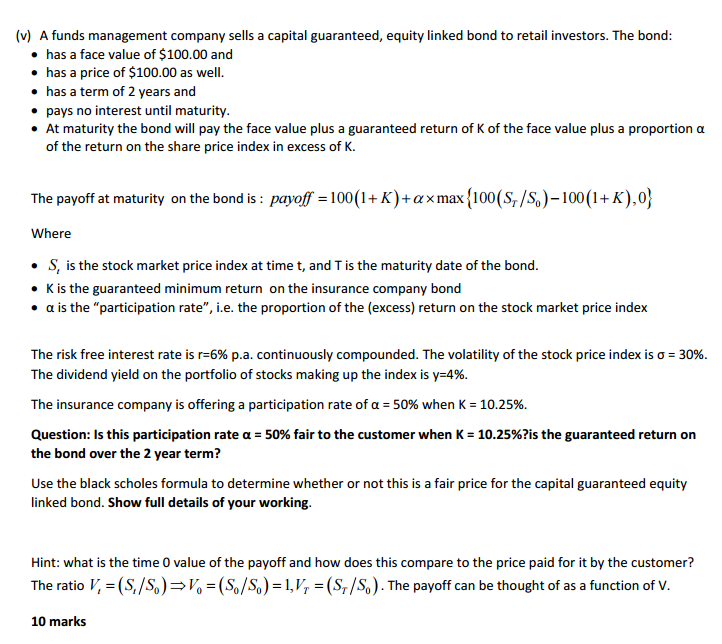

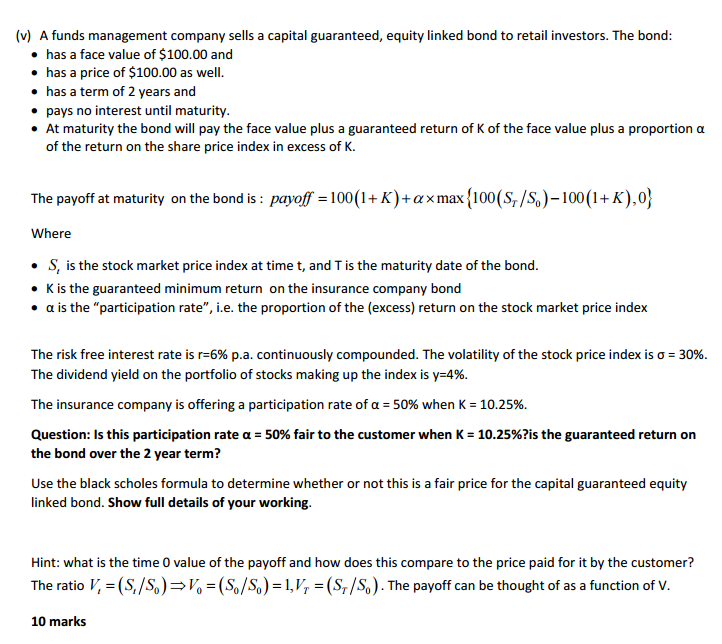

A funds management company sells a capital guaranteed, equity linked bond to retail investors. The bond: has a face value of $100.00 and has a price of $100.00 as well. has a term of 2 years and pays no interest until maturity. At maturity the bond will pay the face value plus a guaranteed return of K of the face value plus a proportion alpha of the return on the share price index in excess of K. The payoff at maturity on the bond is: payoff = 100(1 + K) + alpha times max{100(S_r/S_0)-100(1 + K), 0} Where S_t is the stock market price index at time t, and T is the maturity date of the bond. K is the guaranteed minimum return on the insurance company bond alpha is the "participation rate", i.e. the proportion of the (excess) return on the stock market price index The risk free interest rate is r = 6% p.a. continuously compounded. The volatility of the stock price index is sigma = 30%. The dividend yield on the portfolio of stocks making up the index is y = 4%. The insurance company is offering a participation rate of alpha = 50% when K = 10.25%. Is this participation rate alpha = 50% fair to the customer when K = 10.25%? is the guaranteed return on the bond over the 2 year term? Use the black schools formula to determine whether or not this is a fair price for the capital guaranteed equity linked bond. Show full details of your working. A funds management company sells a capital guaranteed, equity linked bond to retail investors. The bond: has a face value of $100.00 and has a price of $100.00 as well. has a term of 2 years and pays no interest until maturity. At maturity the bond will pay the face value plus a guaranteed return of K of the face value plus a proportion alpha of the return on the share price index in excess of K. The payoff at maturity on the bond is: payoff = 100(1 + K) + alpha times max{100(S_r/S_0)-100(1 + K), 0} Where S_t is the stock market price index at time t, and T is the maturity date of the bond. K is the guaranteed minimum return on the insurance company bond alpha is the "participation rate", i.e. the proportion of the (excess) return on the stock market price index The risk free interest rate is r = 6% p.a. continuously compounded. The volatility of the stock price index is sigma = 30%. The dividend yield on the portfolio of stocks making up the index is y = 4%. The insurance company is offering a participation rate of alpha = 50% when K = 10.25%. Is this participation rate alpha = 50% fair to the customer when K = 10.25%? is the guaranteed return on the bond over the 2 year term? Use the black schools formula to determine whether or not this is a fair price for the capital guaranteed equity linked bond. Show full details of your working