Answered step by step

Verified Expert Solution

Question

1 Approved Answer

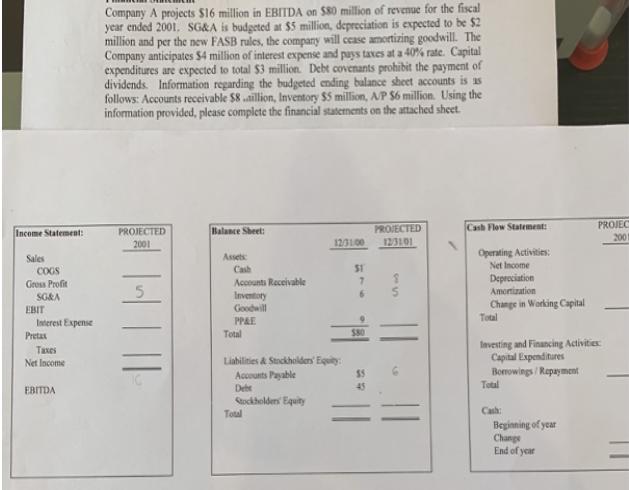

Company A projects $16 million in EBITDA on $80 million of revenue for the fiscal year ended 2001. SGRA is budgeted at $5 million,

Company A projects $16 million in EBITDA on $80 million of revenue for the fiscal year ended 2001. SGRA is budgeted at $5 million, depreciation is expected to be $2 million and per the new FASB rules, the company will cease amortizing goodwill. The Company anticipates $4 million of interest expense and pays taves at a 40% rate. Capital expenditures are expected to total $3 million. Debt covenants prohibit the payment of dividends. Information regarding the budgeted ending balance sheet accounts is as follows: Accounts receivable $8 aillion, Inventory $5 million, A/P $6 million. Using the information provided, please complete the financial statements on the attached sheet. PROJEC PROJECTED 123101 Income Statement: PROJECTED Balance Sheet: Cash Flow Statement: 2001 2001 120100 Operating Activities: Net Income Assets Sales COGS Cash $1 Accounts Receivable Inventoty Goodwill Depreciation Amortization 7. Gross Profit SGRA Change in Working Capital EBIT Total Interest Expense PPAE Pretax Total S80 Investing and Financing Activitiex Capital Expenditures Tases Liabilities & Stockholdens Equity: $5 Net Income Borrowings / Repayment Total Accounts Payable EBITDA Debe 45 ockholden Equity Total Cash: Beginning of year Change End of year |3| || ||

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

2001Projected Income Statement Particulars Amount Million Sales 80 COGS 61 Gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started