Orlando Medicals inventory turnover during fiscal year 2018 was a. $35,147. b. Very slow. c. 83 times.

Question:

Orlando Medical’s inventory turnover during fiscal year 2018 was

a. $35,147.

b. Very slow.

c. 83 times.

d. 137.9 times.

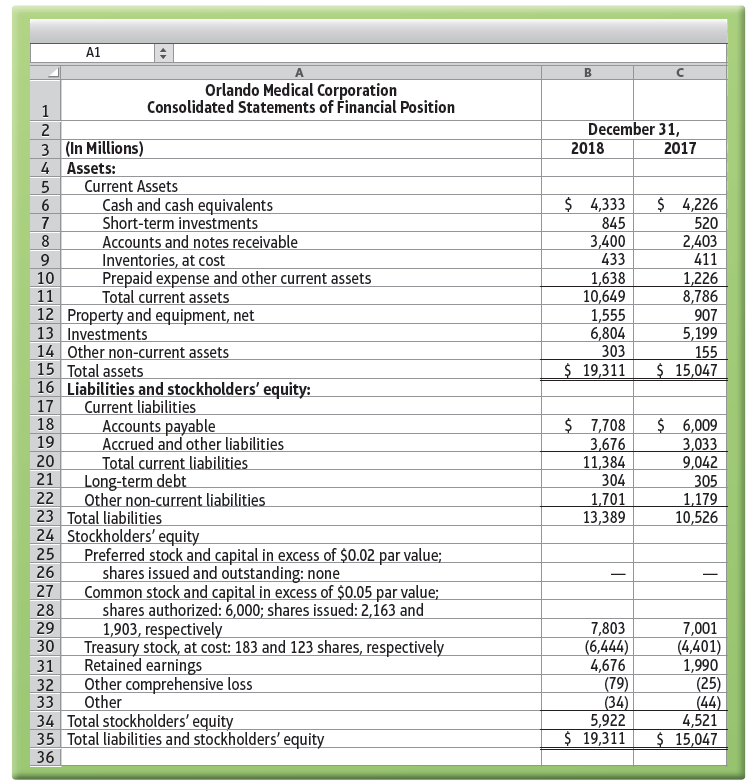

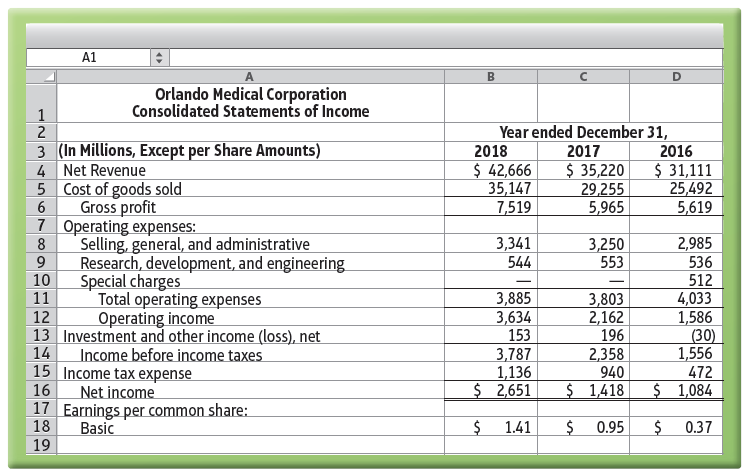

Use the Orlando Medical Corporation financial statements that follow to answer this question.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

A1 Orlando Medical Corporation Consolidated Statements of Financial Position December 31, 2018 2 3 (In Millions) 4 Assets: 2017 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable Inventories, at cost $ 4,333 845 3,400 433 $ 4,226 520 2,403 411 8 Prepaid expense and other current assets 10 11 1,638 10,649 1,555 6,804 303 $ 19,311 1,226 8,786 907 Total current assets 12 Property and equipment, net 13 Investments 5,199 155 $ 15,047 14 Other non-current assets 15 Total assets 16 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued and other liabilities Total current liabilities 17 18 19 $ 7,708 3,676 11,384 304 1,701 13,389 $ 6,009 3,033 9,042 305 1,179 10,526 20 21 Long-term debt Other non-current liabilities 22 23 Total liabilities 24 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; 25 shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively 26 27 28 29 7,803 (6,444) 4,676 (79) (34) 5,922 $ 19,311 7,001 (4,401) 1,990 (25) (44) 4,521 $ 15,047 30 Retained earnings 31 Other comprehensive loss 32 Other 34 Total stockholders' equity 35 Total liabilities and stockholders' equity 33 36 A1 Orlando Medical Corporation Consolidated Statements of Income Year ended December 31, 2018 3 (In Millions, Except per Share Amounts) 4 Net Revenue 5 Cost of goods sold Gross profit 7 Operating expenses: Selling, general, and administrative Research, development, and engineering 10 2017 2016 $ 42,666 35,147 7,519 $ 35,220 29,255 5,965 $ 31,111 25,492 5,619 6 3,341 544 3,250 553 2,985 536 Special charges 512 4,033 1,586 (30) 1,556 472 $ 1,084 11 Total operating expenses 3,885 3,634 153 3,803 2,162 196 12 Operating income 13 Investment and other income (loss), net 14 Income before income taxes 15 Income tax expense 16 3,787 1,136 $ 2,651 2,358 940 $ 1,418 Net income 17 Earnings per common share: 18 Basic 19 1.41 0.95 0.37

