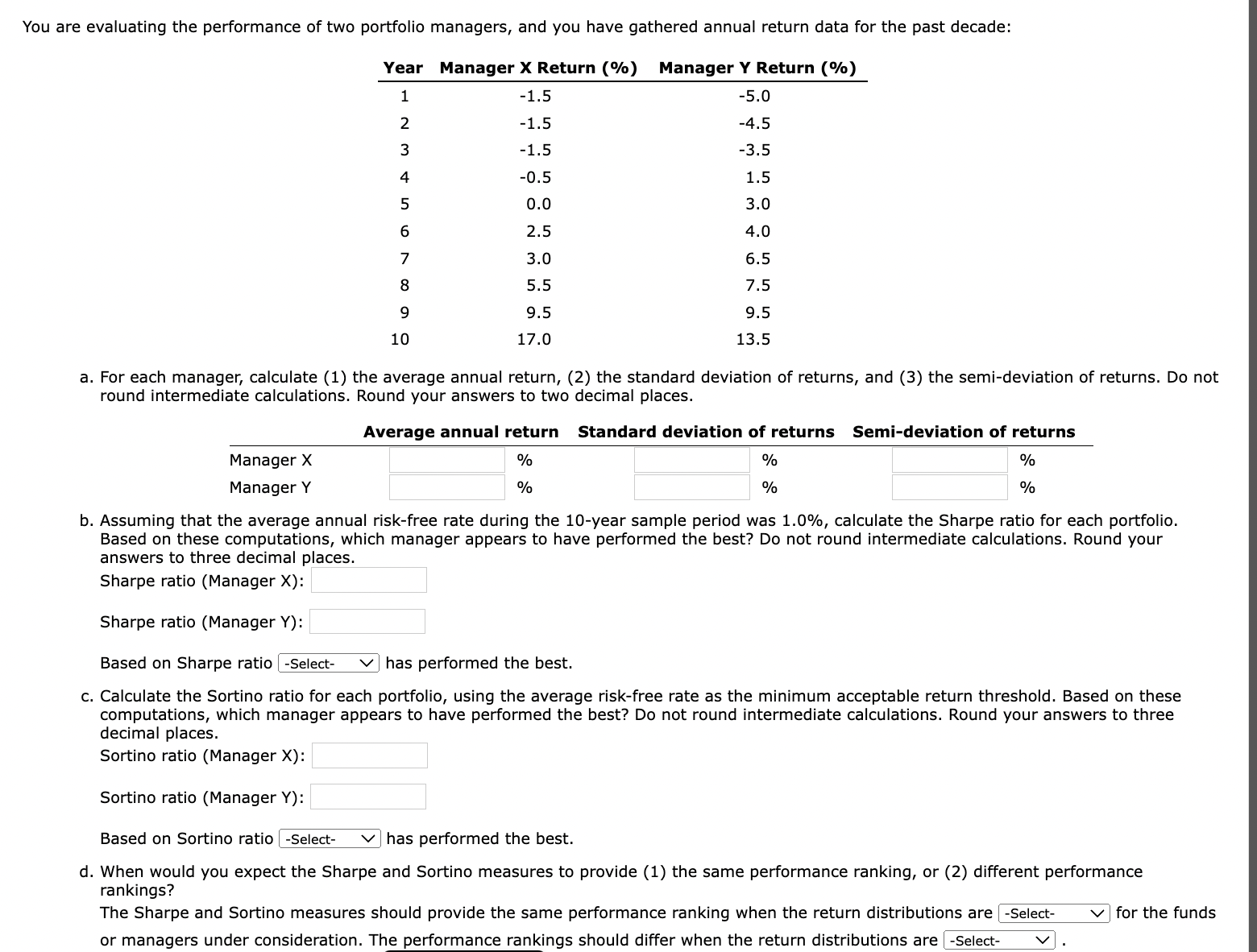

a. For each manager, calculate (1) the average annual return, (2) the standard deviation of returns, and (3) the semi-deviation of returns. Do not round intermediate calculations. Round your answers to two decimal places. b. Assuming that the average annual risk-free rate during the 10 -year sample period was 1.0%, calculate the Sharpe ratio for each portfolio. Based on these computations, which manager appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sharpe ratio (Manager X ): Sharpe ratio (Manager Y ): Based on Sharpe ratio has performed the best. c. Calculate the Sortino ratio for each portfolio, using the average risk-free rate as the minimum acceptable return threshold. Based on these computations, which manager appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sortino ratio (Manager X) : Sortino ratio (Manager Y ): Based on Sortino ratio has performed the best. d. When would you expect the Sharpe and Sortino measures to provide (1) the same performance ranking, or (2) different performance rankings? The Sharpe and Sortino measures should provide the same performance ranking when the return distributions are for the funds or managers under consideration. The performance rankings should differ when the return distributions are

a. For each manager, calculate (1) the average annual return, (2) the standard deviation of returns, and (3) the semi-deviation of returns. Do not round intermediate calculations. Round your answers to two decimal places. b. Assuming that the average annual risk-free rate during the 10 -year sample period was 1.0%, calculate the Sharpe ratio for each portfolio. Based on these computations, which manager appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sharpe ratio (Manager X ): Sharpe ratio (Manager Y ): Based on Sharpe ratio has performed the best. c. Calculate the Sortino ratio for each portfolio, using the average risk-free rate as the minimum acceptable return threshold. Based on these computations, which manager appears to have performed the best? Do not round intermediate calculations. Round your answers to three decimal places. Sortino ratio (Manager X) : Sortino ratio (Manager Y ): Based on Sortino ratio has performed the best. d. When would you expect the Sharpe and Sortino measures to provide (1) the same performance ranking, or (2) different performance rankings? The Sharpe and Sortino measures should provide the same performance ranking when the return distributions are for the funds or managers under consideration. The performance rankings should differ when the return distributions are Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started