Orlando Medicals long-term debt carries an annual interest rate of 11%. During the year ended December 31,

Question:

Orlando Medical’s long-term debt carries an annual interest rate of 11%. During the year ended December 31, 2018, Orlando’s times-interest-earned ratio was

a. 137.9 times.

b. $35,147.

c. 20.1 times.

d. 108.7 times.

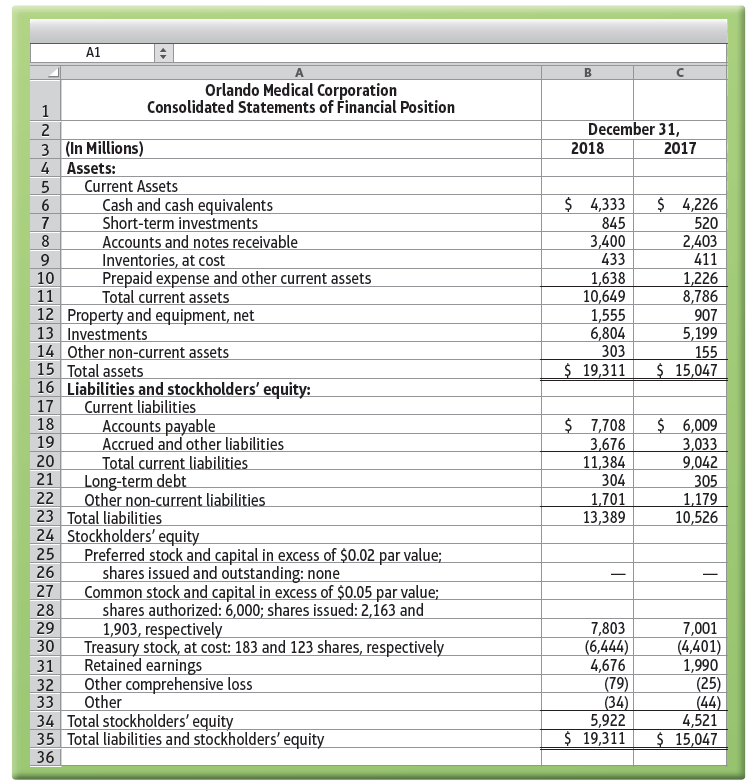

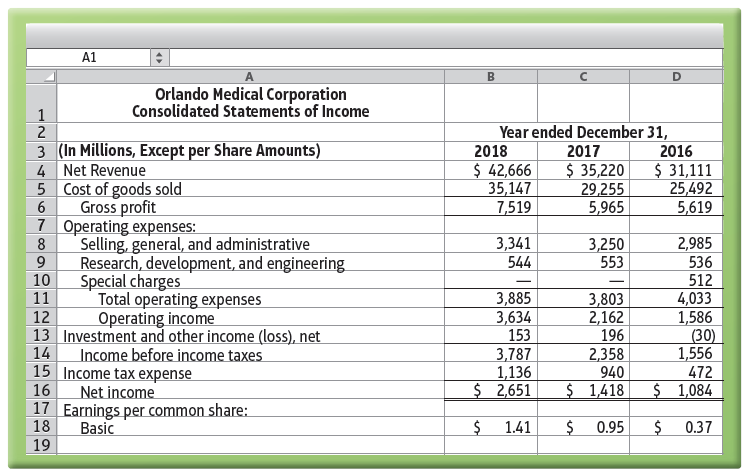

Use the Orlando Medical Corporation financial statements that follow to answer this question.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

A1 Orlando Medical Corporation Consolidated Statements of Financial Position December 31, 2018 2 3 (In Millions) 4 Assets: 2017 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable Inventories, at cost $ 4,333 845 3,400 433 $ 4,226 520 2,403 411 8 Prepaid expense and other current assets 10 11 1,638 10,649 1,555 6,804 303 $ 19,311 1,226 8,786 907 Total current assets 12 Property and equipment, net 13 Investments 5,199 155 $ 15,047 14 Other non-current assets 15 Total assets 16 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued and other liabilities Total current liabilities 17 18 19 $ 7,708 3,676 11,384 304 1,701 13,389 $ 6,009 3,033 9,042 305 1,179 10,526 20 21 Long-term debt Other non-current liabilities 22 23 Total liabilities 24 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; 25 shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively 26 27 28 29 7,803 (6,444) 4,676 (79) (34) 5,922 $ 19,311 7,001 (4,401) 1,990 (25) (44) 4,521 $ 15,047 30 Retained earnings 31 Other comprehensive loss 32 Other 34 Total stockholders' equity 35 Total liabilities and stockholders' equity 33 36 A1 Orlando Medical Corporation Consolidated Statements of Income Year ended December 31, 2018 3 (In Millions, Except per Share Amounts) 4 Net Revenue 5 Cost of goods sold Gross profit 7 Operating expenses: Selling, general, and administrative Research, development, and engineering 10 2017 2016 $ 42,666 35,147 7,519 $ 35,220 29,255 5,965 $ 31,111 25,492 5,619 6 3,341 544 3,250 553 2,985 536 Special charges 512 4,033 1,586 (30) 1,556 472 $ 1,084 11 Total operating expenses 3,885 3,634 153 3,803 2,162 196 12 Operating income 13 Investment and other income (loss), net 14 Income before income taxes 15 Income tax expense 16 3,787 1,136 $ 2,651 2,358 940 $ 1,418 Net income 17 Earnings per common share: 18 Basic 19 1.41 0.95 0.37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

d 3634 lon...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

How many shares of common stock did Orlando Medical have outstanding, on average, during 2018? a. 137.9 million b. 1,880 million c. 20.1 million d. 35,147 million Use the Orlando Medical Corporation...

