Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A founder (entrepreneur) is planning to harvest her investment soon. She believes that the venture is currently worth $35,000,000. There are 10,000,000 shares outstanding,

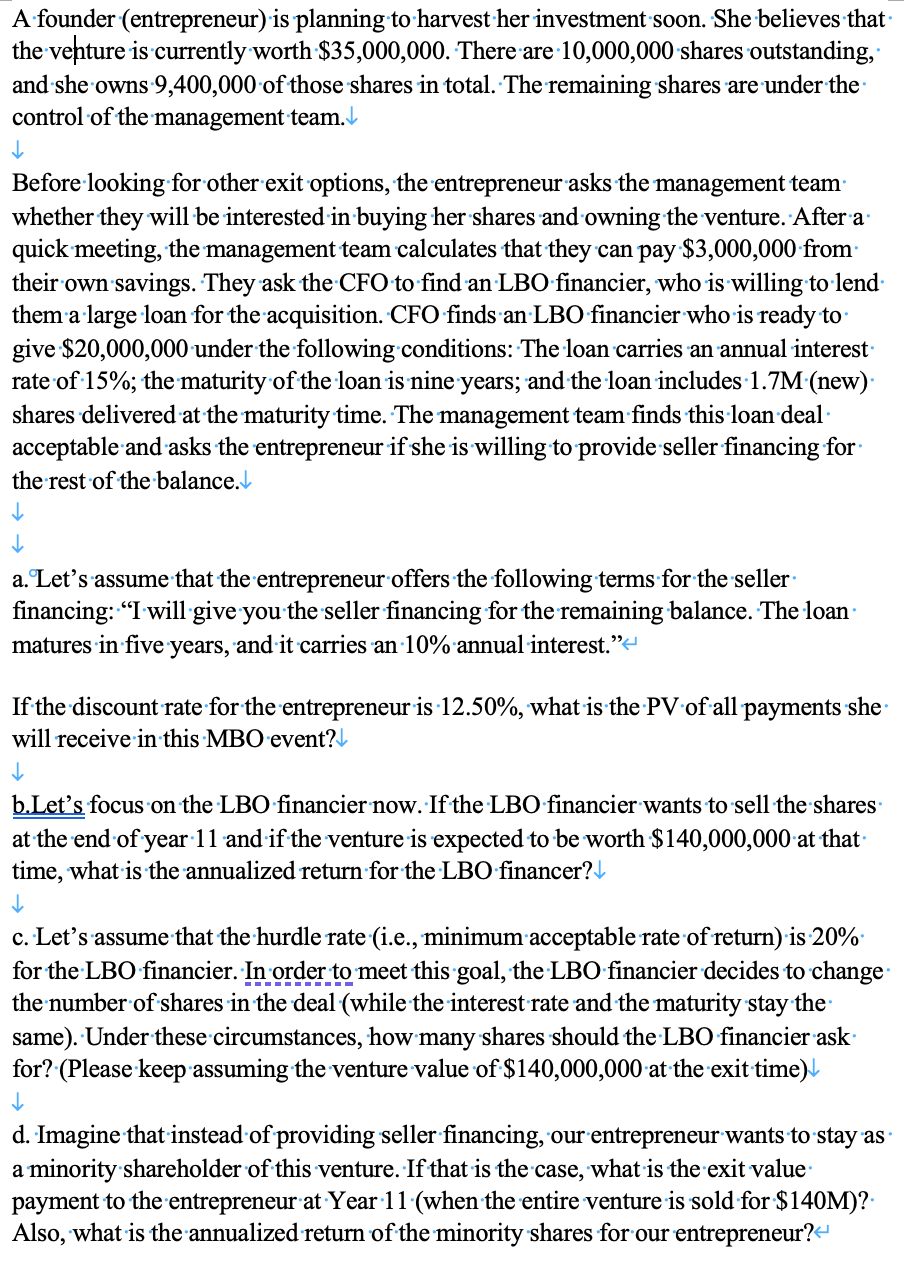

A founder (entrepreneur) is planning to harvest her investment soon. She believes that the venture is currently worth $35,000,000. There are 10,000,000 shares outstanding, and she owns 9,400,000 of those shares in total. The remaining shares are under the control of the management team. Before looking for other exit options, the entrepreneur asks the management team whether they will be interested in buying her shares and owning the venture. After a quick meeting, the management team calculates that they can pay $3,000,000 from their own savings. They ask the CFO to find an LBO financier, who is willing to lend them a large loan for the acquisition. CFO finds an LBO financier who is ready to give $20,000,000 under the following conditions: The loan carries an annual interest rate of 15%; the maturity of the loan is nine years; and the loan includes 1.7M (new) shares delivered at the maturity time. The management team finds this loan deal acceptable and asks the entrepreneur if she is willing to provide seller financing for the rest of the balance. a. Let's assume that the entrepreneur offers the following terms for the seller financing: "I will give you the seller financing for the remaining balance. The loan matures in five years, and it carries an 10% annual interest." If the discount rate for the entrepreneur is 12.50%, what is the PV of all payments she will receive in this MBO event? b.Let's focus on the LBO financier now. If the LBO financier wants to sell the shares at the end of year 11 and if the venture is expected to be worth $140,000,000 at that time, what is the annualized return for the LBO financer? c. Let's assume that the hurdle rate (i.e., minimum acceptable rate of return) is 20% for the LBO financier. In order to meet this goal, the LBO financier decides to change the number of shares in the deal (while the interest rate and the maturity stay the same). Under these circumstances, how many shares should the LBO financier ask for? (Please keep assuming the venture value of $140,000,000 at the exit time) d. Imagine that instead of providing seller financing, our entrepreneur wants to stay as a minority shareholder of this venture. If that is the case, what is the exit value payment to the entrepreneur at Year 11 (when the entire venture is sold for $140M)? Also, what is the annualized return of the minority shares for our entrepreneur?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The PV of all payments the entrepreneur will receive in this MBO event can be calculated as follows PV 3000000 1 0159 35000000 3000000 1700000 1 012...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started