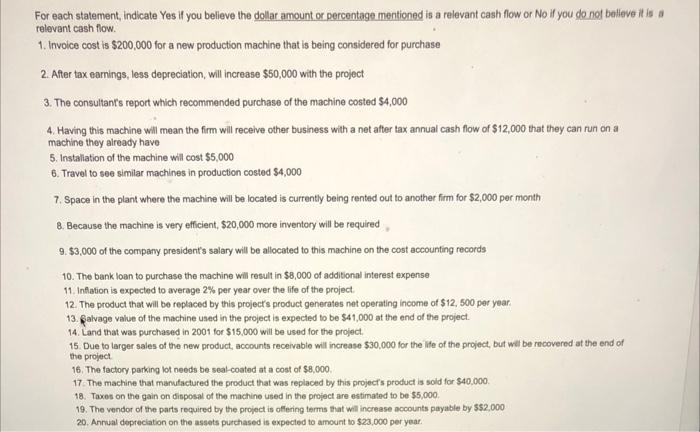

a For each statement, indicato Yes If you believe the dollar amount or percentago mentioned is a relevant cash flow or No if you do not believe it is a relevant cash flow. 1. Invoice cost is $200,000 for a new production machine that is being considered for purchase 2. After tax earnings, less depreciation, will increase $50,000 with the project 3. The consultant's report which recommended purchase of the machine costed $4,000 4. Having this machine will mean the firm will receive other business with a net after tax annual cash flow of $12,000 that they can run on a machine they already have 5. Installation of the machine will cost $5,000 6. Travel to see similar machines in production costed $4,000 7. Space in the plant where the machine will be located is currently being rented out to another firm for $2,000 per month 8. Because the machine is very efficient, $20,000 more inventory will be required 9. $3,000 of the company president's salary will be allocated to this machine on the cost accounting records 10. The bank loan to purchase the machine will result in $8,000 of additional interest expense 11. Inflation is expected to average 2% per year over the life of the project 12. The product that will be replaced by this projects product generates net operating income of $12, 500 per year. 13. Palvage value of the machine used in the project is expected to be 541,000 at the end of the project. 14. Land that was purchased in 2001 for $15,000 will be used for the project. 15. Due to larger sales of the new product, accounts receivable will increase $30,000 for the life of the project, but wel be recovered at the end of the project 16. The factory parking lot needs be seal-coated at a cost of $8,000 17. The machine that manufactured the product that was replaced by this project's product is sold for $40.000 18. Taxes on the gain on disposal of the machine used in the project are estimated to be $5,000 19. The vendor of the parts required by the project is offering terms that will increase accounts payable by $$2,000 20. Annual depreciation on the assets purchased is expected to amount to $23,000 per year