-

Greensboro Golf Corporations long-term debt agreements make certain demands on the business. For example, Greensboro may not purchase treasury stock in excess of the balance of retained earnings....

-

The data below (stored in DesktopLaptop) represent the hours per day spent by American desktop/ laptop users from 2008 to 2016. a. Plot the time series. b. Fit a three-year moving average to the data...

-

Robert is the owner of an automobile manufacturing company. He calls for a board meeting and tells his directors that he wants to build a car that lets the users experience power and exhilaration. He...

-

Find a 3 3 matrix whose nullspace is (a) A point (b) A line (c) A plane

-

The line graph shows the cost of inflation. What cost $10,000 in 1984 would cost the amount shown by the graph in subsequent years. Here are two mathematical models for the data shown by the graph....

-

Over the past year, a company has sold the following ten items. The following table shows the annual sales in units and the cost of each item. a. Calculate the annual dollar usage of each item. b....

-

Ashes Divide Corporation has bonds on the market with 14.5 years to maturity, a YTM of 6.8 percent, and a current price of $924. The bonds make semiannual payments. The coupon rate on these bonds...

-

Caine Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $211,318 and has an estimated useful life of 8 years with zero salvage value. Management...

-

1. The CFO states, "our profits are down substantially", why is that? Which of the following questions is the best to focus on to deliver using analytics? Group of answer choices How is the economy?...

-

Orlando Medicals inventory turnover during fiscal year 2018 was a. $35,147. b. Very slow. c. 83 times. d. 137.9 times. Use the Orlando Medical Corporation financial statements that follow to answer...

-

Orlando Medicals trend of return on sales is a. Improving. b. Declining. c. Stuck at 22.1%. d. Worrisome. Use the Orlando Medical Corporation financial statements that follow to answer this question....

-

Steve and Sue are married with three dependent children. Their 2014 joint income tax return shows $390,000 of AGI and $60,000 of itemized deductions made up of $30,000 of state income taxes and...

-

The waiting times between a subway departure schedule and the arrival of a passenger are uniformly distributed between 0 and 9 minutes. Find the probability that a randomly selected passenger has a...

-

Greenview Dairies produces a line of organic yogurts for sale at supermarkets and specialty markets in the Southeast. Economic conditions and changing tastes have resulted in slowing demand growth....

-

Rudy Gandolfi owns and operates Rudy's Furniture Emporium Inc. The balance sheet totals for assets, liabilities, and stockholders' equity at August 1, 2019, are as indicated. Described here are...

-

If you were team leader how would you break up this assignment for 4 people to complete? Group Case Analysis Parts 4, 5, and 6 IV. STRATEGY IMPLEMENTATION. (How are you going to do what you want to...

-

A genetic experiment with peas resulted in one sample of offspring that consisted of 440 green peas and 166 yellow peas. Construct a 90% confidence interval to estimate of the percentage of yellow...

-

The period of oscillation of an object in an ideal spring-and-mass system is 0.50 s and the amplitude is 5.0 cm. What is the speed at the equilibrium point?

-

Use multiplication or division of power series to find the first three nonzero terms in the Maclaurin series for each function. y = e x2 cos x

-

It is the end of November and Natalie has been in touch with her grandmother. Her grandmother asked Natalie how well things went in her first month of business. Natalie, too, would like to know if...

-

The ledger of Saddler Company includes the following unadjusted balances: Prepaid Insurance $3,000, Service Revenue $58,000, and Salaries and Wages Expense $25,000. Adjusting entries are required for...

-

The trial balance of Ogilvys Boutique at December 31 shows Inventory $21,000, Sales Revenue $156,000, Sales Returns and Allowances $4,000, Sales Discounts $3,000, Cost of Goods Sold $92,400, Interest...

-

Q2R. on account for each depreciable asset. During 2024, Jane VIIS nsactions.) i More Info Apr. 1 Purchased office equipment. 5111,000. Paid 581,000 cash and financed the remainder Jan. 1 with a note...

-

The rate of return on Cherry Jalopies, Inc., stock over the last five years was 14 percent, 11 percent, 4 percent, 3 percent, and 7 percent. What is the geometric return for Cherry Jalopies, Inc.?

-

U.S. GAAP specifies all of the following characteristics of variable interest entities except: A. Equity holders hold less than 5% of the entitys voting stock. B. Equity holders do not have voting...

Study smarter with the SolutionInn App