Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A friendA friend of yours is planning on setting up a new food processing business. They have completed their research and decided it is time

A friendA friend of yours is planning on setting up a new food processing business. They have completed their research and decided it is

time to develop the financial statements including projected balance sheet, net income and cash flow for the business. They

have asked for your assistance to develop these statements and have provided the following information.

Operations:

The owner plans to sell at a price of $case of product and this price will stay the same over the first five years. The costs to

makeship the product includes packaging $case suppliesingredients $case and shipping $case These costs will

increase for packaging, or suppliesingredient and shipping, each year. The quantity sold is estimated to be

year year and Year and ongoing. Year is considered an initial year, year growth year and year target

year. In addition, the firm pays costs per year as follows: wages rent insurance depreciation

interest on loans Wages will increase by each year for five years but all other of these costs will stay the same over

the five years. Tax is on net income. Depreciation is a noncash expense and is used to allocate the cost of equipment over

time to be discussed in the next weeks

Timing of the money sales in cash received from customers has been negotiated as sales in first months and sales in

second six months of the year. Example: If total of yours is planning on setting up a new food processing business. They have completed their research and decided it is

time to develop the financial statements including projected balance sheet, net income and cash flow for the business. They

have asked for your assistance to develop these statements and have provided the following information.

Operations:

The owner plans to sell at a price of $case of product and this price will stay the same over the first five years. The costs to

makeship the product includes packaging $case suppliesingredients $case and shipping $case These costs will

increase for packaging, or suppliesingredient and shipping, each year. The quantity sold is estimated to be

year year and Year and ongoing. Year is considered an initial year, year growth year and year target

year. In addition, the firm pays costs per year as follows: wages rent insurance depreciation

interest on loans Wages will increase by each year for five years but all other of these costs will stay the same over

the five years. Tax is on net income. Depreciation is a noncash expense and is used to allocate the cost of equipment over

time to be discussed in the next weeks

Timing of the money sales in cash received from customers has been negotiated as sales in first months and sales in

second six months of the year. Example: If total sales are then is received in cash year during the months

to while the other received in cash year during the months to

All packaging, suppliesingredients and shipping costs must be prepaid in cash prior to start up of business in Year ie prior

to day year After the start up all packaging, suppliesingredients and shipping costs for the entire year is purchased at one

time and paid in cash in the first months of the year.

All Wages, Rent, Insurance, and Interest on Loan are paid in the first months of the year and in the second months of

the year. Taxes are paid at the end of the year record these as occurring in months These costs are paid in cash as they

come due. Remember that depreciation is a noncash cost.

Investment and Financing:

In order to start the business, the owner purchase equipment of They will finance the business with of their

own investment, loan from family, and from a bank loan. These will occur prior to start up of Year Day for

the business.

Any cash flow gaps that are negative for the first years will be covered by a prenegotiated shortterm line of credit like

overdraft from the bank. The owner has placed their house as a security in order to secure this openended line of credit.

Interest on all long term and shortterm loans is included in the $ interest expense noted earlier in the operations section.

Principal payments to pay back loans from family, from the bank, and from the shortterm line of credit will start on year and

will be for each of the three loans, paid each year in second months of each year from Year onward until loan is paid

off. The owner will not take any dividends from the business during the years you are forecasting, nor will any new investments

or loans be made during that time.

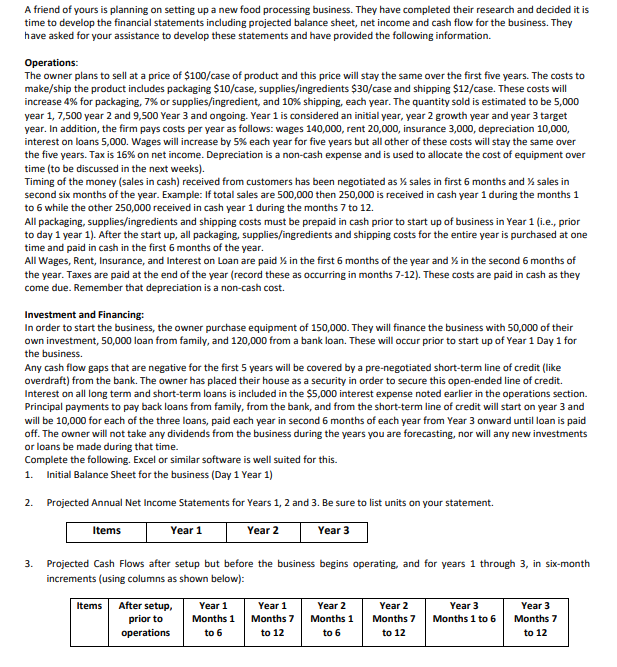

Complete the following. Excel or similar software is well suited for this.

Initial Balance Sheet for the business Day Year A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started