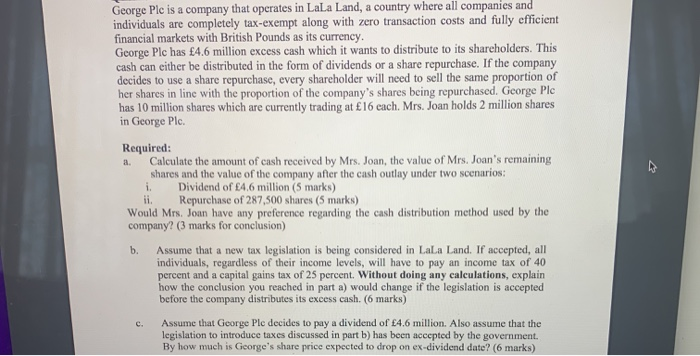

a. George Plc is a company that operates in LaLa Land, a country where all companies and individuals are completely tax-exempt along with zero transaction costs and fully efficient financial markets with British Pounds as its currency. George Plc has 4.6 million excess cash which it wants to distribute to its shareholders. This cash can either be distributed in the form of dividends or a share repurchase. If the company decides to use a share repurchase, every shareholder will need to sell the same proportion of her shares in line with the proportion of the company's shares being repurchased. George Ple has 10 million shares which are currently trading at 16 cach. Mrs. Joan holds 2 million shares in George Plc. Required: Calculate the amount of cash received by Mrs. Joan, the value of Mrs. Joan's remaining shares and the value of the company after the cash outlay under two scenarios: i. Dividend of 4.6 million (5 marks) ii. Repurchase of 287,500 shares (5 marks) Would Mrs. Joan have any preference regarding the cash distribution method used by the company? (3 marks for conclusion) Assume that a new tax legislation is being considered in LaLa Land. If accepted, all individuals, regardless of their income levels, will have to pay an income tax of 40 percent and a capital gains tax of 25 percent. Without doing any calculations, explain how the conclusion you reached in part a) would change if the legislation is accepted before the company distributes its excess cash. (6 marks) Assume that George Ple decides to pay a dividend of 4.6 million. Also assume that the legislation to introduce taxes discussed in part b) has been accepted by the government. By how much is George's share price expected to drop on ex-dividend date? (6 marks) b. a. George Plc is a company that operates in LaLa Land, a country where all companies and individuals are completely tax-exempt along with zero transaction costs and fully efficient financial markets with British Pounds as its currency. George Plc has 4.6 million excess cash which it wants to distribute to its shareholders. This cash can either be distributed in the form of dividends or a share repurchase. If the company decides to use a share repurchase, every shareholder will need to sell the same proportion of her shares in line with the proportion of the company's shares being repurchased. George Ple has 10 million shares which are currently trading at 16 cach. Mrs. Joan holds 2 million shares in George Plc. Required: Calculate the amount of cash received by Mrs. Joan, the value of Mrs. Joan's remaining shares and the value of the company after the cash outlay under two scenarios: i. Dividend of 4.6 million (5 marks) ii. Repurchase of 287,500 shares (5 marks) Would Mrs. Joan have any preference regarding the cash distribution method used by the company? (3 marks for conclusion) Assume that a new tax legislation is being considered in LaLa Land. If accepted, all individuals, regardless of their income levels, will have to pay an income tax of 40 percent and a capital gains tax of 25 percent. Without doing any calculations, explain how the conclusion you reached in part a) would change if the legislation is accepted before the company distributes its excess cash. (6 marks) Assume that George Ple decides to pay a dividend of 4.6 million. Also assume that the legislation to introduce taxes discussed in part b) has been accepted by the government. By how much is George's share price expected to drop on ex-dividend date? (6 marks) b