Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A friend of yours has approached you about starting a hot dog stand at the courthouse. She has collected the following information and would like

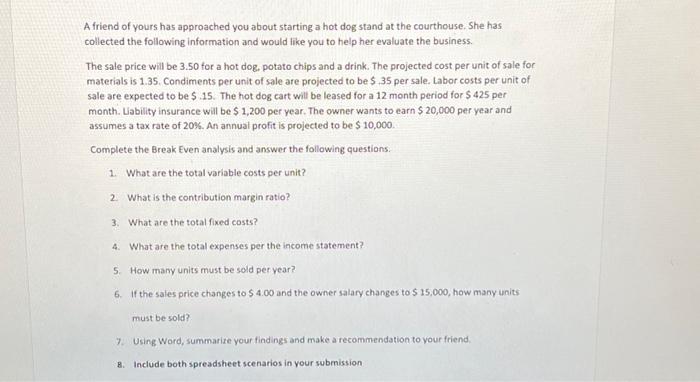

A friend of yours has approached you about starting a hot dog stand at the courthouse. She has collected the following information and would like you to help her evaluate the business. The sale price will be 3.50 for a hot dog, potato chips and a drink. The projected cost per unit of sale for materials is 1.35. Condiments per unit of sale are projected to be $.35 per sale. Labor costs per unit of sale are expected to be $.15. The hot dog cart will be leased for a 12 month period for $ 425 per month. Liability insurance will be $ 1,200 per year. The owner wants to earn $ 20,000 per year and assumes a tax rate of 20%. An annual profit is projected to be $ 10,000. Complete the Break Even analysis and answer the following questions. 1. What are the total variable costs per unit? 2. What is the contribution margin ratio? 3. What are the total fixed costs? 4. What are the total expenses per the income statement? How many units must be sold per year? 6. If the sales price changes to $ 4.00 and the owner salary changes to $ 15,000, how many units 5. must be sold? 7. Using Word, summarize your findings and make a recommendation to your friend. 8. Include both spreadsheet scenarios in your submission

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started