Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A garage s installing a new bubble wash car wash, which requires an initial investment of $290,000 in year 0 . It will promote the

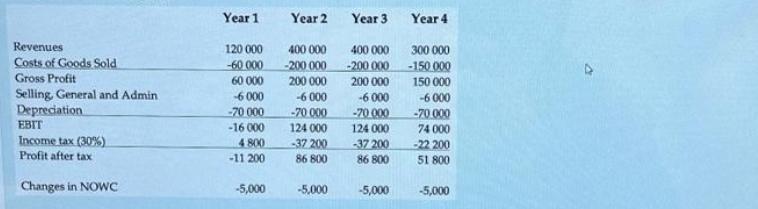

A garage s installing a new bubble wash car wash, which requires an initial investment of $290,000 in year 0 . It will promote the car wash as a fun activity for the family and it is expected that the novelty of this approach will boost sales in the medium term. The garage plans on using an opportunity cost of capital of 10% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projections:

Revenues Costs of Goods Sold Gross Profit Selling, General and Admin. Depreciation EBIT Income tax (30%) Profit after tax Changes in NOWC Year 1 Year 2 Year 3 Year 4 120 000 -60.000 60 000 -6000 -70 000 -16 000 4800 -11 200 -5,000 400 000 -200 000 200 000 -6 000 -70.000 124 000 -37 200 86 800 -5,000 400 000 -200 000 200 000 -6.000 -70 000 124 000 -37 200 86 800 -5,000 300 000 -150.000 150 000 -6000 -70.000 74 000 -22 200 51 800 -5,000

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project we need to discount each years cash flow to its present value and then sum them up First lets ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started