Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. For the year of assessment 2019, calculate the following: i. Chargeable income of the trust body. ii. Total income of the second child. b.

a. For the year of assessment 2019, calculate the following:

i. Chargeable income of the trust body.

ii. Total income of the second child.

b. Explain the tax implication of proviso s. 61(2) to the first child.

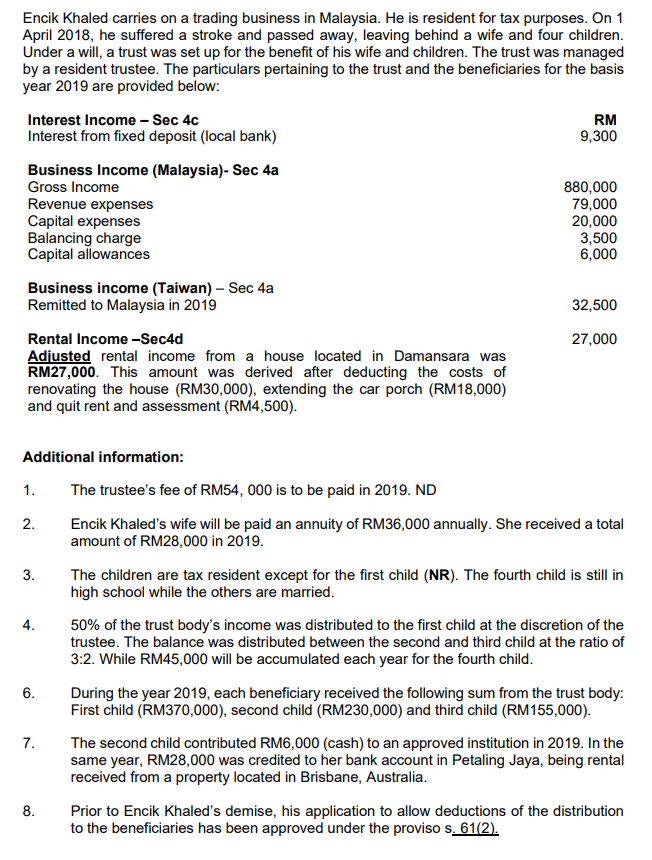

Encik Khaled carries on a trading business in Malaysia. He is resident for tax purposes. On 1 April 2018, he suffered a stroke and passed away, leaving behind a wife and four children. Under a will, a trust was set up for the benefit of his wife and children. The trust was managed by a resident trustee. The particulars pertaining to the trust and the beneficiaries for the basis year 2019 are provided below: Interest Income - Sec 4c Interest from fixed deposit (local bank) 9,300 RM 880,000 79,000 20,000 3,500 6,000 Business Income (Malaysia)- Sec 4a Gross Income Revenue expenses Capital expenses Balancing charge Capital allowances Business income (Taiwan) - Sec 4a Remitted to Malaysia in 2019 Rental Income -Sec4d Adjusted rental income from a house located in Damansara was RM27,000. This amount was derived after deducting the costs of renovating the house (RM30,000), extending the car porch (RM18,000) and quit rent and assessment (RM4,500). 32,500 27,000 Additional information: 1. The trustee's fee of RM54, 000 is to be paid in 2019. ND 2. Encik Khaled's wife will be paid an annuity of RM36,000 annually. She received a total amount of RM28,000 in 2019. 3. The children are tax resident except for the first child (NR). The fourth child is still in high school while the others are married. 4. 50% of the trust body's income was distributed to the first child at the discretion of the trustee. The balance was distributed between the second and third child at the ratio of 3:2. While RM45,000 will be accumulated each year for the fourth child. 6. During the year 2019, each beneficiary received the following sum from the trust body: First child (RM370,000), second child (RM230,000) and third child (RM155,000). 7. The second child contributed RM6,000 (cash) to an approved institution in 2019. In the same year, RM28,000 was credited to her bank account in Petaling Jaya, being rental received from a property located in Brisbane, Australia. Prior to Encik Khaled's demise, his application to allow deductions of the distribution to the beneficiaries has been approved under the proviso s. 612). 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started