Step by Step Answer:

c 351...View the full answer

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

Multiple Choice Questions Use the Hialeah Bell Corporation financial statements that follow to answer questions 1 through 6. 1. Hialeah Bells days sales in average receivables during 2010 was a. 29...

-

(Multiple choice) Use the Buffalo Bell Corporation financial statements that follow to answer questions 1 through 6. 1. Buffalo Bells days sales in average receivables during 2012 was a. 137.9 days....

-

Orlando Medicals trend of return on sales is a. Improving. b. Declining. c. Stuck at 22.1%. d. Worrisome. Use the Orlando Medical Corporation financial statements that follow to answer this question....

-

A utilization greater than one suggests that the mean service time is higher than the mean inter-arrival time. True False QUESTION 3 It costs five times more money to retain a current customer than...

-

(a) Find all 2 Ã 2 matrices whose nullspace is the line 3x - 5y = 0 (b) Sketch the nullspaces of the following matrices: 0 0 2 4 5 0 9 1

-

Explain how to find restrictions on the variable in a rational equation.

-

A company has 600 units on hand and the annual usage is 7200 units. There are 240 working days in the year. What is the days of supply? LO.1

-

Were Mr. Goebel and other African-American applicants victims of racial discrimination because of the hiring policies of Frank Clothiers? Explain your position and cite all relevant Supreme Court...

-

PLEASE SHOW WORK 1. The following are the monthly return for the 1st Quarter of 2018 of A Inc., and B Inc. (30 Points) Months A Return B Return ( ) ( ) ( ) ( ) ( ) ( ) Jan 0.05 0.08 Feb -0.06 -0.05...

-

On January 1, 2017, Lachte Corporation issued $1,800,000 face value, 5%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lachte uses the...

-

Orlando Medicals days sales in receivables during 2018 was (assuming all revenue is on credit) a. 137.9 days. b. 25 days. c. 35 days. d. 20.1 days. Use the Orlando Medical Corporation financial...

-

Orlando Medicals long-term debt carries an annual interest rate of 11%. During the year ended December 31, 2018, Orlandos times-interest-earned ratio was a. 137.9 times. b. $35,147. c. 20.1 times. d....

-

Published information and statistics on the state of the economy is readily available from a number of ^sources. T F

-

Listed in the accompanying table are waiting times (seconds) of observed cars at a Delaware inspection station. The data from two waiting lines are real observations, and the data from the sir line...

-

Franklin Prepared Foods (FPF) sells three varieties of microwaveable meals with the following prices and costs: Variable Cost Fixed Cost per Meat Fish Vegetarian Entire firm Selling Price per Case: $...

-

Isabella is a 14-year-old Hispanic bisexual female who has come into the Department of Child Safety (DCS) care due to neglect. Isabella's mother, Martina, is 35 years old, a single mother, has an...

-

Jeff is able to ride a bicycle although he hasn't ridden one for a few years, thanks to his: ( A ) procedural memory ( B ) episodic memory C ) semantic memory ( D ) cognitive memory

-

1. Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months,...

-

Each prong of a vibrating tuning fork moves back and forth quite precisely in simple harmonic motion. The distance the prong moves between its extreme positions is 2.24 mm. If the frequency of the...

-

Rewrite Programming Exercise 7.5 using streams. Display the numbers in increasing order. Data from Programming Exercise 7.5 Write a program that reads in 10 numbers and displays the number of...

-

Natalie Koebel spent much of her childhood learning the art of cookie-making from her grandmother. They passed many happy hours mastering every type of cookie imaginable and later creating new...

-

Using the data in BE3-5, journalize and post the entry on July 1 and the adjusting entry on December 31 for Idonije Insurance Co. Idonije uses the accounts Unearned Service Revenue and Service...

-

It is the end of November and Natalie has been in touch with her grandmother. Her grandmother asked Natalie how well things went in her first month of business. Natalie, too, would like to know if...

-

1. Compute the productivity profiles for each year. If required, round your answers to two decimal places. 2a. Did productivity improve? 2b. Explain why or why not

-

Explain: An office building is renting for $10/sf, with 50,000 total leasable square feet. Office buildings in the area are selling for cap rates of 5.5%. What information do you have and what are...

-

Practicum Co. pad $1.2 million for an 80% interest in the common stock of Sarong Co. Practicum had no previous equity interest in Sarong. On the acquisition date, Sarong's identifiable net assets had...

Study smarter with the SolutionInn App