Orlando Medicals trend of return on sales is a. Improving. b. Declining. c. Stuck at 22.1%. d.

Question:

Orlando Medical’s trend of return on sales is

a. Improving.

b. Declining.

c. Stuck at 22.1%.

d. Worrisome.

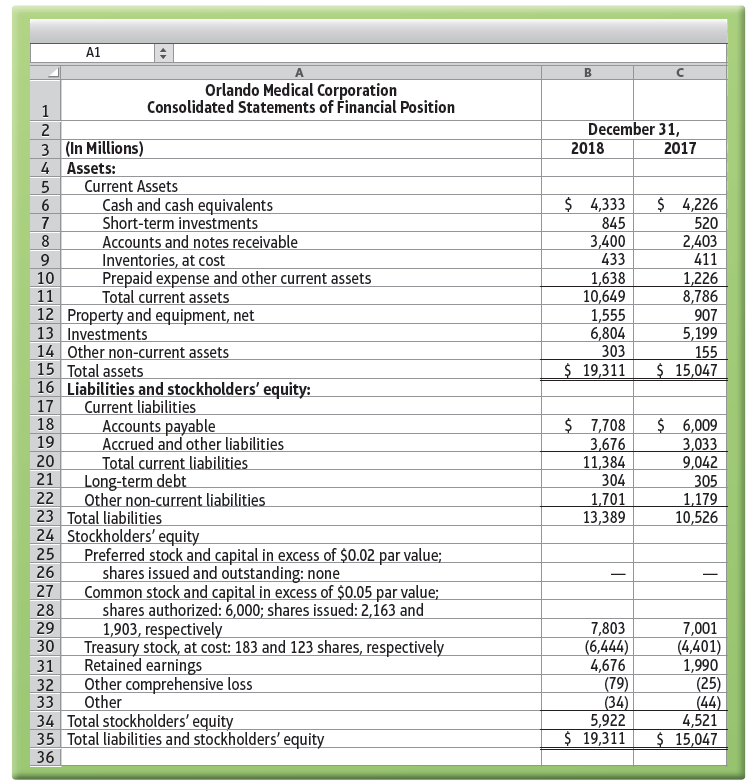

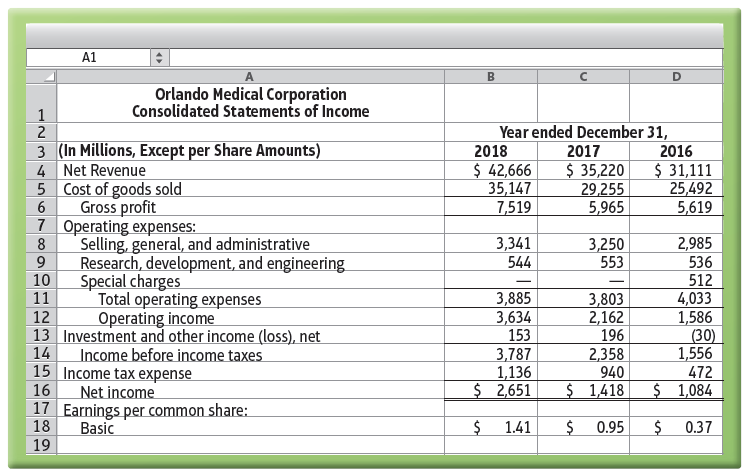

Use the Orlando Medical Corporation financial statements that follow to answer this question.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

A1 Orlando Medical Corporation Consolidated Statements of Financial Position December 31, 2018 2 3 (In Millions) 4 Assets: 2017 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable Inventories, at cost $ 4,333 845 3,400 433 $ 4,226 520 2,403 411 8 Prepaid expense and other current assets 10 11 1,638 10,649 1,555 6,804 303 $ 19,311 1,226 8,786 907 Total current assets 12 Property and equipment, net 13 Investments 5,199 155 $ 15,047 14 Other non-current assets 15 Total assets 16 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued and other liabilities Total current liabilities 17 18 19 $ 7,708 3,676 11,384 304 1,701 13,389 $ 6,009 3,033 9,042 305 1,179 10,526 20 21 Long-term debt Other non-current liabilities 22 23 Total liabilities 24 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; 25 shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively 26 27 28 29 7,803 (6,444) 4,676 (79) (34) 5,922 $ 19,311 7,001 (4,401) 1,990 (25) (44) 4,521 $ 15,047 30 Retained earnings 31 Other comprehensive loss 32 Other 34 Total stockholders' equity 35 Total liabilities and stockholders' equity 33 36 A1 Orlando Medical Corporation Consolidated Statements of Income Year ended December 31, 2018 3 (In Millions, Except per Share Amounts) 4 Net Revenue 5 Cost of goods sold Gross profit 7 Operating expenses: Selling, general, and administrative Research, development, and engineering 10 2017 2016 $ 42,666 35,147 7,519 $ 35,220 29,255 5,965 $ 31,111 25,492 5,619 6 3,341 544 3,250 553 2,985 536 Special charges 512 4,033 1,586 (30) 1,556 472 $ 1,084 11 Total operating expenses 3,885 3,634 153 3,803 2,162 196 12 Operating income 13 Investment and other income (loss), net 14 Income before income taxes 15 Income tax expense 16 3,787 1,136 $ 2,651 2,358 940 $ 1,418 Net income 17 Earnings per common share: 18 Basic 19 1.41 0.95 0.37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

a 2016 1084 31...View the full answer

Answered By

John Kago

Am a processional practicing accountant with 5 years experience in practice, I also happens to have hands on experience in economic analysis and statistical research for 3 years. am well conversant with Accounting packages, sage, pastel, quick books, hansa world, etc, I have real work experience with Strata, and SPSS

4.70+

31+ Reviews

77+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

Multiple Choice Questions Use the Hialeah Bell Corporation financial statements that follow to answer questions 1 through 6. 1. Hialeah Bells days sales in average receivables during 2010 was a. 29...

-

(Multiple choice) Use the Buffalo Bell Corporation financial statements that follow to answer questions 1 through 6. 1. Buffalo Bells days sales in average receivables during 2012 was a. 137.9 days....

-

Book value per share1 of Orlando Medicals common stock outstanding at December 31, 2018, was a. 137.9. b. $35,147. c. $2.99. d. 20.1. Use the Orlando Medical Corporation financial statements that...

-

St . Petersburg Graduate School of Management ( GSOM ) in russia . now you required to Analyze the landscape and competitive market of our school ( you will need to choose from which market you are...

-

Prove that the row vectors of an n n invertible matrix A form a basis for Rn.

-

In Exercises 115122, find all values of x satisfying the given conditions. Y = 2x + 5x = 4, y2 = x + 15x - 10, and 1 - y - y = 0. 1

-

Analyze the following data to produce an ABC classification based on annual dollar usage.Part Number Annual Unit Usage Unit Cost $ Annual $ Usage 1 200 10 2 15,000 4 3 60,000 6 4 15,000 15 5 1400 10...

-

Network Solutions just introduced a new, fully automated manufacturing plant that produces 2,000 wireless routers per day with materials costs of $50 per router and no other costs. The average number...

-

Suppose that Ken-Z Art Gallery has annual sales of $870,000, cost of goods sold of $560,000, average inventories of $244,500, average accounts receivable of $265,000, and an average accounts payable...

-

A particle of mass 2 kg is fired up a smooth slope of length 4m, with initial speed 10ms -1 , which is inclined at 30 above the horizontal. The bottom of the slope is at the same level as horizontal...

-

Orlando Medicals long-term debt carries an annual interest rate of 11%. During the year ended December 31, 2018, Orlandos times-interest-earned ratio was a. 137.9 times. b. $35,147. c. 20.1 times. d....

-

How many shares of common stock did Orlando Medical have outstanding, on average, during 2018? a. 137.9 million b. 1,880 million c. 20.1 million d. 35,147 million Use the Orlando Medical Corporation...

-

Briefly describe the type of information that should be in an introduction.

-

Mail - Jame Mail - Jame x a Amazon.co x a Amazon.co. X https://gpt x _ Calendar - - C * gptc.blackboard.com/webapps/blackboard/content/contentWrapper.jsp?content_id=_1846554 GEORGIA PIEDMONT...

-

Prepare a partnership return and the appropriate K-1s for W & M Partnership. William Winston (SSN: 226-00-4265) lives at 53 Mantis Road, Your City, Your State - Your Zip. He operates Lovely Lady...

-

A new store is opening in Rock Spring, with 175,000 available square feet. Each department must have at least 17,000 square feet and no department can have more than 24% of the total retail floor...

-

Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together with comparative data for the year ended December 31, 2021. From the statement of cash flows...

-

Stockholders of Sarasota Company, Riverbed Company, and Pronghorn Company are considering alternative arrangements for a business combination. Balance sheets and the fair values of each company's...

-

Five ideal mass-spring systems are described by their masses, spring constants, and amplitudes of oscillation as follows. Rank them in decreasing order of the frequency of oscillations. (a) Mass m,...

-

The water in tank A is at 270 F with quality of 10% and mass 1 lbm. It is connected to a piston/cylinder holding constant pressure of 40 psia initially with 1 lbm water at 700 F. The valve is opened,...

-

Below is a series of cost of goods sold sections for companies B, F, L, and R. InstructionsFill in the lettered blanks to complete the cost of goods soldsections. L. Beginning inventory Purchases...

-

Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is the sale of fine European mixers. The owner of Kzinski...

-

The selection of an inventory cost flow method is a decision made by accountants. Do you agree? Explain. Once a method has been selected, what accounting requirement applies?

-

Use the following information: \ table [ [ Country , \ table [ [ Consumer Prices ] ] , Interest Rates,Current Units ( per US$ ) ] , [ Forecast , 3 - month, 1 - yx Covt Bond,, ] , [ 2 0 2 4 e ,...

-

Year-to-date, Yum Brands had earned a 3.70 percent return. During the same time period, Raytheon earned 4.58 percent and Coca-Cola earned 0.53 percent. If you have a portfolio made up of 40 percent...

-

Rate of Return If State Occurs State of Probability of Economy State of Economy Stock A Stock B Stock C Boom .15 .31 .41 .21 Good .60 .16 .12 .10 Poor .20 .03 .06 .04 Bust .05 .11 .16 .08 a. Your...

Study smarter with the SolutionInn App